‘Productivity’ is a sedative word. It’s one of those terms that economists use which send normal people to sleep. That’s unfortunate because, in the long run, it probably matters more than any other data point in the national accounts: more than Gross Domestic Product, more than wages. More, even, than employment. Productivity ought to be a wake-up call rather than a sedative.

Productivity describes the amount of economic output we produce for each hour of work. So if a baker produces ten loaves in an hour, which he then sells for £1 each, he has a personal productivity of £10 per hour. And, over a period of time, productivity growth determines how much our incomes can rise. So if the baker increases his output, perhaps by investing in a larger oven or simply working more efficiently, and manages to bake 12 loaves in our hour, his productivity has risen by 20 per cent to £12 an hour. All else equal – presuming he manages to sell the loaves for the same price – this gives him a larger financial surplus and makes him better off. If someone’s output only rose as a result of working more hours, that individual would be no better off.

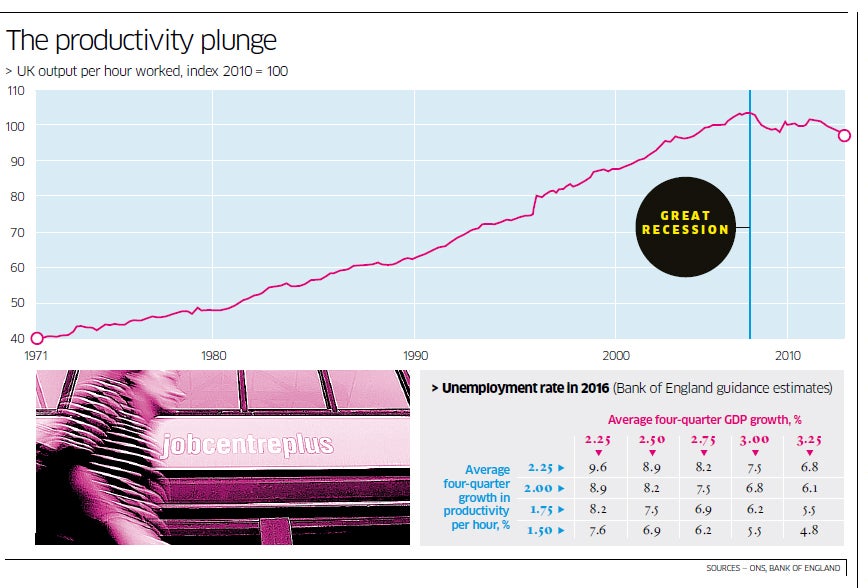

The primary reason our living standards as a nation have risen since the industrial revolution is productivity growth. Through the development of new technologies and large investments in public education we have steadily produced more economic output for each hour worked. This has allowed incomes and living standards to rise. Since the 1970s, the productivity level of the whole economy has risen at an average annual rate of around 2.5 per cent a year. There have been a few bumps on the way but the steady upward trend is clear.

But something alarming happened in the Great Recession: productivity went into sharp reverse. And, as the chart above shows, it’s still not recovered in the half decade since. Last year productivity actually shrank by 1.2 per cent. This is the flipside of the stronger than expected performance of the labour market in recent years. The government boasts that more than a million private sector jobs have been created in the past three years and that more hours are now being worked across the economy than ever before. And it’s broadly correct. But output has been feeble as GDP has flat-lined. Put the two together and you have the productivity depression.

The Bank of England has pledged to keep interest rates at their record lows until unemployment falls from its present level of 7.8 per cent to 7 per cent at least. It does not expect this to happen until the second half of 2016. But many in the City of London think unemployment will come down quicker than this. They are betting the target could be hit as soon next year, putting an interest rate rise into play.

On the surface this looks like an optimistic take on the British economy. But, in fact, it is a rather pessimistic view on the UK’s productivity outlook and, hence, living standards.

The Bank of England hasn’t published its productivity growth forecast but according to calculations by Capital Economics, the central bank implicitly thinks productivity will rise by around 0.5 per cent this year, 1.6 per cent in 2014, 1.5 per cent in 2015 and 2.1 per cent in 2017. That’s an average over the three years of just 1.4 per cent a year, still well below the pre-crisis trend.

But traders are assuming productivity growth will be even weaker. The table, left, from the Bank of England shows some scenarios for the unemployment rate in three years’ time, with varying assumptions of GDP and productivity growth. Assume average GDP growth of 2.75 per cent and productivity growth of 2.25 per cent and the unemployment rate is still 8.2 per cent in 2016. Assume the same rate of GDP growth and productivity growth of just 1.5 per cent and unemployment falls to 6.2 per cent in that year. You can play around with the forecasts but the essential message is clear: lower unemployment in the coming years translates into weak productivity growth. If the City is right we are facing a full decade of lost productivity growth.

There is a puzzle around productivity. Economists don’t understand why it has collapsed so dramatically since 2008. Some think that there are a lot of firms who could increase their output if there were more demand and that productivity will rebound sharply as the recovery beds in. They think businesses that have been hanging on to under-utilised workers will put them to work, rather than hiring more bodies. That would imply unemployment falling relatively slowly. But others think the productive capacity of our firms has been permanently damaged by the financial crisis and that employers will not be able to produce more output without increasing staffing levels. This outlook also implies that the recovery will help push up inflation, which will further pile on pressure for higher interest rates.

The Bank leans towards the former, more optimistic, view of the amount of spare capacity in the economy. The City seems to sit in the pessimistic camp. We will find out in due course who is right. But we should keep in mind that, in the through-the-looking-glass world of collapsed productivity, optimism over near-term employment growth translates into pessimism over our future standards of living.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies