Deutsche Bank cuts 35,000 jobs by 2020 and exits 10 countries

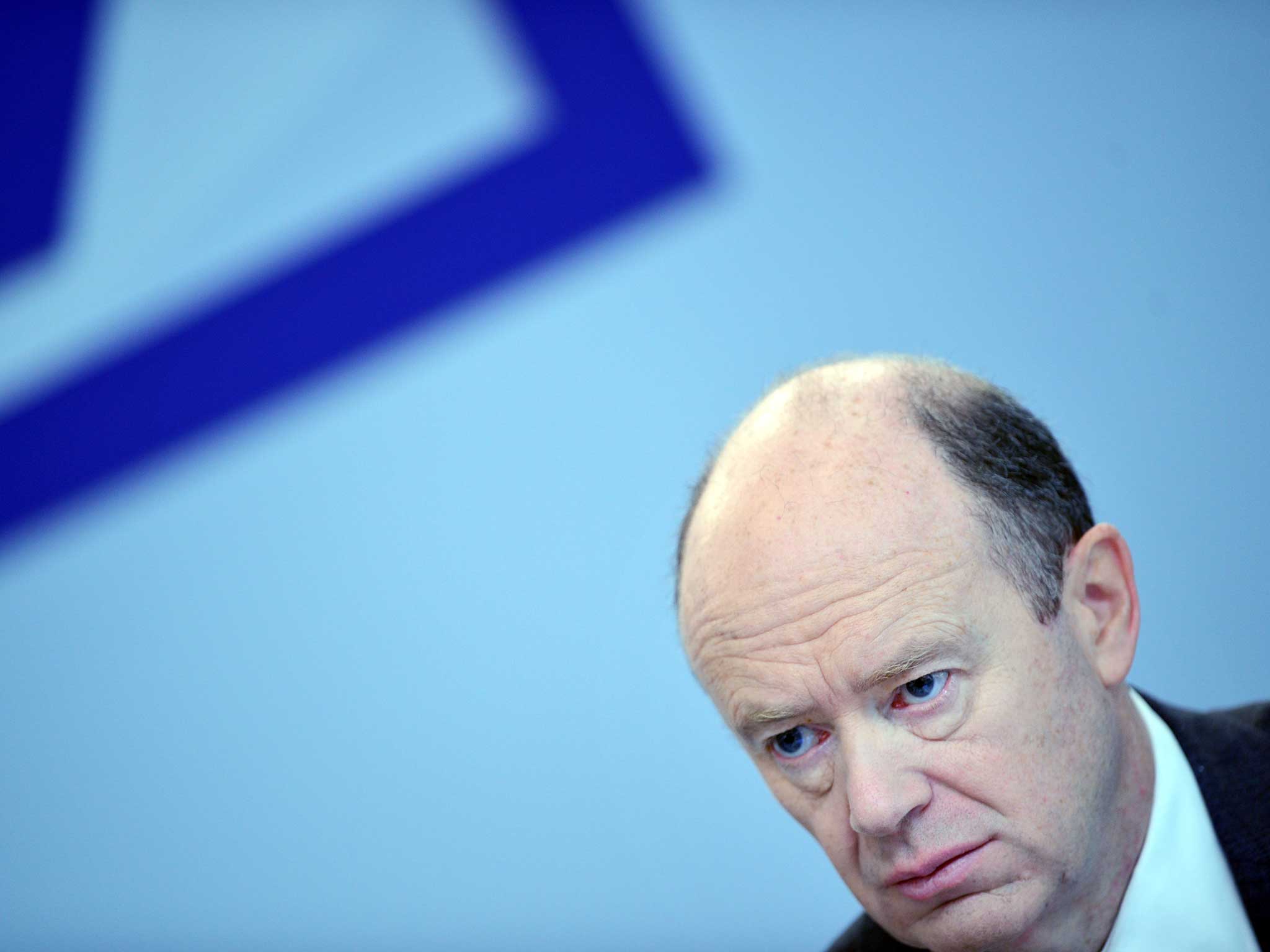

The new strategy was unveiled by co-chief executive John Cryan as part of the German bank’s third quarter results.

Deutsche Bank is to cut 35,000 jobs over the next two years as it seeks to curb losses.

The new strategy was unveiled by co-chief executive John Cryan as part of the German bank’s third quarter results.

Deutsche Bank said it will cut approximately 9,000 full-time jobs by 2020 and close its operations in 10 countries.

A further 6,000 external contractors and 20,000 positions will go, the latter through selling or exiting businesses. The cuts should save the bank €4 billion a year.

Deutsche Bank’s “Strategy 2020” includes plans to cut the number of clients served by its investment banking and markets business by 50 per cent. The reductions will be focused on “higher operating risk countries.”

Mr Cryan said he had been working towards plans to stabilise the bank and turn around its long term performance. He said he wants to run the organisation it with “greater discipline” and “purpose based on delegation of responsibility.”

“Sadly, this also means closing some of our branches and country locations, and reducing some of our front-office and infrastructure staff too. This is never an easy task, and we will not do so lightly. I promise that we will take great care in this process, moving forward together with our workers’ representatives,” Mr Cryan said.

The bank will withdraw from Argentina, Chile, Mexico, Peru, Uruguay, Denmark, Finland, Norway, Malta, and New Zealand. It will also move its trading activities in Brazil to global and regional hubs.

The lender said it would seek to modernize its internal technology, calling its information technology structure “outdated and fragmented,” and to eliminate about 90 legal entities within the institution.

The announcement came Thursday as the bank reported a net loss of €6.02 billion, in the three month to the end of September.

Deutsche Bank is also seeking resolution for a scandal in Russia, in which it was examined by US regulators seeking to find out whether $6 billion in trades made by the German bank for Russian clients constituted money laundering.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies