Investment bankers in line for bonus bonanza as income soars

While most Britons struggle to cope with a brutal squeeze on their spending, the City of London's investment banks are preparing for a bonus boom after raking in huge increases in fees.

Click HERE to view graphic (135k jpg)

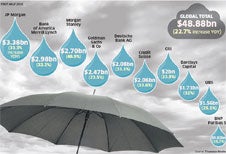

Despite widespread rumblings of discontent over what they charge, investment banks levied a total of $48.9bn (£30.5bn) in fees in the first half of this year, a study by Thomson Reuters found. That represented a 23 per cent rise on the same period last year and was the best opening half since 2007, before the financial crisis squeezed off the fees pipeline as deals and company flotations dried up.

Fees charged in Britain have risen more slowly but were still up a massive 16 per cent to £1.7bn. It means that, come bonus time, bankers will be expecting six or seven-figure payouts again, even if new rules demanding that at least part of the pay of "star bankers" – the so-called rainmakers who generate the most fees – is deferred and paid in shares now mean that they have to wait to pocket the cash.

Bonus pools are typically based on a percentage of the fees generated by banks. The Thomson Reuters report covers the full spectrum of investment banking charges, which are generated for services such as advising on deals or underwriting share issues.

JP Morgan was the biggest fees "whale", raking in $3.4bn, nearly 7 per cent of the global fees "wallet". Morgan Stanley was the biggest climber – its $2.7bn fees total was a stunning 48.9 per cent rise on last year. Six of the top ten earners were American banks.

The Americas generated the biggest regional increase in fees – up 26.9 per cent. Despite Europe's economic woes and growing panic about Greece and other debt-ridden eurozone nations, the Continent also posted a substantial rise in fees of 26.4 per cent. Only Japan registered a fall, with fees paid by her companies tumbling 23 per cent. In January, the Office of Fair Trading raised concerns about fees after finding that investment banks had sharply raised their charges to companies for services such as underwriting shares issues. Companies now pay 3 per cent of the total amount raised from any share issue, compared with 2.5 per cent before the financial crisis.

The OFT also criticised companies, saying: "[They are] not focused on the cost of equity underwriting services, instead prioritising speed, confidentiality and a successful 'take-up'.

"Some may also lack regular experience of raising equity capital, which makes it difficult to hold investment banks to account on costs. While institutional shareholders have expressed concerns, they have yet to put sufficient pressure on companies to reduce the fees paid."

But the watchdog said it would not refer the issue to the Competition Commission and instead told shareholders and directors they should "drive competition for themselves".

News of rising bank fees will revive the debate about the City's bonuses culture. Brendan Barber, general-secretary of the Trades Union Congress, said yesterday: "The large increase in fees collected by UK banks show that the good times are rolling in the City again. This will astonish the millions of credit-starved businesses and people struggling for a mortgage, who can't persuade the banks to lend. A healthy banking sector should be encouraging business investment and growth, not just its own profits and bonus pools."

Investors' organisations were less concerned about the rise in fees, but said they were still worried about companies rushing into deals of questionable quality on the back of advice from investment banks. Michael McKersie, at the Association of British Insurers, said: "The big question for us is not the overall total amount of fees but whether they are commensurate with the quality of work undertaken. We need to know whether the right deals are really being done."

The money men doing the biggest deals in Europe

Viswas Raghavan

JP Morgan's head of international capital markets worked on the flotation of Italy's luxury goods giant Salvatore Ferragamo this year, as well as a €5bn rights issue by car maker Porsche. Hernan Cristerna, one of JPM's most senior M&A bankers, was also hugely productive in 2011.

Christian Meissner

Mr Meissner joined Bank of America Merrill Lynch last year to run investment banking for Europe, Africa and the Middle East, and has since been promoted to co-head of global corporate and investment banking. Under his watch BAML has worked on major deals including the Glencore IPO.

Franck Petitgas

A renowned art lover who is a trustee of the Tate, Mr Petitgas joined Morgan Stanley in 1993 from SG Warburg. The Frenchman has a background in equity capital markets and has bolsterd the company's mergers and acquisitions practice in Europe to one of the strongest in the industry.

Yoël Zaoui

Based in London, Mr Zaoui is global co-head of mergers and acquisitions in the investment banking division at Goldman Sachs, the company he joined in 1988. Mr Zaoui was born in Morocco and grew up in Rome, and he has overseen huge growth in the business's European revenues.

Stephan Leithner

Mr Leithner is the global co-head of investment banking coverage and advisory at Deutsche Bank and sits on Anshu Jain's executive committee. He is working on the Deutsche Börse merger with NYSE and Deutsche Telekom's proposed sale of T-Mobile in the US to AT&T.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies