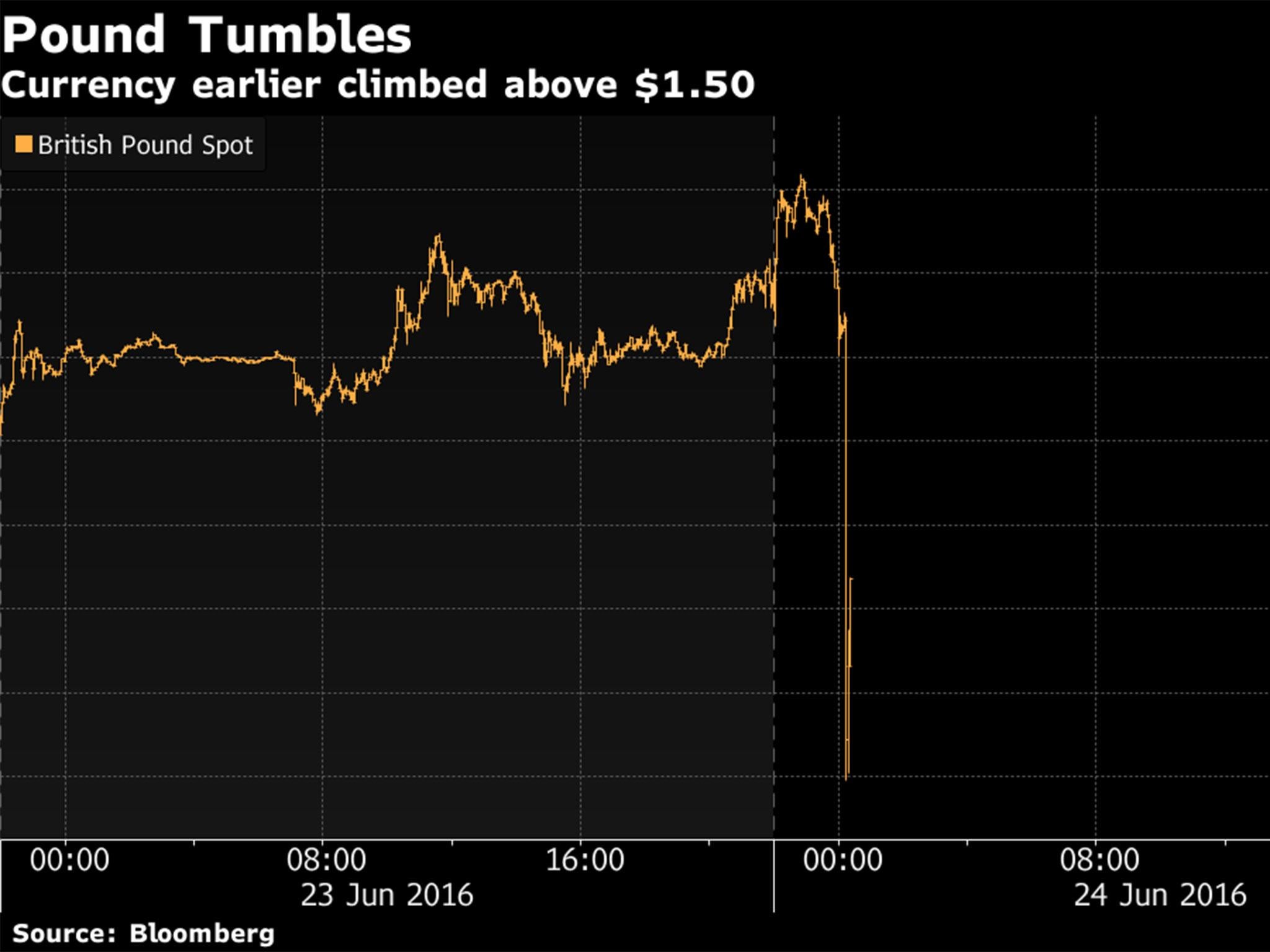

The pound plummeted by 4.4 per cent against the dollar after a shock large victory for leave in Sunderland. It was the sharpest recorded daily fall in the value of the UK currency since the 2008 financial crisis.

The pound had been pushed up to a new high for the year of US $1.5 as financial traders, working through the night, responded to polls earlier in the evening showing a relatively comfortable lead for Remain.

Follow the latest live updates on the EU referendum

Brexit or Remain? Follow the results on our live tracker

But that mood rapidly reversed after the count in the north-eastern city showed a 20 point victory for Leave and sterling was sent rapidly down to just US $1.4295.

A host of analysts, including the Bank of England, have forecast that the pound could fall by 20 per cent against the dollar if Britain does vote for Brexit.

The pro-EU camp won 51 per cent of the vote in Newcastle, smaller than the 12 per cent lead that had been forecast, and in neighbouring Sunderland the vote in favour of exit was an emphatic 61 per cent.

“The early optimism of the YouGov poll at 10pm has evaporated almost instantaneously. Newcastle was a squeaky win for Remain but Sunderland was a huge kick in the ribs and the bottom has fallen out of the pound” said Jeremy Cook of World First.

Andy Scott, economist at HiFX, said: “Sterling just fell 400 points against the dollar after a significant victory for leave in Sunderland with 61 per cent of the vote. Stunning moves and things are really starting to look uncertain in these results”.

The pound fell by 6.52 per cent on 24 October 2008, according to calculations by the Financial Times. The next biggest daily swing was 4.86 per cent on 16 September 1992, Black Wednesday, when the pound crashed out of the European Exchange Rate Mechanism.

Unlike markets in stocks and shares, in which traders can only trade in set hours, currency markets are open 24 hours a day.

Volatility is expected in equity markets when they open at 8am, especially if Leave is in the lead.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies