The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Pound remains steady against euro and US dollar after Donald Tusk presents EU’s Brexit negotiating stance

In the longer run, many economists and investors still think that a sustained sterling recovery is not on the horizon

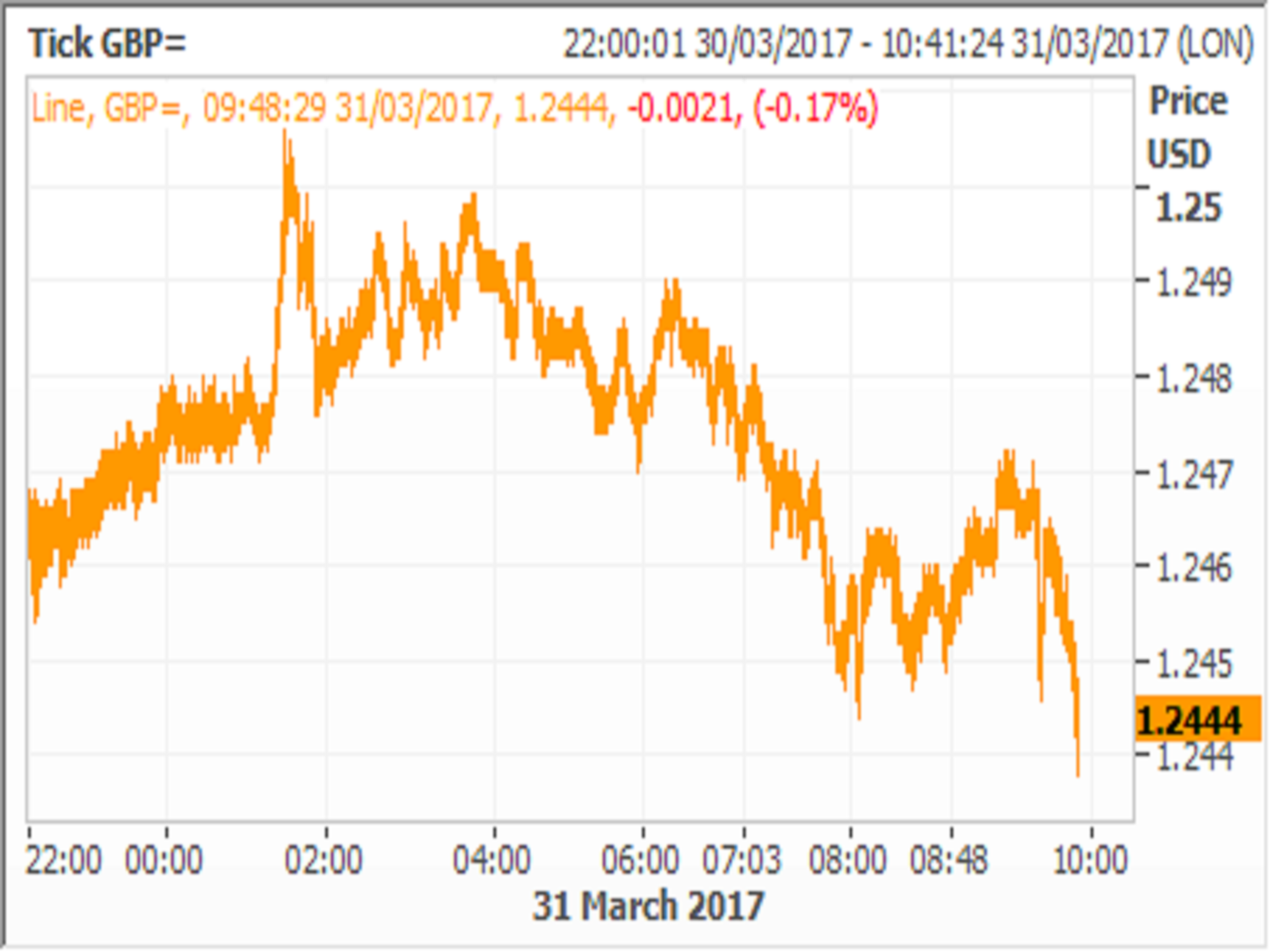

The pound was broadly steady against both the dollar and the euro on Friday after EU Council President Donald Tusk outlined his proposed negotiating guidelines for Brexit, two days after Theresa May formally triggered Article 50.

Speaking in Malta, Mr Tusk made clear that Britain must start to deal with its divorce from Europe before talks on future trade terms could commence.

In a nine-page document he said that there must be “sufficient progress” on withdrawal talks before negotiations on future relations could begin.

But currency markets seemed unperturbed. In fact, with trading little changed during the day, the pound rose slightly late Friday to around $1.254 against the dollar and €1.165 against the euro.

Over the week, the pound was almost unchanged, despite the UK’s formal triggering of Article 50.

“The already very bearish sentiment and positioning on sterling helped provide support,” strategists at French bank Societe Generale wrote in a note.

“Moreover, the soothing rhetoric from the UK Government that accompanied the Brexit trigger helped allay immediate concerns of a difficult negotiation,” they added.

In the longer run, however, many economists and investors still think that a sustained sterling recovery is not on the horizon and more volatility is in store.

David Meier, an economist at Swiss bank Julius Baer, said on Friday that he thinks that “economic uncertainty will curb foreign direct investments going forward”. He added that this was his main case for having a pessimistic, or bearish, forecast for the currency.

Last week, strategists at Deutsche Bank published an update to their forecast, predicting the currency could still fall as low as $1.06 before recovering.

The strategists at Societe Generale also cautioned that “it is still early days, and the talks are likely to get heated in the months ahead”.

Some, however, are more optimistic. Strategists at Morgan Stanley said that they are positioning in favour of the pound against the dollar on account of UK data proving robust and a recent survey from the Bank of England pointing to stronger investment intentions.

They add that Scottish parliament backing another independence referendum might also “add pressure to the government to come to a more moderate Brexit arrangement”.

See how much you could save on international money transfers with HiFX: sign up and make a transfer

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies