Hamish McRae: Confidence is returning, but what happens when things get too hot?

Economic View: Monetary policy has not been well-judged. We could and should have done better

Things are hotting up. Just yesterday, there was a report by the Association of Chartered Certified Accountants saying that optimism in UK business was at a four-year high, while Lloyds Bank said its business confidence barometer was the highest it had ever been since the series began in 2002. Both are consistent with the strong purchasing managers' indices earlier in the month, and a CBI/PwC survey of the mood of financial firms which showed the greatest optimism since 1996.

True, similar surveys from the US and Europe are somewhat more muted. There have been mixed messages from the US, where people are still recovering from the dent to confidence caused by concerns over the debt ceiling. As for Europe, there has on balance has been broadly positive data, but from a low base.

For example, it was reported yesterday that Spain has at last emerged from a two-year recession. At any rate, share prices have continued their upward path, with the S&P 500 index up 26 per cent this year, the FTSE 100 up 19 per cent, the German Dax up 18 per cent and the Cac 40 (the most widely used French indicator) up 21 per cent.

So the issue now is whether and when things might become too hot. There is little immediate danger because there is so much spare capacity in the economy, but you can start to see pockets of pressure – London housing, for example – and at some stage policy will have to tighten. But when?

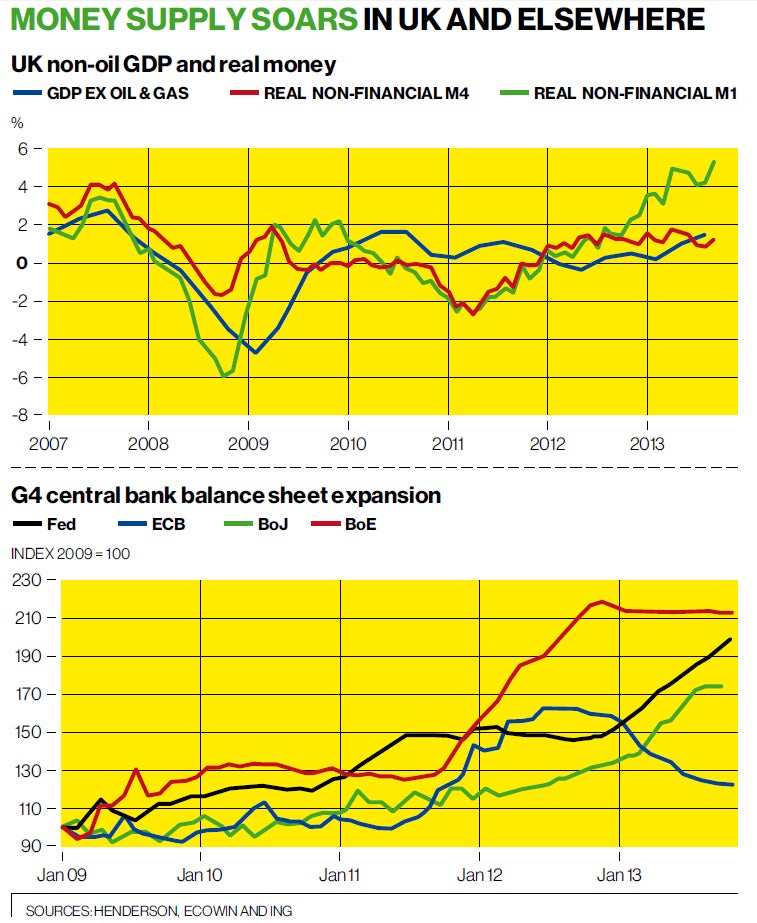

I find the first graph particularly interesting. The work has been done by Simon Ward of Henderson, who draws attention to the surge in real money supply, in particular the narrow definition, M1. As you can see M1, the green line, gives some sort of lead indicator for what might happen to GDP, the blue line. There is a debate going back a generation as to whether one should may more attention to the broad definition of money, here shown as a red line, or narrow money.

Narrow is basically cash that is immediately available, stuff sitting on deposit ready to be spent tomorrow, whereas broad includes deposits on up to three months' notice. Mr Ward argues that in current conditions of very low rates narrow money is probably more relevant.

If that is right, we should expect a surge in activity over the next six months or so as this money is translated into real demand. Then, over the following couple of years, so the theory goes, the extra cash will have the effect of increasing prices. Mr Ward also notes that our real money is higher than that of the US, eurozone or Japan, suggesting that in the next year or so UK growth is likely to run ahead of the rest of the developed world.

Another way of looking at this is to focus not on money supply as such but on the scale of the boost that central banks have given to their economies. The bottom graph comes from the economics team at ING Bank, and as you can see the Bank of England has expanded its balance sheet by proportionately much more than the US Federal Reserve, the European Central Bank or the Bank of Japan. The Fed is still expanding its balance sheet though its monthly purchases of Treasury bills, but these are likely to be tapered down in the coming months.

The Bank of Japan, under its new governor, has recently upped the flow of cash it has been pumping into the system. In recent months, the ECB has been clawing back some of the stuff it had to provide southern European banks, as have been able to fund themselves rather more easily, rather than having to be propped up by the ECB.

But as you see, while we have stopped our quantitative easing, the actual amount of cash we have put into the system is huge. The Bank of England holds one third of the national debt, and we have no idea as to how and when it will sell that debt to genuine long-term investors.

So here is a proposition. By next spring, a few things may have happened. One is that the present surge in growth will have become self-reinforcing, with the result that we will indeed be the fastest-growing large economy in the developed world. A second is that unemployment will have fallen to close to 7 per cent. A third is that the FTSE 100 index will have passed its all-time high of 6960, reached at the very end of 1999, following the S&P 500 and the FT All-Share index, both of which have done so. There is technical support for this view. For example, Richard Teale at Updata, the chart experts, reckons that the medium and long-term trends are still bullish so the trends would be behind a break to new highs.

If this proves right, and it seems to me to be perfectly plausible, then the Bank of England will have to act. Not to do so would be to repeat the mistake it made in the period from about 2005 onwards in allowing a credit and housing bubble to blow up out of control. The plain fact is that we had a similar credit boom to the US and have subsequently had a worse inflation experience than either the US or Europe. Our monetary policy has not been well-judged. We could and should have done better, even under the mandate the Bank had and even with the split of responsibility over banking regulation.

There is of course time. We are talking about policy next spring, not now. But common sense says that monetary policy should tighten much earlier than the Bank indicated in its so-called forward guidance. If the facts change; policy should change.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies