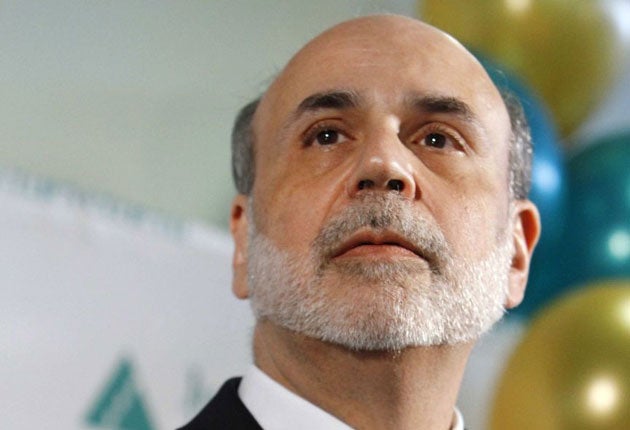

Fed chairman Ben Bernanke's economic fears keep the QE taps running

Shares surge, bond yields plummet as Fed wrongfoots Wall Street; Central bank slashes its growth forecasts for 2013 and 2014; Governor needs 'more evidence' of economic revival to ease stimulus

The US Federal Reserve stunned the global financial markets last night as it opted to keep its quantitative easing programme going at $85bn a month despite widespread expectations that it would take the first step towards "tapering" it down.

The central bank said it would "await more evidence" that recent economic progress "will be sustained" before reversing course.

Stock markets soared and Treasury bond yields tumbled on the announcement, with both the Dow Jones Industrial Average and the Standard & Poor's 500, the two main stock indices in New York, both closing at record highs. The latter was up 1.2 per cent at 1725.52, while the former gained 1 per cent to close at 15,676.

Currently, in the third round of a policy known as quantitative easing, the bank is buying $85bn worth of mortgage-related and government bonds every month, and most observers had expected that figure to be reduced by $10bn-$15bn per month after the Fed chairman Ben Bernanke outlined a rough timeframe for rolling back the programme earlier this year.

But in a statement following the latest meeting of its policy-setting Federal Open Market Committee (FOMC) yesterday, the Fed said it was too early to begin reducing the measures that have been supporting the world's largest economy as it attempts to recover from the crisis and the subsequent recession.

With long-term interest rates rising and potential fiscal challenges on the horizon as Republican and Democrats in Washington fight over the budget, Mr Bernanke said the Fed can't shape policy based on market expectations. He added there was "no fixed schedule" for when it might roll back policy, and "no magic number" in terms of the unemployment rate that would lead to a change in policy.

"What we will be looking at is the overall labour market situation, including the unemployment rate but other factors as well." he said.

Expectations of a cut had been stoked in June after Mr Bernanke said the scope of the bond-buying programme could be reduced this year, and purchases wound down completely by the middle of next year as unemployment falls towards 7 per cent.

But although the jobless rate in the US has been steadily improving, easing to 7.3 per cent last month, the most recent drop came about for the wrong reasons, with the labour force participation rate declining to 63.2 per cent, its lowest level since 1978.

Also, disagreement between Republicans and Democrats has raised the prospect of a government shutdown in coming weeks. Not long afterwards, the issue of the debt ceiling is once again slated to rear its head.

Meanwhile, in a gloomy new set of forecasts for the US economy, the Fed said growth this year would now be 2 to 2.3 per cent, down from 2.3 to 2.6 per cent predicted in June. Next year's downgrade was even sharper.

Shock and awe: Wall Street reacts

Wayne Kaufman, Rockwell Securities

"Everyone is a little shocked to say the least. The Fed is sending a message that the economy is weak, and that's confusing. I would have been happier with a small taper to prepare the investing public to the idea"

Ronald Simpson, Action Economics

"They surprised everybody. The dollar got crushed, stocks are up and yields are down. Nobody was positioned for this. Some people [now] might think the lack of doing anything is kind of like a warning sign for the economy"

Marc Doss, Wells Fargo Bank

"The Fed's erred on the side of caution: they are willing to risk inflation, willing to risk bubbles, because they are worried about the economy. This sets the tone across the globe. We were to be the first to take the foot off the accelerator but not yet"

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies