Mining mega-merger set to go ahead despite investor qualms

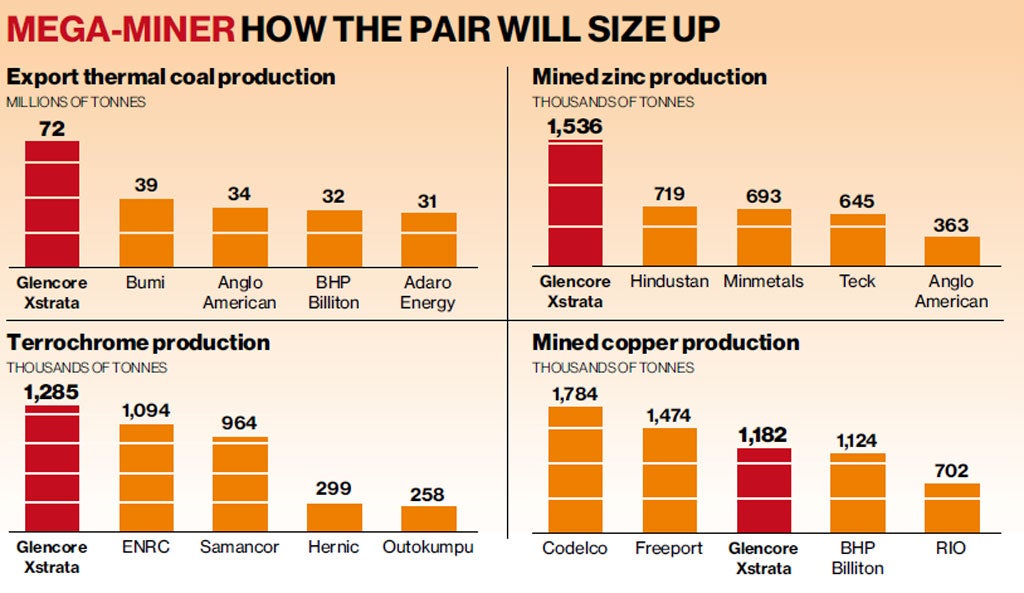

Shareholders are set to approve Glencore and Xstrata's long-awaited £56bn merger agreement after eight months of talks, despite substantial opposition to the deal, a leading investor predicted yesterday.

At least three significant Xstrata shareholders plan to oppose the merger, which would create a mining and commodities trading powerhouse, arguing that it undervalues their company.

They include Threadneedle Investments, which owns 0.29 per cent of Xstrata, and Knight Vinke, the activist investor with a 0.5 per cent shareholding, which reiterated its opposition yesterday. A third investor also plans to oppose the deal, but believes voting against the merger is futile.

"It's all over bar the shouting. It's pretty obvious that the deal has the tacit approval of Qatar. Clearly they have agreed to the new 3.05 ratio," said a source at the investor, referring to the revised deal which will see Xstrata shareholders receiving 3.05 Glencore shares for each of theirs.

Xstrata's shares rose by 22.5p, or 2.35 per cent, to 980p, while Glencore closed down 1.1p at 342p, after the agreement was announced yesterday, suggesting that the City broadly believes the deal will go ahead.

Qatar has a 12 per cent stake, which in effect gives it the swing vote on whether the deal goes ahead. It was Qatar's opposition to the original transaction – with a ratio of 2.8 – that prompted Glencore to revise its offer.

Although Qatar had originally pushed for a ratio of 3.25, it has softened its stance in recent weeks. The fund declined to comment yesterday.

Christopher LaFemina, an analyst at Jefferies, said: "We continue to expect this mega-merger to be completed, especially in light of these important changes to the deal structure."

Glencore and Xstrata agreed that shareholders can vote for it with or without about £140m of controversial retention payments. Previously, the deal was contingent on approval for the retention payments.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies