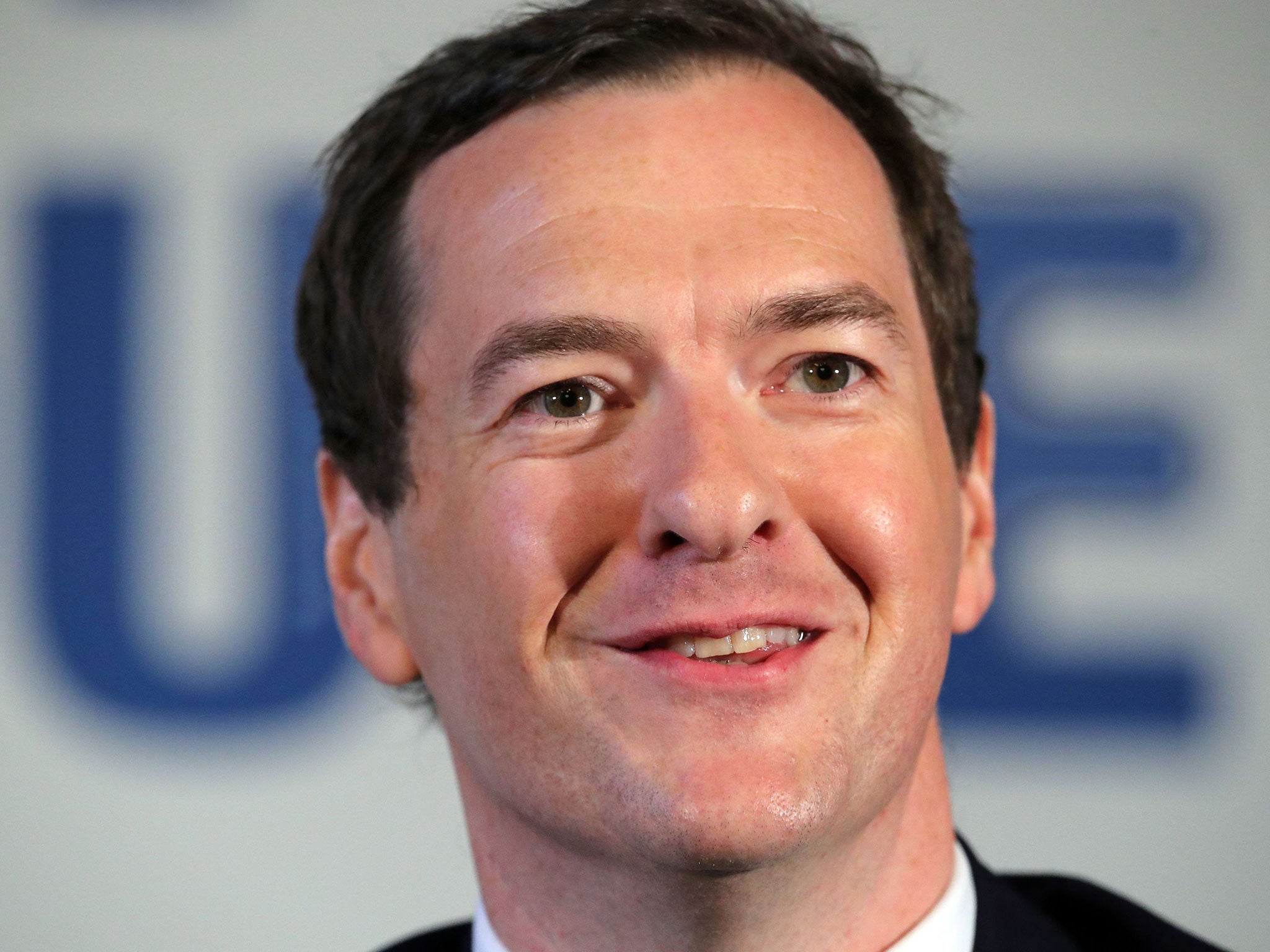

George Osborne says the Bank of England's quantitative easing makes the rich richer

As chancellor Mr Osborne never commented on the distributional consequences of the Bank of England’s monetary stimulus measures

The former chancellor, George Osborne, has said that money printing by the Bank of England has made the rich richer and that interest rate cuts have hurt savers.

Speaking from Washington in an interview with Bloomberg TV, Mr Osborne said: “We need to offset the very necessary loose monetary policy and the distributional consequences that it is having. Essentially it makes the rich richer and makes life difficult for ordinary savers.”

“There’s a role for government policy not in stopping that monetary policy which keeps the economy strong but in mitigating its impact. I think all of us who believe in free markets need to work harder to find an answer to the anger that people clearly feel out there.”

The Bank produced its own analysis in 2012 which showed that its quantitative easing (QE) scheme – which it restarted in August to support the economy in the wake of the Brexit vote – inflates asset values.

And the Bank has acknowledged that the rich have more of these assets than the poor, meaning they automatically benefit more.

Yet, as chancellor, Mr Osborne never commented on the distributional consequences of the Bank of England’s monetary stimulus measures or interest rate cuts, despite widespread complaints from some groups that QE was making the rich richer.

His June 2015 budget was also widely criticised for entailing a much bigger cut to the incomes of poorer families than those in the top half of the distribution, as he slashed £12bn from the benefits bill by 2020.

In the wake of the 2015 general election Mr Osborne also scrapped the Treasury’s distributional analysis charts showing the impact of overall budget tax and welfare changes, which critics said was born of a desire to disguise the regressive nature of his policies.

The Institute for Fiscal studies has however, continued to publish the charts.

Mr Osborne did, however, implement policies in office designed to help savers, such as pensioner bonds for the elderly and a virtual elimination of tax on savers’ interest income.

The Bank of England’s policymakers have defended the QE programme’s impact, arguing it helps to boost aggregate demand and that this supports employment and the incomes of all.

It maintains that without QE, which began in 2009, the economy would have fallen into an even deeper recession and that the only way to get interest rates to a sustainably higher level is for the Bank to stimulate the economy.

In August the Bank's Monetary Policy Committee voted to increased its £375bn asset purchase programme by a further £70bn, made up of £60bn of Government bonds and £10bn of corporate bonds.

QE has also been widely attacked for increasing the accounting deficits of companies’ defined benefits pension schemes by boosting the value of their future liabilities to workers. But the Bank points out QE has also inflated the value of the assets of those schemes, meaning that the overall impact on fully funded schemes has been neutral.

What experts have said about Brexit

Show all 11In Mr Osborne's TV interview, his first since being sacked by Theresa May as chancellor in July, he also stressed the need for the UK to have a “soft” Brexit, implying that the UK needs to remain in the EU single market, although this would almost certainly mean continuing to accept at least some free movement of EU citizens into the UK.

“The economic consequences of a harder Brexit will be more severe,” he said.

Mr Osborne was criticised during the referendum campaign for his vivid warnings of a recession if the UK voted to leave the EU. So far, the economic indicators suggest the economy will avoid that fate and some City economists have been revising away their initial forecasts for a recession.

But Mr Osborne, the MP for Tatton, said it was still “too early to say” what the economic consequences of Brexit would be.

“It's going to be the decisions that we take now which are also going to have a big impact on our long-term economic prospects,” he said.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies