Productivity isn't the problem after all – it's the way we measure it

View from Washington

It is the great puzzle of our time and it is particularly evident on this side of the Atlantic: why is the hi-tech boom not increasing productivity? There are huge numbers of hi-tech start-ups in the United States with investors paying such high prices that there is a real concern that there will be another bust. Established companies such as Apple (mobile phone sales up “only” 35 per cent this quarter) and Google continue to grow rapidly. Uber and Airbnb disrupt their respective sectors – yet productivity growth as measured is sluggish and US median incomes have not risen for two decades.

Add to this our own personal experience of the gains we have experienced both in our work and our leisure from the new technologies – the ease of communication, the time saved – and the failure to increase productivity really is a puzzle. Maybe, however, there is a simple explanation.

It is that there isn’t a productivity problem; there’s a measurement problem.

The person who has articulated this most vigorously is Hal Varian, a microeconomics professor who taught at Berkeley and is now chief economist for Google. His argument is that conventional economics only counts as economic activity things that are paid for. Since a lot of the services generated by the hi-tech industries are free to the user, they are not counted in GDP. It follows that GDP is higher than measured and accordingly productivity is higher too.

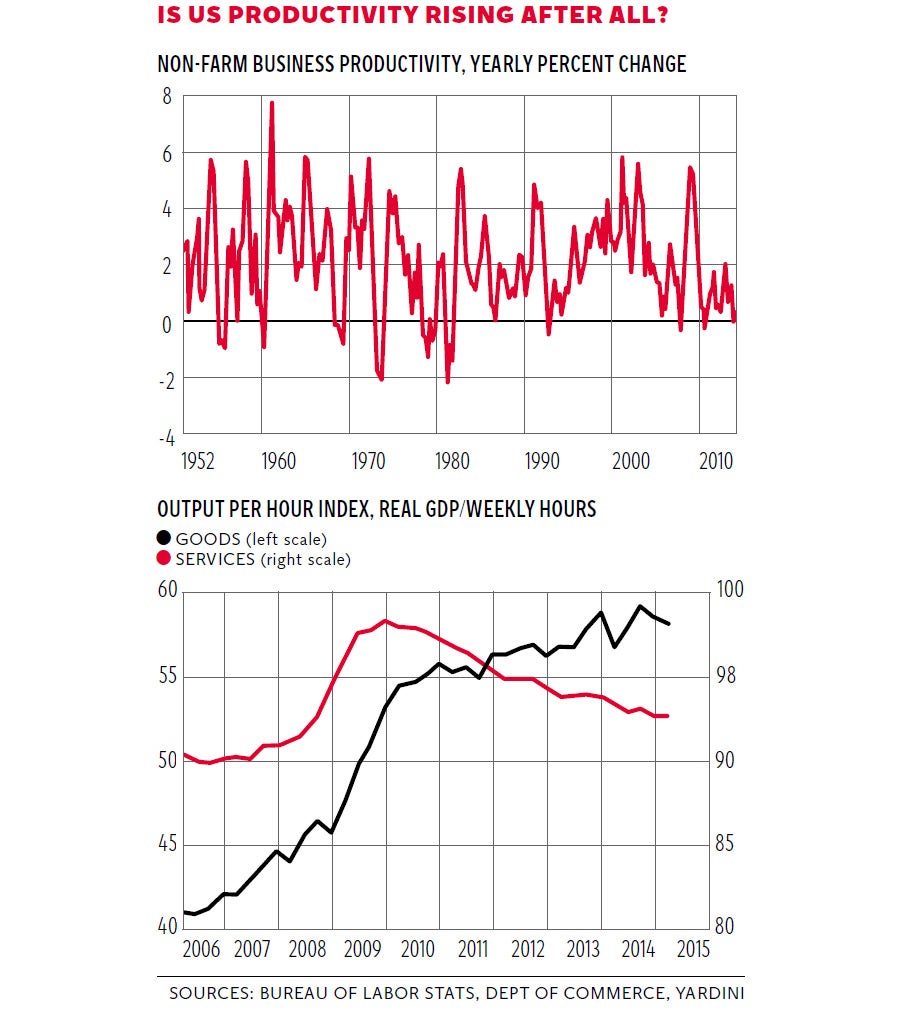

Intuitively this makes a huge amount of sense, because it squares with our personal experience. But pinning it down is hard. So what do the official statistics say? The top graph shows what has happened, or at least recorded, to US non-farm productivity since the early 1950s. As you can see the line jumps about a lot, but the average right through to the 1990s is around 2.5 per cent a year, whereas it drops to at best about 1 per cent a year during the past decade.

As far as this more recent period is concerned, the economist Ed Yardeni has done some further calculations on real output in the service and manufacturing against hours worked to produce a chart that gives a proxy for productivity in both sectors from 2006 to this year. (It seems there are no official stats breaking down productivity between services and manufacturing.) The results are really odd. Manufacturing has continued to increase productivity, though the growth has tailed off a bit, but service productivity has actually been falling since 2009. According to these calculations US services productivity dropped by nearly 6 per cent between the end of 2009 and early this year.

This must be wrong. The US is the centre of an extraordinary global phenomenon, exporting its technology across the world, with ever more competent (and seductive) software, not to mention the must-have hardware, yet its productivity during this boom is actually falling? It must be a measurement problem.

Unfortunately, measuring a measurement problem is almost impossible. We do have some experience in adjusting for quality in both goods and services. If, for example, a new car is more reliable than the previous model, though otherwise indistinguishable, you can adjust for that. On paper the cost of roadside repairs would appear as a rise in GDP, whereas in reality our living standards do not increase at all when we are stranded by a broken-down car.

You can make similar adjustments for improvements in quality of services, though this is tricky too. For example, if thanks to advances in treatment you can cure an illness with medication rather than an operation, the lower cost appears as a decline in GDP but, of course, it is a much better outcome not to have to go through the trauma of the op. One of the oddities in UK productivity statistics is that when banks sprayed loans around that never got repaid, that appeared as bankers having high productivity. If, on the other hand, they make fewer loans but ones that are repaid, then their productivity goes down. One of the UK productivity problems results from having a relatively smaller financial services sector, even if the sector is qualitatively better.

The trouble is that in the past there has at least been something going through the national accounts – some goods or some services are duly recorded – but now many activities are not recorded at all. For example, when we use Google Maps to navigate round an unfamiliar city, nothing appears in GDP. Google knows where we are to within a few yards, which feels slightly spooky, but the fact that we have not had to buy a map, or even subscribe to satnav, does not appear in GDP.

This affects government revenue. It does not get the VAT on the service we use because that service is not paid for and not officially recorded. Google makes a tiny amount of revenue, and may make more as location-based services develop further, but even then, if the service we “buy” is simply time saved, that will not appear in the statistics either.

That surely is the key to what is happening. We may not be getting increases in our living standards as measured by GDP per head or per hour worked. But we are getting increased living standards in time saved and hence more effective use of time both at work and at leisure.

Now you could argue that we don’t use this extra time very well. Are we really better off by sending YouTube videos to each other of cute dogs pretending to play the piano, or people falling off swings and landing on their backsides? It is true, too, that a vast amount of time at work is lost by people obsessively checking their personal emails or scanning the internet for some new celeb scandal. But how people use their time is up to them. We reveal what we want by what we do; it is called “revealed preference” and a jolly useful economic concept it is.

What I suggest will happen is that we will get better at measuring non-paid for services and finding some way of allowing for these in calculating genuine economic activity. When we do that we will, I suspect, find out that far from stagnating, productivity is rising as steadily as it was before. But it will be a while before the stats catch up.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies