We need to plan for the day when job prospects are bright – but only for robots

US Outlook: So is a robot coming for your job?

There is a scene in Total Recall, Arnold Schwarzenegger’s 1990 sci-fi stinker, when he gets in a cab driven by a grinning robot. A moment of comic relief – as if that were ever going to happen. The colonies on Mars depicted in the film are still a long way off, but the robot cabbie is pretty much already here. Maybe not yet on every street, but within the next decade, almost certainly.

Just this week a supercomputer developed by Google, Deep Mind, took a two-nil lead in a five-game “Go” match against Lee Se-Dol, a South Korean Grandmaster who had confidently predicted walking away with the million bucks Google put up as prize money. Questions about Deep Mind’s ability have been answered, although what on earth “Go” is remains a mystery.

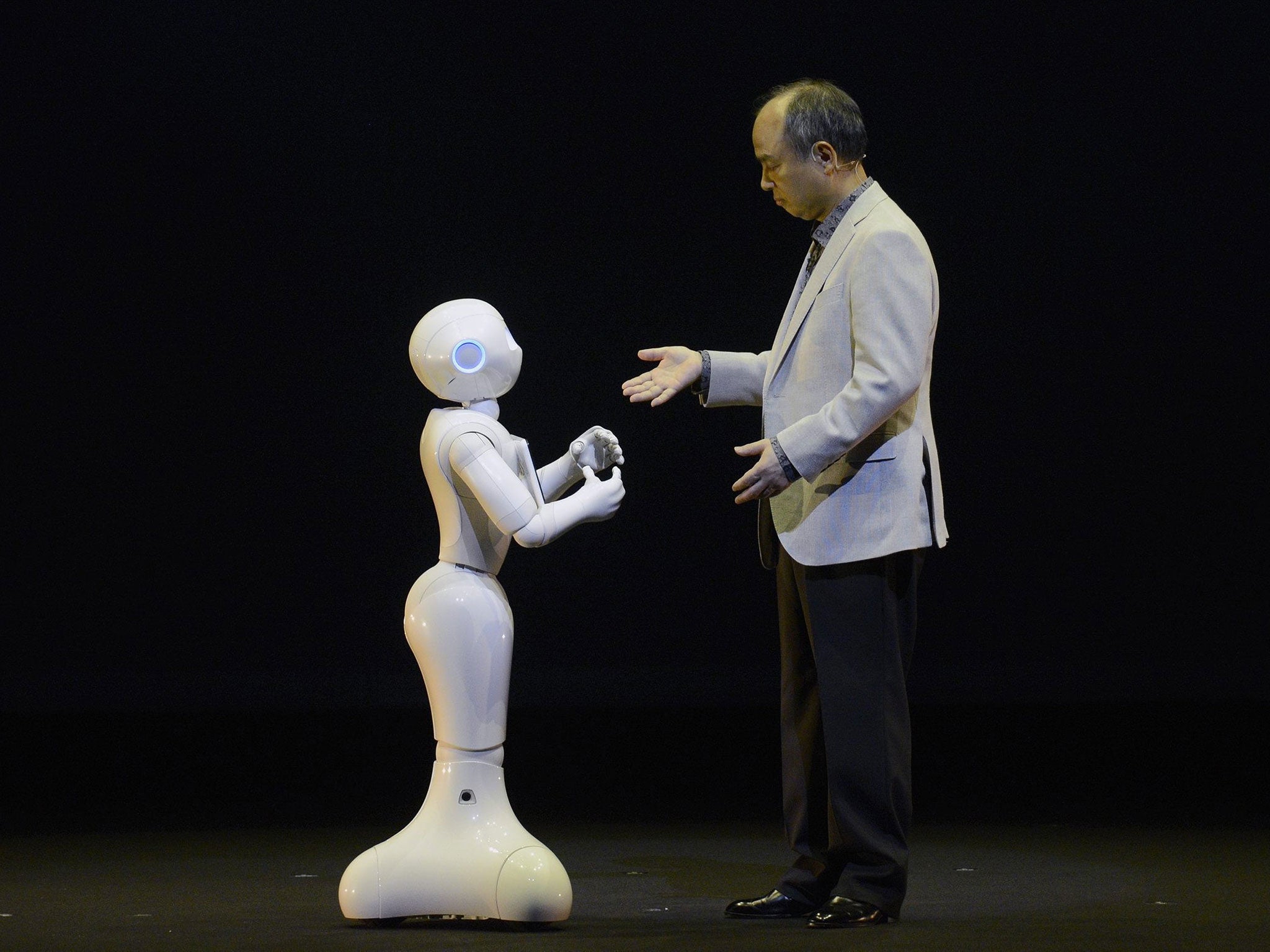

Big breakthroughs in robotics and artificial intelligence (AI) are now almost a daily occurrence. Large corporations – and not all of them tech companies either – are investing tens of billions of dollars in research and development to make C-3PO, the humanoid depicted in Star Wars, a reality.

So is a robot coming for your job? A study published this week by the Pew Research Centre suggests Americans are at least aware of the threat that automatons pose to their employment. Two-thirds of the 2,000 people surveyed believe that within 50 years many more jobs will be taken over by robots.

The trouble is, 80 per cent of those questioned also believe their own jobs will be safe.

Such cognitive dissonance is not surprising; we are optimistic creatures by nature. But the truth is that no occupation is truly safe from automation. Robotic vacuum cleaners have been on the market for years, so why not robotic road sweepers? Almost all jobs that involve driving or physical labour are under threat.

And it’s not just jobs we think of as manual that are threatened – work done by accountants, lawyers and even doctors could conceivably be carried out by computers – if much of it isn’t already. AI is even frightening people within the tech industry, and although professionals are not going to be fully replaced by the likes of Deep Mind any day soon, it will happen.

The research also revealed a naive degree of confidence in how people view their employers – only one in ten respondents thought their company would replace them with a robot or software if they could. I’ve got bad news, folks: any employer would replace any job with a robot if they thought it would improve profits.

Where does that leave us humans? The future is either a dystopian hell where billions of people live as a desperate underclass, or a utopia where people are free to pursue artistic endeavours to their heart’s content – which still begs the question of how people will earn enough money in paradise.

So perhaps the most important experiment going on right now has nothing to do with robots or AI, and everything to do with human beings: providing basic guaranteed incomes. Finland, Canada, Switzerland and Germany are more than just flirting with the idea, they are actually trialling giving every citizen a basic income. How those experiments pan out may decide our future – every bit as much as the latest robotic servant or supercomputer.

Can Twitter’s chief hang on to his superpowers?

Sometimes you have to bite the bullet and admit that you were wrong. This column has been sceptical, to put it mildly, that Jack Dorsey could function effectively as chief executive of both Square and Twitter.

Mr Dorsey needed to do more than just function – he also had to deliver the results at Square, the payments company, and a turnaround at Twitter. Judging by Square’s numbers this week and changes at Twitter, Mr Dorsey is indeed Superman for now.

As if working an average of 18 hours a day wasn’t enough, Square’s fourth-quarter results comfortably beat Wall Street forecasts. Revenue of $374m (£262m), almost 10 per cent better than forecast, was based on 47 per cent year-on-year growth in transaction revenue to $299m. The company reported a similar jump in gross payment transactions (the total value of payments settled using Square) to $10.2bn. Unlike most of its technology peers, the company’s stock is now trading significantly higher than its IPO valuation.

Meanwhile Twitter is at least starting to make the kind of changes that might halt its slide. It started by trying to stop the brain drain through increasing staff cash and stock bonuses – a long-term investment despite its short-term cost implications. Traders are also beginning to back Twitter, perhaps because of (so far) unfulfilled takeover rumours but also because the company is not going bust any time soon. Based on the current cash burn rate, Twitter’s $3.5bn in the bank is enough to last another 400 years. According to option trading company Schaeffer’s Investment Research, call buyers have outnumbered put buyers by around four to one in the past week – a very bullish sign.

However, there are reasons to remain sceptical. First, the numbers reported by Square were its first set as a public company. Beating forecasts just weeks after an IPO is the bare minimum required. Maintaining that growth as the company begins to generate more from software sales than hardware sales will be the hard part.

Second, Twitter has benefited from short covering and from a broader market rally. How much longer will that rally last? It’s worth remembering that the last big bear markets, in 2001 and 2008, did not happen overnight and were punctuated by numerous false dawns. The case for not getting caught up in the current rally remains as strong now as it did a month ago.

Right now Mr Dorsey is crushing expectations, including those of this column – but it’s still too early to pop the champagne corks. His challenge remains as difficult as ever, and not many people can last long pulling 18-hour work days.

But if Square stays on course and Twitter turns the corner, he will rightly be regarded as one of the best executives of his generation. And I’ll eat the rest of my humble pie.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies