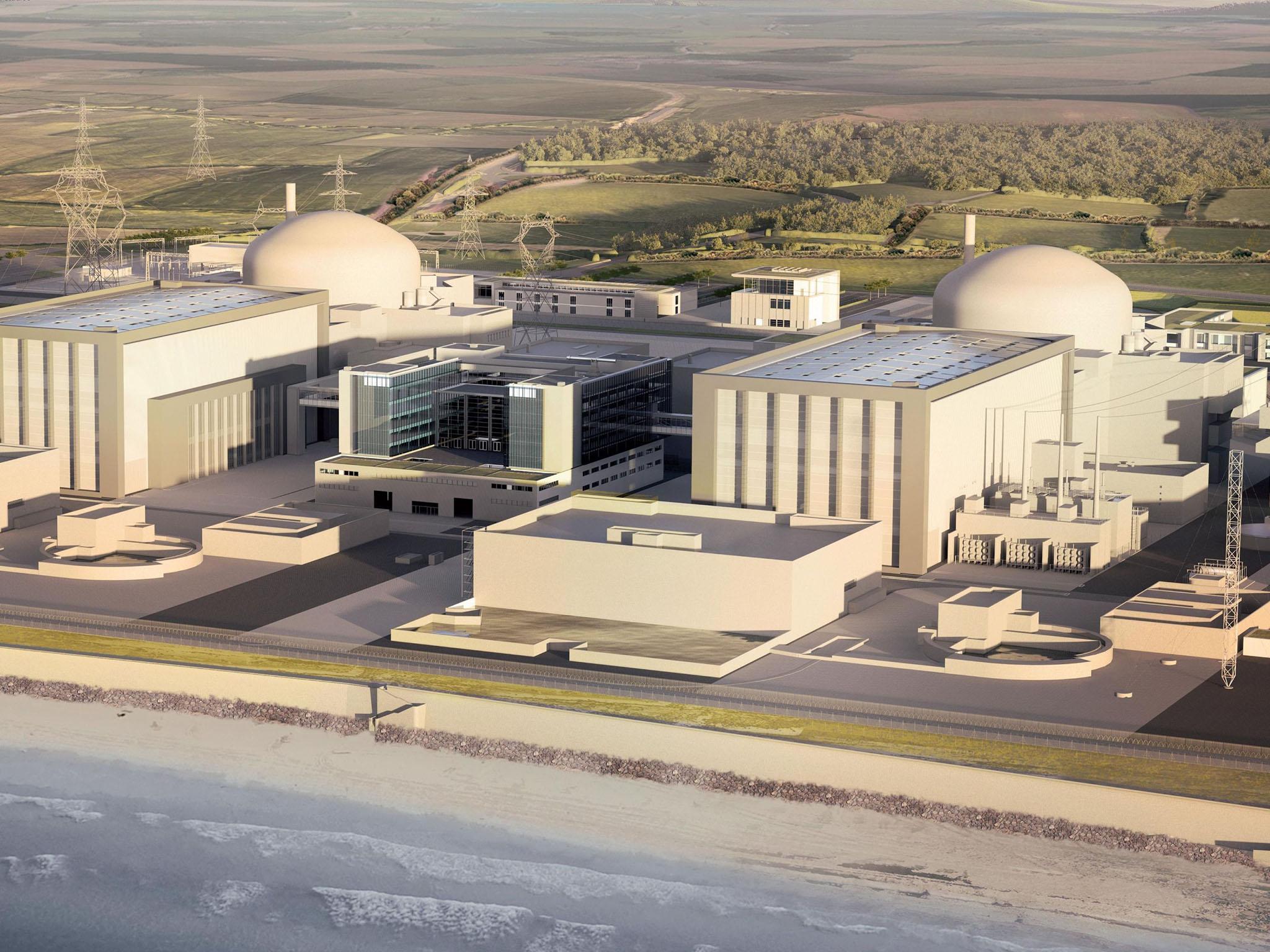

EDF board member resigns ahead of Hinkley Point nuclear power station vote

Gerard Magnin, one of 18 board members, has quit, saying that the £18bn project is too financially risky and will divert France away from investment in renewable energy

A board member of the French energy giant EDF has resigned ahead of a vote to give the green light to construction of the controversial Hinkley Point nuclear power station in Somerset.

Gerard Magnin, one of 18 board members, quit today saying that the £18bn project is too financially risky for EDF and will divert France away from investment in renewable energy.

The resignation of Magnin, who has a background in alternative energy, is not expected to derail EDF's approval for the project today.

But it signals growing doubts about Hinkley Point and the financial capacity for EDF to deliver the UK's first new nuclear power station in 20 years.

The firm's chief financial officer, Thomas Piqemal, resigned in March over the project, saying it would jeopardise EDF's financial situation.

“As a board member proposed by the government shareholder, I no longer want to support a strategy that I do not agree with,” Magnin wrote in a letter to EDF chief executive Jean-Bernard Levy which has been seen by Reuters.

EDF is listed on the French stock exchange but the French state retains an 81 per cent stake.

When the project to build a state-of-the art European Pressurized Reactor (EPR) on the Somerset coast was originally outlined in October 2014 EDF was only supposed to take a 50 per cent stake.

The rest was supposed to be financed by Chinese state companies and another majority state-owned French-nuclear engineering firm Areva.

But Areva has subsquently stumbled financially and its nuclear unit has been absorbed by EDF. And the Chinese have said they will fund no more than a third of the project, leaving EDF to finance 66 per cent of Hinkely Point.

Since January 2015 EDF's share price has fallen by 50 per cent and its market capitalisation is just €22bn, less than the entire Hinkley Point project value.

The company, which has €37.4bn of debt, also needs to spend €50bn to upgrade its French nuclear plants over the next decade.

“Let's hope that Hinkley Point will not drag EDF in the same abyss as Areva” said Magnin in his letter.

EDF unions have six seats on the board and have suggested they might vote against the Hinkley Point investment, arguing that it could jeopardise the company's future.

The Hinkley Point reactor is also controversial in the UK as the UK government has agreed to buy electricity from the plant for 35 years at a price that is more than twice current market rates.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies