Oil price collapses below $45 as US production soars

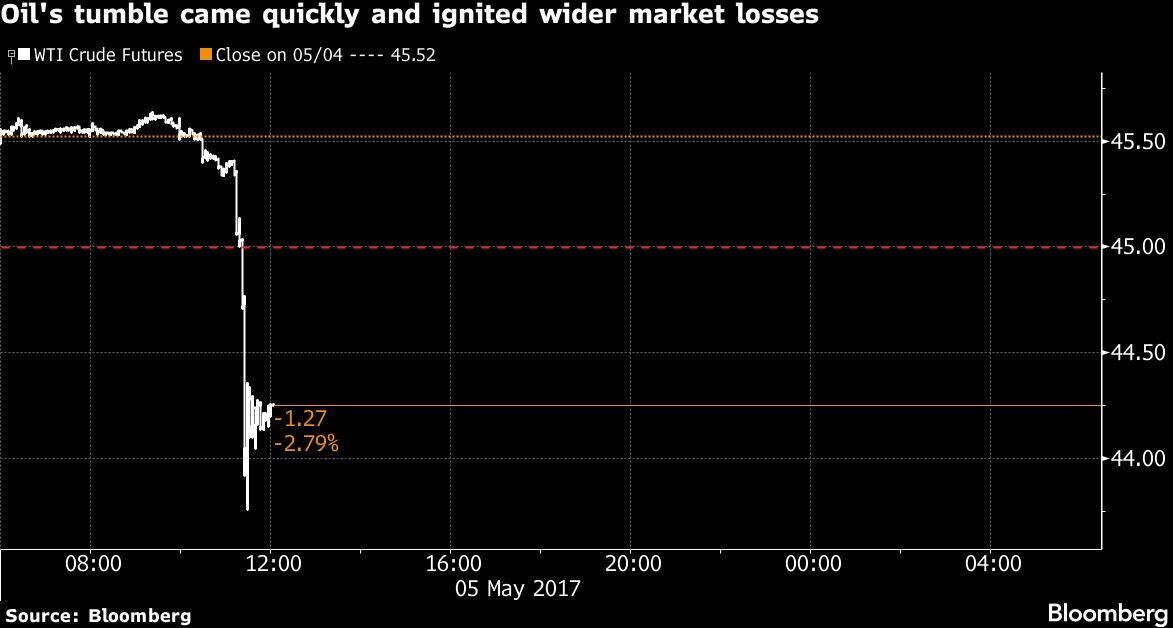

In less than 10 minutes on Friday, futures slumped more than $1 amid a surge in volume. They have collapsed 9.3 per cent this week

Oil slid below $45 (£35) a barrel for the first time since OPEC agreed to cut output in November as US shale confounds the producer group’s attempts to prop up prices.

In less than 10 minutes on Friday, futures slumped more than $1 amid a surge in volume. They have collapsed 9.3 per cent this week, sliding to the lowest since 15 November — two weeks before the Organisation of Petroleum Exporting Countries signed a six-month deal to curb production aimed at easing a global glut. The decline is being driven by expanding US output before OPEC is set to decide whether to prolong its cuts.

While OPEC’s curbs drove oil in early January to the highest since July 2015, that increase encouraged US drillers to pump more. The result has been 11 weeks of expansion in American production in the longest run of gains since 2012. Prices were still more than 50 per cent below their peak in 2014, when surging shale output triggered crude’s biggest collapse in a generation and left rival producers such as Saudi Arabia scrambling to protect market share.

“We’re seeing a strong reaction and a change in mood,” said Victor Shum, a Singapore-based vice president at IHS Energy. Prices that “overshot” to the mid-to-high $50s after the output deal are now “back to reality” amid surging American supplies, he said.

West Texas Intermediate for June delivery dropped as much as $1.76, or 3.9 per cent, to $43.76 a barrel on the New York Mercantile Exchange, and was at $44.76 at 3.01 p.m. in Hong Kong. Total volume traded was more than quadruple the 100-day average. The contract lost $2.30, or 4.8 per cent, to close at $45.52 on Thursday.

“There’s a lot of option-related activities so as the market falls through $45, the holders of short, put positions need to hedge,” said Mark Keenan, head of Asia commodities research at Societe Generale SA. “They need to sell futures and that can drive some very significant and volatile moves through those levels.”

US Output

Brent for July settlement slumped as much as $1.74, or 3.6 per cent, to $46.64 a barrel on the London-based ICE Futures Europe exchange. Prices are down 7.8 per cent this week, heading for a third weekly decline. The global benchmark crude traded at a premium of $2.57 to July WTI.

Energy companies led losses among equities in Asia, with the MSCI AC Asia Pacific Energy sub-index dropping 1.5 per cent. PetroChina Co. lost 2.8 per cent, while Australia’s Santos Ltd. slipped 3 percent. The S&P Oil & Gas Exploration and Production Index had slid as much as 4.9 percent Thursday to the lowest since August.

Business news: In pictures

Show all 13US crude production rose to 9.29 million barrels last week, the highest level since August 2015, according to the Energy Information Administration. While OPEC is likely to prolong curbs for a further six months, American shale supply remains a concern, according to Nigeria’s oil minister.

OPEC will meet 25 May in Vienna to decide whether to extend supply cuts through the second half.

“There’s disappointment that the production cuts we’ve seen from OPEC and others has not had any impact at this stage on global inventory levels,” said Ric Spooner, a chief market analyst at CMC Markets in Sydney. “The market seems to be much further away from a balanced situation than some had previously forecast. There is a possibility that oil could be headed to the low $40s range from here.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies