The eurozone has underperformed since the single currency launched

Economic View

Let’s start with some good news about Europe. Irrespective of all the stuff about Greece, which will continue running for weeks, there is growing evidence that the eurozone economy is recovering. A number of forecasters have been upping their estimates for growth, the latest being Standard & Poor’s, which put the eurozone this year at 1.6 per cent and 1.9 per cent next.

What is happening is catch-up. The eurozone has lagged behind the Anglosphere since the recovery got under way in 2009, for reasons that may be associated with the relatively late adoption of quantitative easing (QE) by the European Central Bank. The mechanism whereby QE boosts the economy is still not fully understood: is it principally through higher asset prices, or a lower exchange rate, or by pushing banks to increase their lending? Or all three, but in different proportions in different countries? Or maybe it has all been a bit of a fluke, as the ECB programme coincided with the plunge in the oil price, which has boosted real incomes.

But whether we understand it or not, the fact remains that since the end of last year the eurozone economy has undoubtedly picked up pace. In some instances the turnabout is remarkable. The IMF now expects Spain to grow at 3.1 per cent this year and while unemployment is still dreadful, at 22 per cent, it is coming down steadily. France and Italy are making less progress but at least there is some growth there, which there wasn’t a year ago.

That is the good news, and once an economic turning point has been established, the new path tends to carry on for some time. The S&P outlook extends for two-and-a-half years, with the recovery supported by rising consumer and business confidence. There is, of course, the uncertainty generated by the Greek situation and S&P acknowledge that this might weaken the recovery.

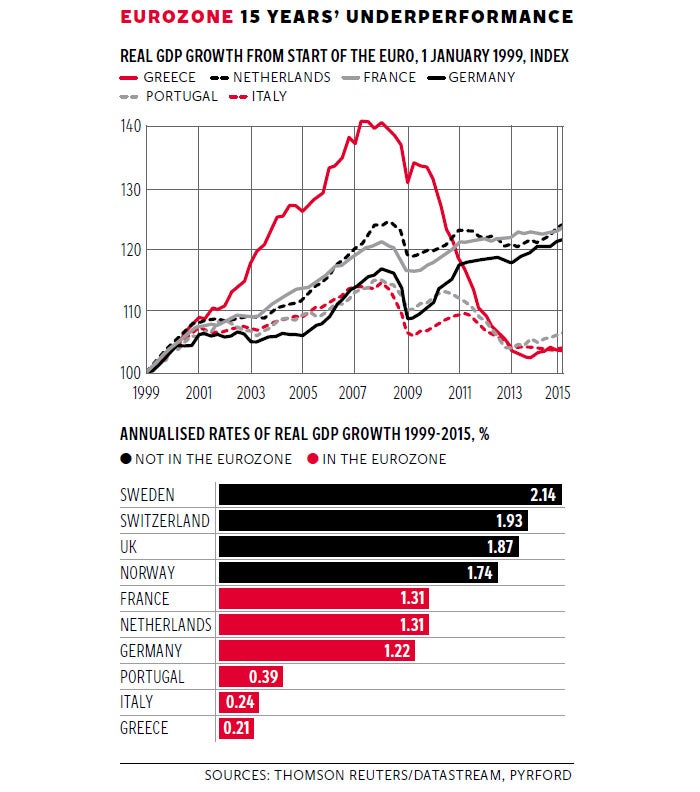

Now for the less good news: one of the things that the events in Greece have brought to the fore is the longer-term performance of the eurozone. It is not very good. Some work by Pyrford International, the fund management arm of the Bank of Montreal group, highlights just how bad it has been. The top graph shows what has happened to selected eurozone economies since the euro launch in 1999 – with Greece joining in 2001. Greece was the star performer during the boom years, but is now pretty much back to where it was in 1999. It is actually a smaller economy than it was in 2001, when it adopted the euro.

But the underperformance is not just in Greece. Italy and Portugal have had a lost 15 years too. Even Germany and France have grown by little more than 1 per cent a year, with France slightly outpacing Germany. Not many people realise that. You can see the average growth rates for these countries in the bar charts on the bottom graph, together with the growth over the same period for the four largest non-eurozone European economies. Sweden has been the star performer, and the UK has not done too badly over this period. It is an obvious point to make, but the countries outside the eurozone have done materially better than those inside it. While it would be quite wrong to attribute this solely to the impact of the euro, it is hard to avoid the conclusion that membership has had some negative impact.

This point is picked up by Pyrford. It argues that 16 years is a long enough period to be able to draw some conclusions about the benefits or otherwise of eurozone membership: “Without political union, a common-currency bloc will never work in the long-run.” It concludes robustly that “the euro is a piece of economic nonsense” but acknowledges that there are few more acts in this tragedy still to come.

That is a strong, independent view and it deserves to be noted. But it is not a European view. Within Europe, and even within Greece, the euro has majority support. What is interesting, looking at that graph, is the way in which despite the fact that the Greek economy is back to where it was 15 years ago, people there still want to keep the euro. We in Britain thank our lucky stars that we managed to keep out of the mess: all credit to John Major and Gordon Brown. My own view is that had we gone in, we would be out by now, in which case we would be even more unpopular in Europe than we are already. But while there are pockets of resistance on the Continent, we have to acknowledge that hostility to the euro is not the prevailing view – and in the two other countries which have had formal eurozone rescues, Portugal and Ireland, the euro retains popular support.

Two or three years of decent growth will buttress this support. It follows that even if Greece does end up leaving the eurozone, it is unlikely that there will be contagion as far as the currency is concerned. Whatever contagion there is will be in the bond markets, and the generally low level of long bond yields will limit the practical damage. For example, suppose that Italy has to pay a 3 percentage point risk premium over Germany: it could still borrow at less than 4 per cent. Once rates rise to more normal levels the pressures would mount, but we are some way from that.

Conclusion one: whatever happens in Greece, the rest of the eurozone is secure for the time being. Conclusion two: the eurozone will continue to underperform the rest of Europe, and so its long-term future is not secure at all.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies