Hamish McRae: Optimism is in the air in Washington

Economic View

It is the final straight. The capital itself is getting ready for what has been billed as a “hundred-year storm” as Hurricane Sandy is forecast to meet a second storm coming out of the Midwest on Tuesday.

But the US economy has, in this run-up to the election, achieved a certain calm. There is a rule of thumb being suggested that a Romney victory would be good for equities and an Obama one good for bonds, the argument being that the former would be more friendly to business while the latter would press on with quantitative easing and other policies designed to hold rates down.

I am rather suspicious of this line of argument, for two reasons. One is that the fundamentals of the economy, any economy, are more important for markets than the political spin at the top. The other is that markets, even the US ones, are becoming increasingly determined by global rather than domestic influences.

In the case of US shares, what matters most will be if the world economy recovers from its present pause; and for US bonds, if we have passed some sort of turning point and are heading into a global bear market in fixed interest securities. Sure, politics matter for economic outcomes, but economics matter more for political ones.

You cannot get away from the “it’s the economy, stupid” phrase from Bill Clinton’s 1992 campaign. So the dominant question now is whether the US economy is seen as having made sufficient progress over the past four years to justify the re-election of President Obama or whether people feel sufficiently disappointed by what has been a sluggish recovery to want change.

That is what I mean by a certain calm, because there has been a modest pick-up in economic performance in recent months. The healing process is under way, after the excesses of the boom years, but it takes time.

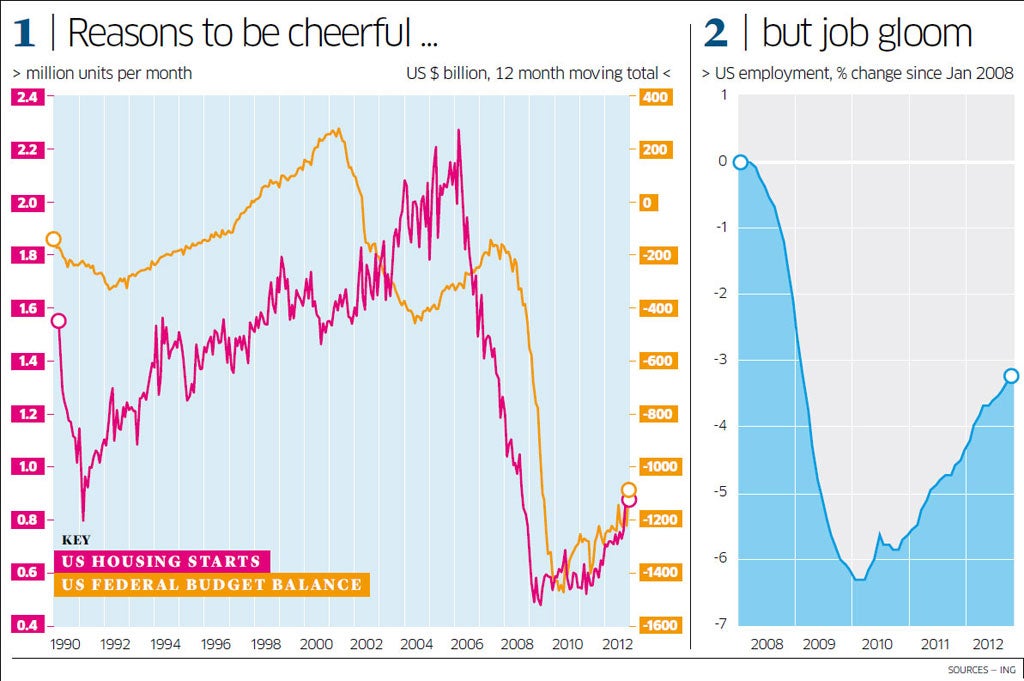

You can catch a feeling for this from the two graphs. On the right, there is disappointment, and on the left, progress. On the right, while employment has recovered, it is still way below its previous peak. Thus, US experience is quite different from our own. In terms of published GDP figures – the third-quarter showed growth of 2 per cent – the US has recovered better, for it is now just past its previous peak. We are still 3 per cent below it. But in job creation, we have done better, for we have just passed the peak.

Socially, this is a disaster. You are not so conscious of this in Washington, as the economy has been supported by federal spending; but elections aren’t won in Washington. The fact that the causes of this distress go back to fiscal, monetary and regulatory errors of previous administrations does not necessarily help the people who have tried to sort things out.

Anyone who thinks that the sorting-out is not happening should look at the left-hand graph. I have put two measures of progress on to it. One is housing starts. This is useful for three reasons. One is that the US recession began with a collapse in the housing market. The second is that building spreads wealth widely and employs a lot of people, including the relatively lower-skilled. And third, it is an indicator of confidence: you don’t start construction of a house unless you are reasonably sure there might be someone to buy it. As you can see, there has been a notable improvement in the past three or four months.

The other indicator is the federal deficit. The obvious point here is the scale of the fiscal catastrophe as a result of recession, though it is also worth noting that George W Bush failed to do what Clinton achieved, which was to use the good years to get the budget into surplus. But look at the very latest numbers: the running deficit has been improving and, if anything, that pace of improvement has picked up. US fiscal policy deserves no praise, and the task of the next administration will be to get the deficit under control again – but the numbers, while dreadful, are starting to move in the right direction.

In the next few days, there will be some more bits of information, of which the labour market data this coming Friday is seen as the most important. You may recall that a sharp fall in unemployment last month gave President Obama a boost. The problem is that numbers bounce around, and if this unemployment were to rise, then that halo effect would be reversed.

From our own perspective in Britain, what matters is not so much who is in the White House but whether the next administration is broadly competent. The path the US is heading along is not so different from ours. Arguably, they have done more on the banking front in repairing the system so that creditworthy borrowers can borrow again. Arguably, we have a more credible deficit-reduction programme – actually we have a much more credible one, as no one knows how the US will cope with the so-called “fiscal cliff”: the tax increases and spending cuts that come in automatically on 1 January 2013.

And that brings me to what, as a regular visitor, always strikes me as remarkable about American economic policy. The place always feels calm. US Treasury debt is still regarded as a great “safe haven” for the rest of the world to place its spare savings in. But policy actually is not calm at all. It is extreme. The deficit remains extreme; the loose money policy of the Federal Reserve is extreme; the possibility of a sudden sharp rise in taxation in two months’ time is extreme. There remains, even in politically polarised Washington, an optimism that things will be fixed. Let’s hope that is right, whosoever ends up having to do the fixing.

Is a real global slowdown just around the corner?

We should be suspicious of improbably good GDP figures, just as we should be suspicious of improbably bad ones. And so it was last week with the news that the UK economy grew by 1 per in the third quarter. That is an annual rate of 4 per cent.

Now ask yourself, is it probable that an economy shrinking at an annual rate of between 1 and 2 per cent for the first part of the year suddenly put on a spurt such as this? It does not square, not just with the other data including job growth, but with our common sense understanding of how we as individuals, as employees, even as business owners, behave.

What I think has happened is that the UK economy continued to grow slowly in the third quarter, just as it had been doing for the rest of the year, and that this will eventually be confirmed when final figures are available in several years’ time.

Actually, I’m worried about something else. I think there may be a real global slowdown about to happen. I don’t think it is evident yet in the US or UK, but continental Europe may be in more trouble that anyone realises, with the really scary crunch in the south spreading to the north. There were some bad numbers on business confidence from Germany last week and if Germany were to falter, the rest of Europe would be in huge trouble. UK exports to the eurozone have been very weak.

Add in the fiscal problems of the US, noted above, and continuing uncertainty about what on earth is happening in China, and I think it is possible the world economy may grow much more slowly through the winter, before picking up in the second half of next year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies