Hamish McRae: Now the G20 leaders must decide whether to co-operate or compete

Economic Life

Don't expect anything inspiring from the Group of 20 meeting in London on 2 April and you won't be disappointed. It will be messy. Fortunately, though, messy will be good enough. The past few days have been full of stories of dissent between the various participants. The head of our civil service says there is no one in the US administration yet to take the phone calls. The European finance ministers feel that the huge fiscal deficits being run up by the UK and the US are certainly irresponsible and probably ineffective. The Japanese are aghast that exports have halved and they are running a current account deficit. The Chinese are upset that they have seen their currency rise, as they were being pressurised to do, and their exports plunge. And the IMF, revising down its forecasts yet again, says that governments are not doing enough (er, Britain will be running a fiscal deficit of 10 per cent of GDP next year; do they really want us to go up to 12 per cent?)

Besides, the idea that you can get any meaningful agreement between 20 governments with their leaders meeting for one day is ridiculous. There will be a string of "initiatives" as usual but hardly anyone goes back and looks at what happens a few months later. Frequently it is nothing: the statement of intent is substitute to the action thereof. But this does not matter much.

The big issue is whether it is better to co-operate or compete. In an ideal world, governments would co-ordinate their optimal policies and, hey presto, growth would be restored. In the real world, when you don't know what works, having different governments experiment with different policies may be quite a sensible approach. You can see this in recent months. Take two policies that are being tried here. One is a temporary cut in VAT. That, by general acclaim, has been a failure and has not been imitated by other countries. We should have known that, had we looked at the experience of the Germans. They found that a change in VAT did not have any lasting impact on retail sales when they altered their rates recently and were pretty scornful of our policy. On the other hand, the voluntary, partial nationalisation of banks does seem to have achieved some resonance, with the US, among, others moving in that direction.

And just yesterday, the Swiss National Bank started some "unconventional" policies to try to boost bank liquidity, some of which seem to be following our quantitative easing route. This piecemeal approach surely must be sensible. It mimics the way a company would test a new product by doing a pilot launch in one place and then, if it sells, rolling it out across the whole market. So let one country try something out first, then – if it works – others will pick it up too. It is certainly much more sensible than everyone going with the wrong policy and all making the same mess of things at the same time. Remember that it was international co-operation on banking capital adequacy and on accounting standards that made the current financial crisis vastly worse than it would otherwise have been. The same flawed policies were applied everywhere in an effort to create a level playing field.

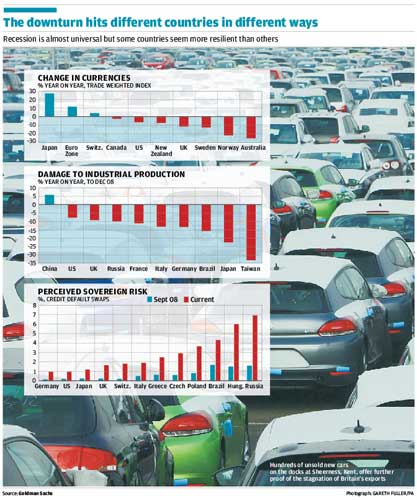

There is a further reason for respecting multiple approaches. Different countries fund themselves in different positions, as the graphs demonstrate. As you can see, the Japanese yen has soared over the past year and the euro has been pretty strong, whereas sterling and, most particularly, the Australian dollar have fallen sharply. Partly as a result, industrial production in Japan, plus that in France, Italy and Germany have taken some big hits. By contrast the damage to industrial output in Britain and the US is more limited. Unfortunately, given the weak market for any form of manufactured goods, UK exports have so far failed to respond to the cheap pound, but we may be better placed as a result of the undervalued currency when markets improve.

There have also been sharp changes in the risk the markets see of a country defaulting on its debts, as measured by the change in credit default swaps. These show the "insurance" a country has to pay against default – what a borrower would have to pay to cover the risk of a country defaulting in any one year. As you can see, the risk has risen for every country, with the markets assigning an 8 per cent chance that the Russian government will default in the coming 12 months. The UK is ranked as more risky than Germany, the US or Japan, but less so than Switzerland or Italy.

This is not the only measure of risk and is actually rather flawed because the market is a narrow one. The UK has just had its AAA rating confirmed for a dollar issue and 10-year gilt yields are now down to the same level as Germany. But this measure does say that the US can take risks with its fiscal policy that other countries cannot. It has a greater capacity to borrow, a function of its role as a reserve currency and also probably the sheer size of its economy. America can, so to speak, get away with things the rest of us can't. So if, say, Hungary was to try to follow the same policies as the US, it would run into an even deeper currency mess than it is already; different countries need different policies.

If all this seems a bit dispiriting, it need not be. Any measure that an individual country takes to boost demand will have some impact on others. Thus, Germany has a bounty on scrapping cars and exchanging them for new ones. If a German buys another Mini as a result, that helps BMW, the owner, but it also provides more demand for the British Mini plant at Cowley. If tax cuts in the US encourage people to buy more toys (or whatever), that helps Chinese exports. Insofar as any policy designed to boost domestic demand in one country is effective, it also helps other economies too.

There are two concerns, however. One would be if the policies designed to help one country were targeted against another. In a small way, the US support of its banks leans in that direction, for it forbids them to employ foreigners as a result. I'm not sure how this would work in practice but you can see the danger. The other and even more troubling thing would be if the G20 summit in London was perceived as a failure. The unpleasant precedent is the London Economic Conference in June 1933. Some 66 nations met to try to develop policies to counter the global depression, get international trade going again and steady the foreign exchanges. It failed. The new US president, Franklin D Roosevelt, radioed from his holiday on a yacht in the Pacific, condemning the conference for trying to stabilise currencies and making it clear that the US would not join in the negotiations. FDR may be hailed as a hero nowadays for the New Deal but, at the time, he was regarded by the rest of the world as a wrecker.

The world economy is not in the peril now as it was then, despite the unhelpful assertions from politicians who like to claim it is. But a summit that is perceived to fail is worse than no summit at all. Low expectations for this one are in order.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies