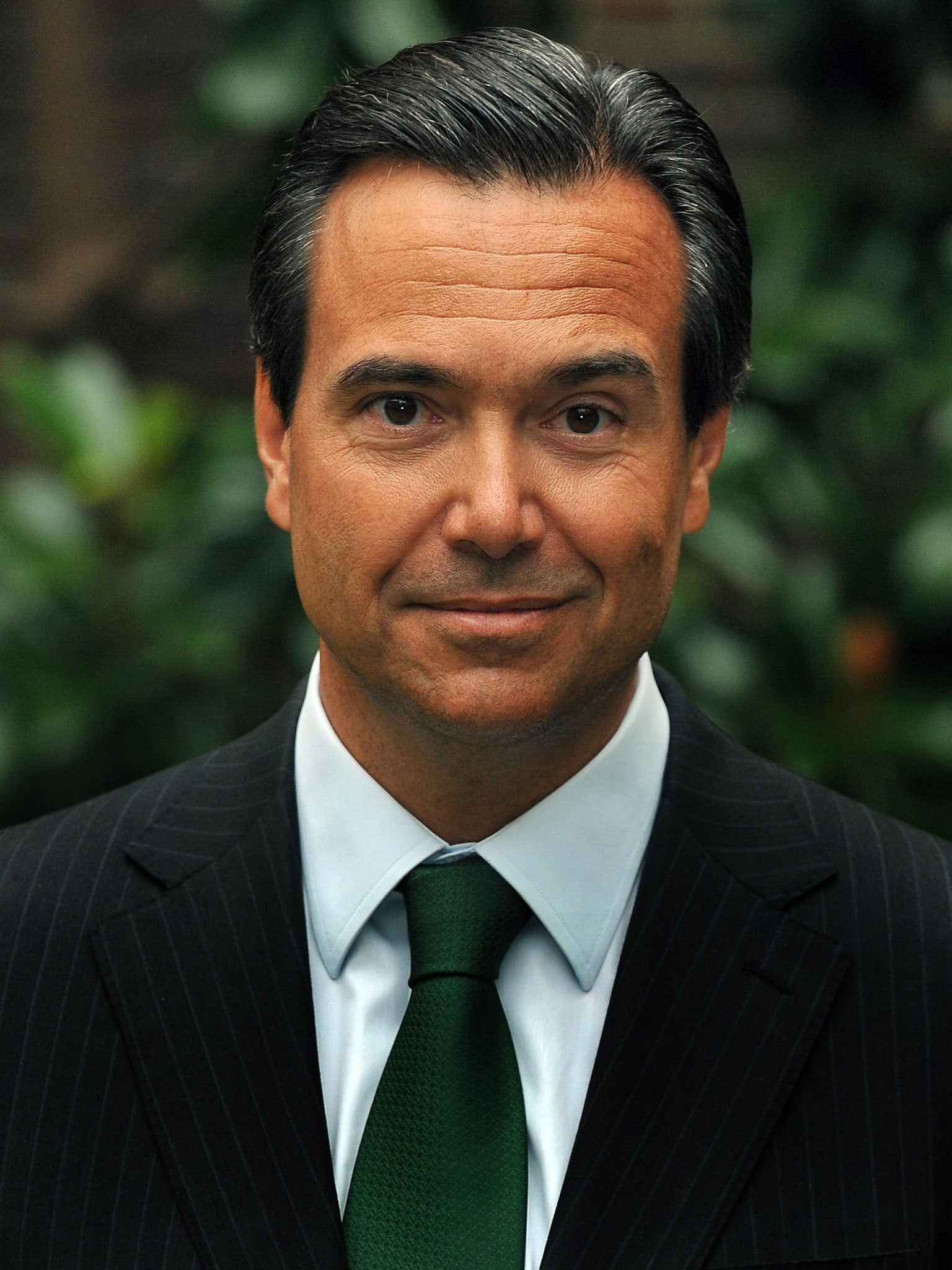

The chief executive of taxpayer-backed lender Lloyds Banking Group is on course to seal a multi-million pound bonus payout next month.

Antonio Horta-Osório will pick up a windfall of more than three million shares if Lloyds’ share price remains above 73.6p – the level the Government paid to bail out the bank in 2008 – for at least 30 consecutive days. The shares closed at 80.37p on Friday, ending a third week above the target threshold.

According to reports on Sunday night, the bonus pay-out could be worth more than £2.5m to the 49-year-old, although he would not be able to claim the money until 2018.

Lloyds axed 7,000 staff posts last year after running up losses of around £3.5bn in 2011. It is in the process of shedding another 8,000 staff over the next two years. Britain’s biggest union, Unite, demanded an end to the cuts.

The group has also offloaded part of its business, including wealth manager St James’s Place, to raise funds. Last week, it confirmed it was in talks with Aberdeen Asset Management to sell part of Scottish Widows.

Mr Horta-Osório, a Portuguese-born banker, joined Lloyds in early 2011 but took time off in October that year with exhaustion and checked into the Priory Clinic with sleep deprivation. At the time said he did not sleep for five days but his decision to take time off caused share prices to plummet to around 29.2p.

Mr Horta-Osório oversaw the sale of the first tranche of the government stake in the bailed-out bank in early 2012. At the time, he said that Lloyds was in “worse shape than I thought when I took the job”.

Since being rescued by the state, Lloyds has cut thousands of jobs and found itself embroiled in mis-selling scandals. However, the bank has performed strongly in recent months and is expected to report impressive third quarter results on Tuesday with City analysts predicting that a significant boost in profits.

Last month, ministers sold 6 per cent of Lloyds, for 75p a share. Chancellor George Osborne has said there would be no further sales for several months. The Government’s holding now stands at about 32 per cent.

On Friday, Royal Bank of Scotland’s new chief executive, Ross McEwan reveals his first set of results. Mr McEwan’s set-piece review of the business is not due until February, but he is already having to address issues like the break-up of the bank into good and bad parts.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies