Business investment is likely to remain weak in 2017, according to the latest Credit Conditions Survey from the Bank of England.

Capital spending by firms fell by 1.5 per cent in 2016, the first calendar year decline since the financial crisis, as firms reined in spending due to the uncertainty created by the Brexit vote last summer.

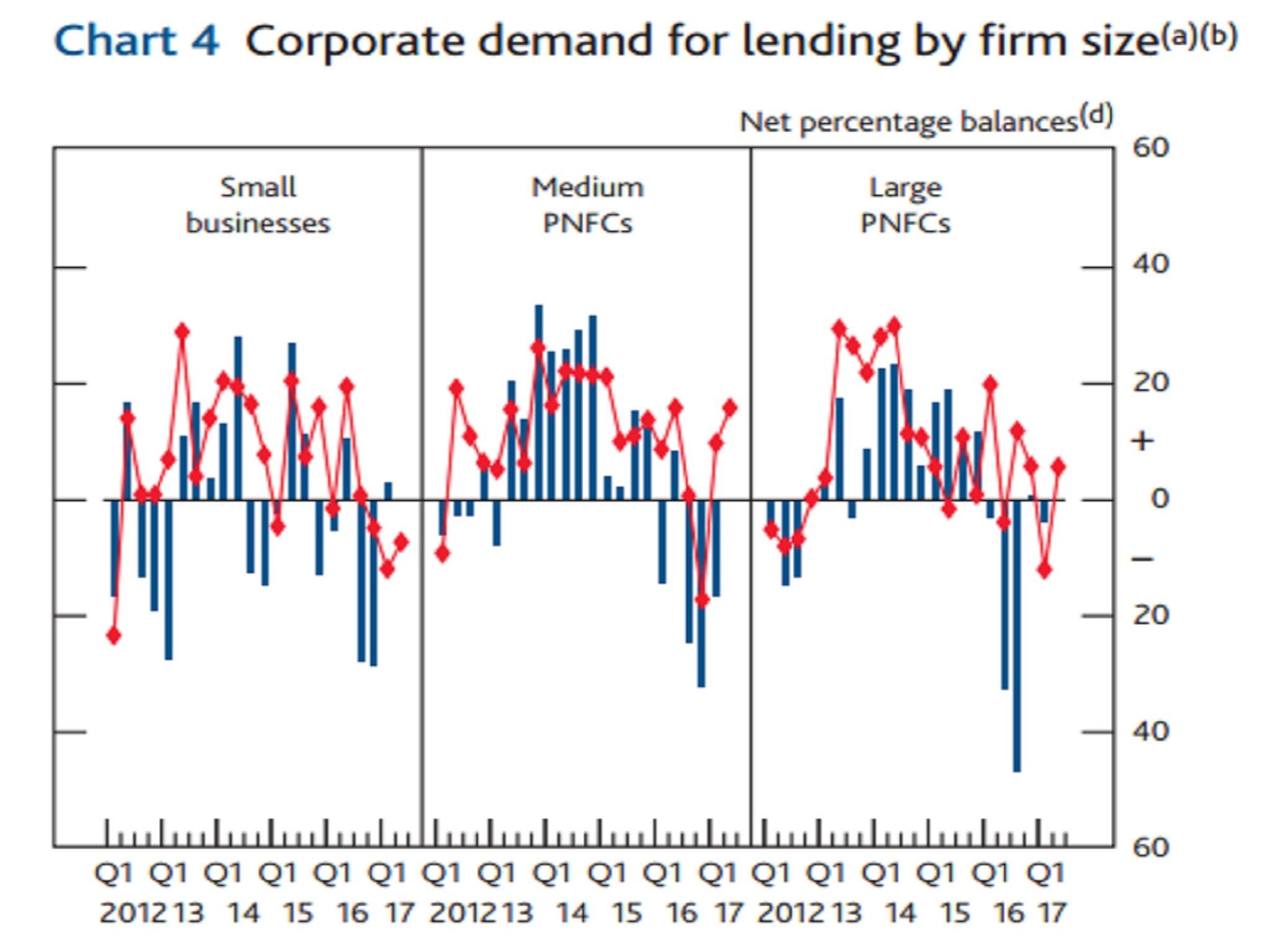

And the Bank's survey released Thursday shows that demand for credit from medium and large firms continued to fall in the first three months of this year, after recording major declines last year.

"Lower capital investment was reported to be exerting a significant drag on demand for corporate lending in Q1, although increased merger and acquisition activity had pushed up on demand," the Bank said.

In its February Inflation Report the Bank of England projected business investment to fall by a further 0.25 per cent in 2017.

The Bank's Governor Mark Carney said that it now expected the level of firms' capital investment to be around a quarter lower in three years' time than it did before the referendum "with material consequences for productivity, wages and incomes".

First fall since the financial crisis

The latest report by the Bank of England's network of regional agents showed a slight improvement in investment intentions for services firms in the first quarter of 2017 and a more sizeable one for manufacturing companies.

However, the agents added that "a lack of visibility of the United Kingdom’s future trading arrangements was weighing on longer-term plans for some contacts".

The Office for Budget Responsibility in March projected a 0.1 per cent fall in business investment in 2017.

The latest Bank Credit Conditions Survey was conducted between 20 February and 10 March.

It also showed that British lenders plan to rein in the supply of credit to consumers.

A net balance of 18.8 percent of British lenders expect to tighten the availability of unsecured credit to consumers in the next three months, up from 7.9 per cent in the final quarter of 2016 and the highest since 2008.

Consumer spending, supported by lower saving and unsecured borrowing, has been the dominant driver of UK GDP growth since last year's referendum, fuelling doubts about its sustainability.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies