HSBC scandal: Chief executive Stuart Gulliver apologises to MPs for 'unacceptable events' at bank's Swiss subsidiary

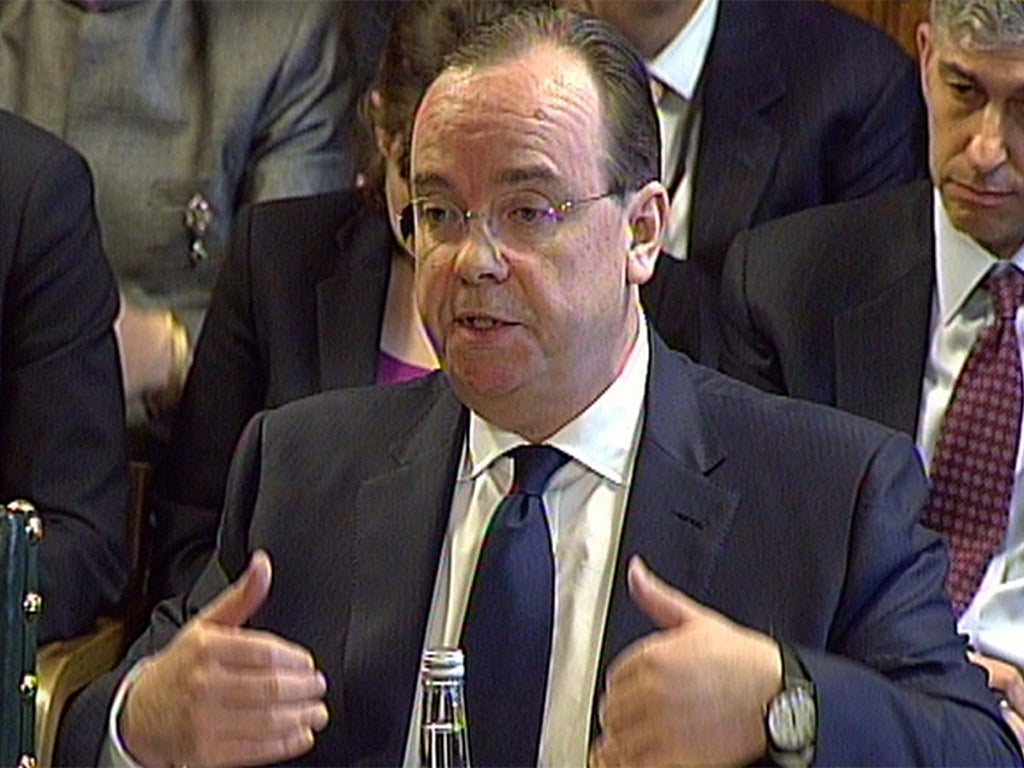

Gulliver and HSBC chairman Douglas Flint were grilled by MPs on the Treasury Select Committee

HSBC chief executive Stuart Gulliver has apologised to MPs for "unacceptable" practices at the bank's Swiss subsidiary which he said had caused "damage to trust and confidence" in the company.

Mr Gulliver's apology came as he and HSBC chairman Douglas Flint were grilled by MPs on the Treasury Select Committee over what committee chair Andrew Tyrie said were "extraordinary" revelations about tax-avoidance activities linked to the Geneva branch in the mid-2000s.

The HSBC chief executive also defended his personal decision to be paid by the bank via a Panamanian company with an account in the Swiss private bank, insisting that the arrangement was not designed to avoid tax, but to protect his privacy against other members of staff who were able to view employees' accounts via the company computer system.

Mr Gulliver acknowledged that the arrangements looked "puzzling" to outsiders, but insisted: "There was no tax advantage or purpose whatsoever."

He said he was a Hong Kong resident and intended to return there after completing his assignment in the UK, but had paid UK tax on his worldwide earnings from HSBC, company dividends and sales of shares.

Mr Gulliver - who has worked for HSBC for 35 years and became chief executive in 2011 - told the committee: "I would like to put on the record an apology from both myself and Douglas for the unacceptable events that took place at our private bank in Switzerland in the mid-2000s. It is an apology we would like to make to you, our customers, our shareholders and the public at large.

"It clearly was unacceptable. We very much regret this, and it has damaged HSBC's reputation."

Asked precisely what he was apologising for, Mr Gulliver said: "The lack of controls and practices which now - judged with the benefit of hindsight - we would not be at all comfortable with if they were happening today, and which have clearly resulted in damage to trust and confidence in HSBC and created further reputational damage to our firm and have therefore hurt clients, customers, shareholders, our staff and people at large."

Mr Tyrie asked the HSBC chief exectuive: "Who is doing the apologising here?"

Mr Gulliver replied: "I am, as the group CEO of HSBC."

He added: "I've been with the group for 35 years. I am responsible for cleaning it up, so I have made substantial changes ... I wasn't running the private bank at that point in time, but I have spent 35 years working with HSBC, so there is a proximity issue."

Challenging Mr Gulliver over the unusual way in which he was paid, Mr Tyrie told him: "You've said you're trying to clean everything up. Some years ago, you were certainly muddying the waters with these extraordinary tax arrangements, weren't you?"

The HSBC chief executive replied: "I can understand how people find these arrangements kind of unusual. I myself grew up in Plymouth, I went to a state school, so I can understand why the public would find them unfamiliar and rather strange."

Mr Gulliver said he left the UK in 1980 with the intention of spending his career overseas, and had made his home in Hong Kong and set up the Panamanian "nominee entity" in 1998 to channel his pay from the bank.

"There was no tax advantage or purpose whatsover to the Panamanian company. It was a Panamanian nominee entity constructed purely to give me privacy within my own company," he said.

"At that point in 1998, my compensation was not a matter of public record. When I became a director of HSBC in 2008, my compensation became public and that structure was wound up in 2009.

"It was purely about privacy from colleagues in Hong Kong and Switzerland. We had a computer system back in the day that allowed everybody to inquire into staff accounts ... I was amongst the highest paid people and I wished to preserve my privacy from colleagues. Nothing more than that."

He added: "Looking back on it from 15 years later, clearly Panama looks quite strange. But it was simply a nominee entity. I didn't choose Panama. It was a structure that at a particular time our Swiss private bank was putting in place."

Mr Tyrie asked him: "You do understand how this looks today, do you?"

Mr Gulliver replied: "I understand that it looks puzzling to people and I understand it looks difficult and suggests that there might have been other reasons related to tax, but there were not.

"I have been UK tax resident since 2003, I've paid UK tax on my worldwide earnings from HSBC, I've paid UK tax on HSBC dividends, I've paid UK capital gains tax on any shares that I've sold ... I've also paid the remittance-based charge of £30,000 a year directed by HM Revenue and Customs to cover overseas investment income that stays overseas."

Asked if HSBC had suffered "reputational damage" from the disclosure of Mr Gulliver's financial arrangements, Mr Flint said: "Yes."

"I was not aware of the private arrangements," he added.

Mr Gulliver said he had changed HSBC from a "federal" structure to a more centralised one since becoming chief executive in 2011, and sold off 77 businesses.

Both bankers insisted they had not discussed the activities at HSBC's Swiss arm with anyone at the Treasury.

"Certainly I did not discuss the Swiss case with anyone in the Treasury," Mr Gulliver said.

Mr Flint added: "I don't believe so, I believe all our discussions were with HMRC."

Mr Tyrie read out a long list of "regulatory problems" HSBC was currently facing, including PPI mis-selling, interest rate derivative mis-selling, Forex manipulation and violation of international sanctions.

Mr Flint said: "It is a terrible list ... One of the most humbling things that has happened in my career is a recognition of all the things you did not know, and you go and say 'what could I have known or what should I have known?'

"What these instances have illustrated or brought to the fore is that allowing interpretation at 88 countries as it was at the time is the wrong way to go and we should centralise control."

Asked who was responsible for introducing the federal structure, Mr Flint said: "Each chief executive decides the organisation structure that he thinks best fits the control environment of the firm. I think that the regional structure worked very well until it clearly didn't. And now it has been changed."

Mr Gulliver was asked what it said about the "culture" of HSBC that he had feared his colleagues would pry into his bank account.

”I would respectfully point out we are talking about 1998,“ he said. ”It is a very old arrangement.“

He said he employed a lawyer who completed his tax return.

Mr Gulliver said HSBC no longer did "hold mail accounts", where they never sent correspondence to the customer's home.

But he stressed that at the time in Switzerland such practices "would not have been seen as suspicious".

Press Association

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies