Ditch the management gobbledygook, Mr Lewis, and speak English

Midweek View

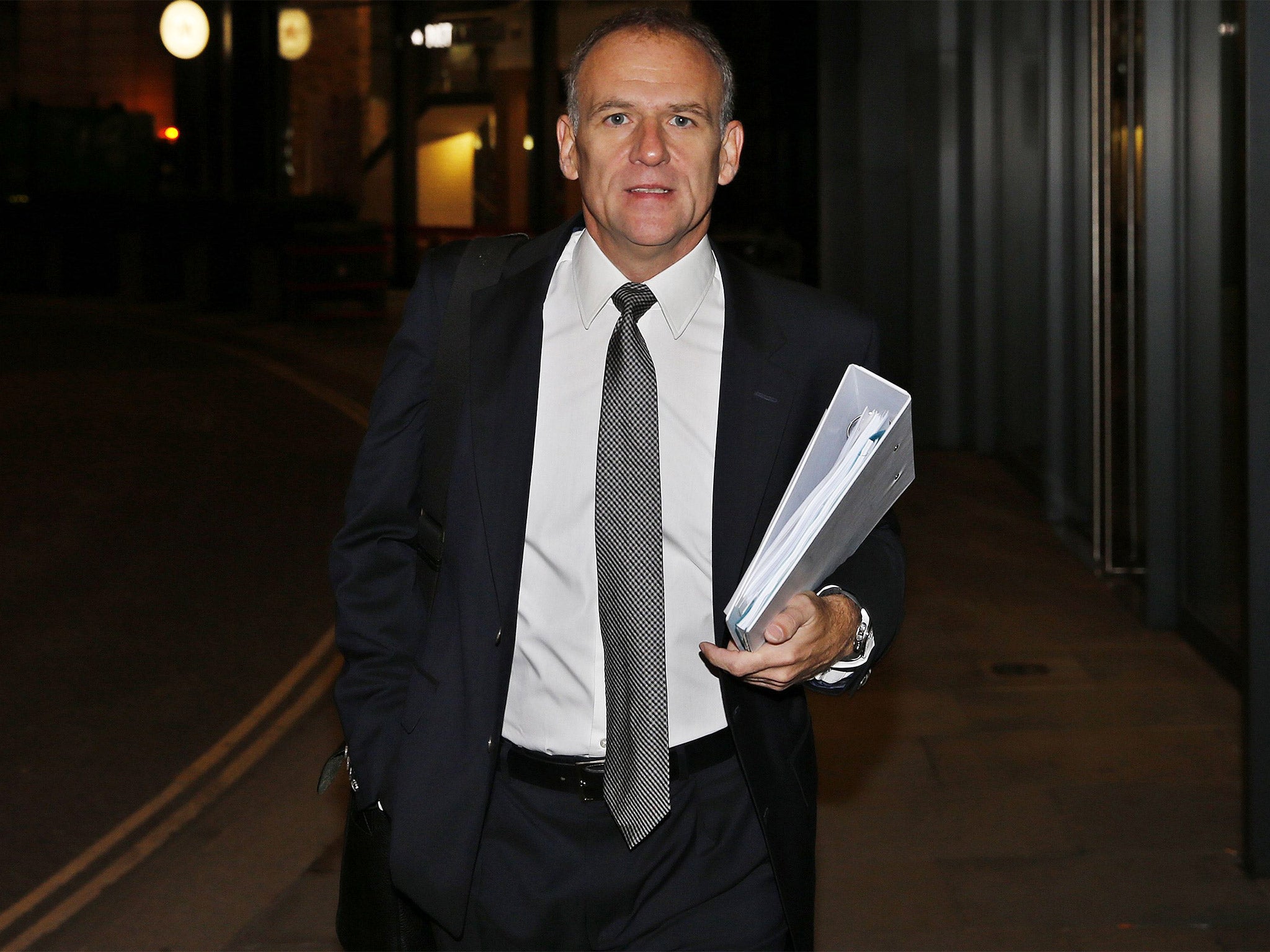

That Dave Lewis, he doesn’t mess about.

Having discovered a hole in the accounts, the new Tesco chief has not held back. He’s determined to get to the bottom of the problem, heads have rolled, and he believes in sharing the awfulness with the outside world. The result was yesterday’s warning of a gulp-inducing 30 per cent fall in annual profits.

In short, Lewis is saying loud and clear: Tesco is nowhere near as good as everyone thought. But stick with me, believe in me, and things will improve.

The worry is it’s not clear how much of the 30 per cent drop is due to the new, cleaner accounting procedures. The prospect arises that in recent years, Tesco has been relying on the beating up of suppliers and demanding discounts and payments from them for a whopping near-third of its profits.

On the other hand, if it’s not the bulk of the 30 per cent then Tesco is continuing to be hit hard by the competition, and still has not righted a downward trend.

Given the frenzied level of activity aimed at getting the retailer on track in the last few months, that would be a serious cause for alarm. Tesco has added 6,000 front-line staff in its shops, increased availability on key lines and is bombarding customers with offers and promotions.

The suspicion is that Asda is powering on regardless, strengthening its position as the destination for low prices, and that the smaller Aldi and Lidl are also eating away at Tesco’s long-held market dominance.

Lewis has to apply some ruthless surgery and cash-raising. Previously, he ruled out a rights issue but that has to remain a possibility, along with disposals of Blinkbox, Dunnhumby, Giraffe, Dobbies, and its stake in Harris + Hoole, partial sale of Tesco Bank, the unlocking of its vast land portfolio, and the offloading of some international operations, such as Asia.

Lewis does appear to know what the over-riding problem is, that Tesco, for all its success and expansion, lost sight of the most precious asset of all: the customer. He is stressing time and again the importance of putting customers first and of doing the right thing for them.

But oh dear, he cannot rid himself of management gobbledygook – presumably a legacy from having spent too long in Unilever. So, he says of the new accounting policies, we have “begun the cascade with suppliers”.

No Dave, that’s dreadful. There’s no polite way of putting this, but the image it conjures is of Tesco peeing on them, and that simply won’t do. Not any more.

The knives are out for City watchdog’s boss

A large dose of schadenfreude will surge across the City today as bankers and all the others who have felt the wrath of the Financial Conduct Authority delight in the discomfort of the watchdog.

Publication of the report by Simon Davis, a partner at Clifford Chance, into the debacle surrounding a disastrous briefing to the Daily Telegraph that resulted in the collapse of the share prices of the big insurance companies in March this year will not be pleasant reading for the regulator. Chancellor George Osborne was scathing in his criticism that saw the report go uncorrected for hours.

The FCA’s director of supervision, Clive Adamson, announced it would be examining 30 million historic policies, which caused understandable shock and alarm. Instead, the scope of the investigation was much narrower.

I was with bankers earlier this week and they could not conceal their glee that, for once, the shoe will be firmly on the other foot. They’ve had to put up with withering attacks on their behaviour from the FCA. They’re looking to Davis to dish out the same.

But there was an element of irritation as well, because it appeared the regulator had already moved to head off the findings of Davis’s probe. In what was billed as a restructuring to create a “sharper focus”, three top officials are leaving: Adamson; FCA communications chief, Zitah McMillan; and Victoria Raffe, director of authorisations. Bonuses were being cancelled for others, including for Martin Wheatley, the FCA’s chief executive.

Adamson’s division, which supervises thousands of financial firms, will merge with Raffe’s. Tracey McDermott, the director of enforcement, is being promoted to replace Adamson.

The FCA can claim until it is blue in the face that the moves were not prompted by the Davis review. The timing says otherwise. If it’s an attempt to head off the worst of a negative report, to silence critics, it seems rather crass – no one is fooled.

The jury remains out on Wheatley. He’s fond of publicity, and likes firing from the hip – “shoot first and ask questions later” is how he described his approach to consumer protection, a remark that caused eyebrows to raise across the City and Whitehall, as not being appropriate for a regulator.

His aggressive attitude has won him few friends in the City. While that has resulted in a successful onslaught against payday lenders, and record fines and settlements for banking misbehaviour, there are those who say he is giving the City a bad name – that anyone could be forgiven for thinking London is worse than other comparable financial centres.

He’s accused of erring on the side of the customer, not the corporate. There’s no doubt that City regulation is tougher than the “light touch” of before, but again, there are those who question his sense of balance and fairness – pointing out that referees must always remain neutral and are required to take decisions that are unpopular.

While it looks good, too, giving the watchdog a “sharper focus”, the structure that is now being unravelled has been in place for a long period – and there are those around the FCA who in the past have questioned the framework’s efficacy.

This is a tricky spell for Wheatley and the FCA. They cannot say that departures have been made, a restructuring put in place, and some bonuses scrapped – and expect the Davis report and the insurance briefing fiasco to be forgotten. As one banker said to me this week: “Imagine if we’d done that, imagine the size of fine we’d have had to pay.” The knives are out for Wheatley; he would be wrong to assume they’re going to be returned any moment soon.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies