The UK public finances registered a robust performance in May, according to the Office for National Statistics, bringing some welcome breathing space to the Government amid multiplying signs of an economic slowdown.

Public borrowing was £6.7bn, down from £7.1bn in the same month a year earlier, and bang in line with the consensus of City economists.

VAT receipts were up 4.3 per cent year on year, while income tax and capital gains receipts rose 3.6 per cent.

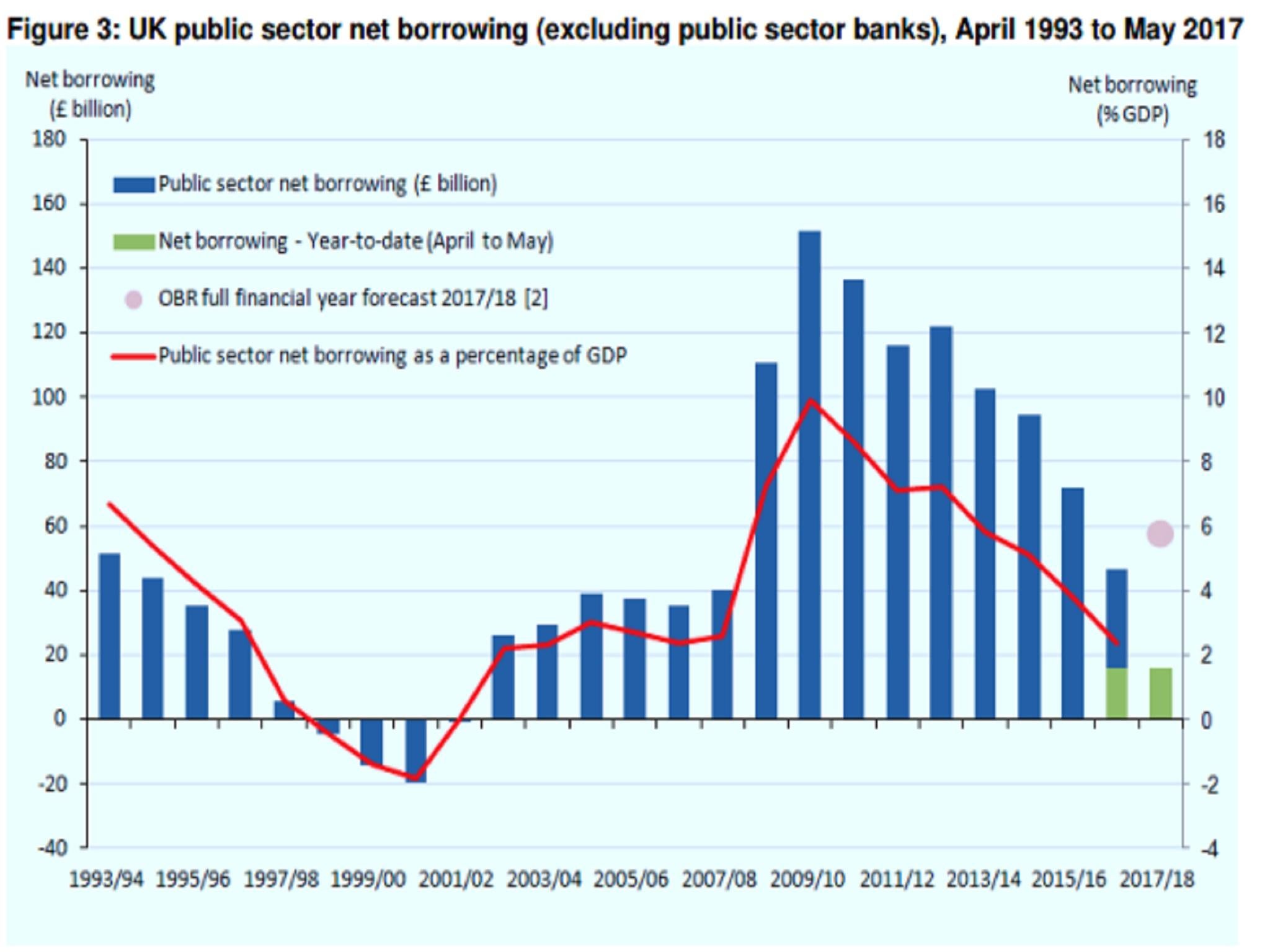

Public borrowing in the 2016/17 financial year was £46.6bn according to the latest ONS estimate, or 2.4 per cent of GDP, slightly lower than the £51.7bn forecast by the Office for Budget Responsibility in March.

However, the OBR has projected the deficit to rise to £58.3bn, or 2.9 per cent of GDP, in the current 2017/18 financial year as the 2016/17 figure was flattered by various one-off factors.

Solid start

GDP growth slowed to 0.2 per cent in the first quarter of 2017, down from a 0.7 per cent expansion in the final quarter of 2016.

While retail sales surged in April, they slipped back again in May, as consumer price inflation hit 2.9 per cent.

Scott Bowman, UK economist at Capital Economics, said the latest public finances data suggested a "solid start" to the financial year, but cast doubt on whether this would be maintained.

"We wouldn’t read too much into the borrowing figures for the first few months of the fiscal year as they are based on a significant amount of forecast data....What’s more, the election result suggests that the planned forthcoming fiscal squeeze may be scaled back slightly," he said.

A spokesperson for the Treasury said: "We have reduced the deficit by three-quarters since 2010 but there is still further to go. We are committed to bringing the public finances back to balance by the middle of next decade, building a stronger economy that can deliver higher living standards for people across the country."

Also on Wednesday, the latest report from the Bank of England's network of regional agents showed a further moderation in consumer spending in May, due to higher prices.

Firms' investment intentions rose slightly, but from a low level. And there was little sign of rising pay pressure, with nominal annual awards clustering only around 2-2.5 per cent.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies