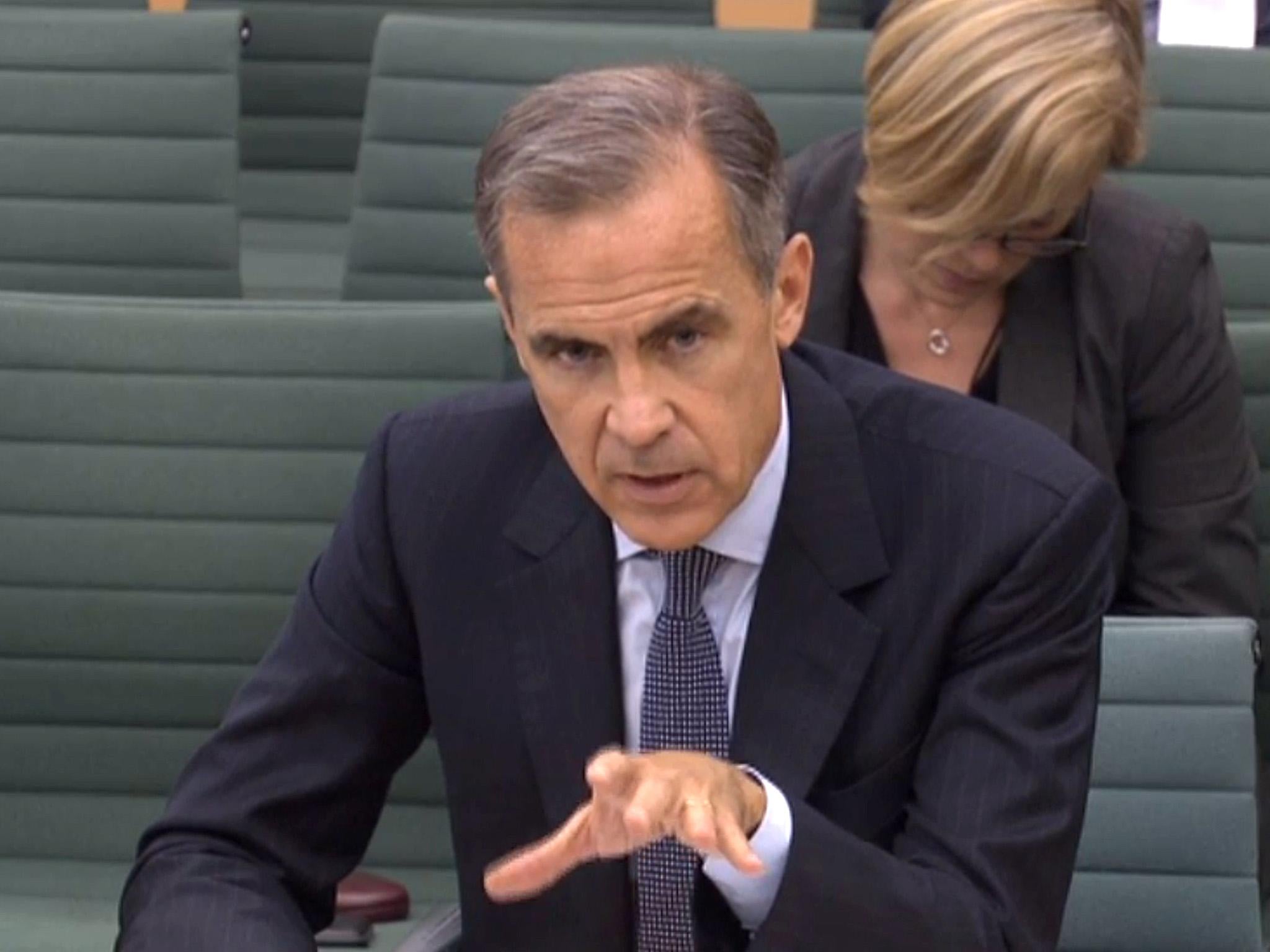

Europe more at risk from hard financial Brexit than UK, says Mark Carney

Greater risks for the EU than for the UK if no 2019 Brexit transition deal agreed, says Bank of England Governor

The European Union is at greater risk than the UK if the two parties are unable to agree a financial transition phase for the City of London after Brexit in 2019, the Governor of the Bank of England, Mark Carney, has warned.

Giving evidence to the Treasury Select Committee, Mr Carney stressed again that it would be "welcome" and "highly advisable" for UK-based financial firms that do business with Continental Europe to receive transition arrangements so they do not lose access abruptly in two years' time.

“If there is not such a transition put in place, in our view it will have consequences. We will work to mitigate those consequences as much as possible,” he added.

But he stressed that if this did not happen the greater financial stability risk lay with European states, rather than the UK.

“I'm not saying there are not financial stability risks to the UK - and there are economic risks to the UK - but there are greater financial stability risks on the continent in the short term for the transition than there are for the UK,” he said.

The Governor stressed the reliance of European households, governments, corporations and banks on the City.

“If you rely on a jurisdiction for half of your lending [and] half of your securities transactions you should think very carefully about transition from where you are today to where you will be tomorrow,” he said.

The fear in the City is that the UK will leave the single market, potentially meaning UK-based financial firms will suddenly no longer be able to sell services to Continental customers.

The UK-based derivative clearing operations are also thought likely to be required to move to mainland Europe after Brexit.

The chief executive of the London Stock Exchange warned on Tuesday that the UK's vote to leave the EU poses a risk to the global financial system and could cost the City of London up to 230,000 jobs if the Government fails to provide a clear plan for post-Brexit operations.

Asked about the possibility of a regulatory "equivalence" regime for the City of London in the wake of Brexit, which could allow financial business to continue uninterrupted, Mr Carney stressed that "we don't want to be a rule taker as an authority" and for the Bank of England to be required to merely "cut and paste" financial rules made in Brussels and Frankfurt.

Business news: In pictures

Show all 13Asked whether Brexit was still the biggest single risk to the financial system, the Governor said "strictly speaking the view of the [Financial Policy] Committee is 'no' ".

“The scale of immediate risks around Brexit have gone down” he said, while stressing that they were still "elevated".

The Governor was asked about the recent suggestion by his chief economist Andy Haldane that the Bank had had a "Michael Fish moment" when it failed to anticipate the 2008 financial crisis and also in its warning of a recession in the wake of the Brexit vote last year.

Mr Carney defended the Bank on the latter front and said that it had helped to "make the weather" through its provision of liquidity after the referendum vote and regulatory requirements in advance of it.

“We helped to make the weather in that we catalysed contingency plans, actions, pre-positioning of collateral, other steps with other major central banks and actual better risk management, which helped ensure that this was a smooth process, and put the country in a better place to take advantage of the opportunity,” he said.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies