Spectre of deflation haunts Britain

Bank of England expected to continue cutting interest rate despite inflation falling less than experts’ predictions

Inflation fell less than expected in January but the figures did little to dispel fears that the UK could soon be hit by deflation.

Higher prices for alcoholic drinks and retailers limiting new year price cuts meant that Consumer Price Index inflation – used in most wage settlement negotiations in the UK – held up at 3.0 per cent, from 3.1 per cent the month before. Economists had predicted a rate of 2.7 per cent.

Most of the upward pressure on prices in January came from items such as games, toys, clothes and furniture, whose prices were cut by retailers in the run-up to Christmas.

The Bank of England is expected to keep cutting interest rates to shore up the economy and ward off deflation – a damaging cycle of falling prices which encourages businesses and consumers to defer spending amid expectations that prices will fall further, thus worsening the recession.

The Bank is also expected to start pumping extra money into the economy by buying corporate bonds and other debt as early as next month.

The latest figure is still above the Bank of England’s 2 per cent target but the central bank believes inflation will fall sharply in the months ahead and is ready to act to ward off a potential vicious downward spiral in prices.

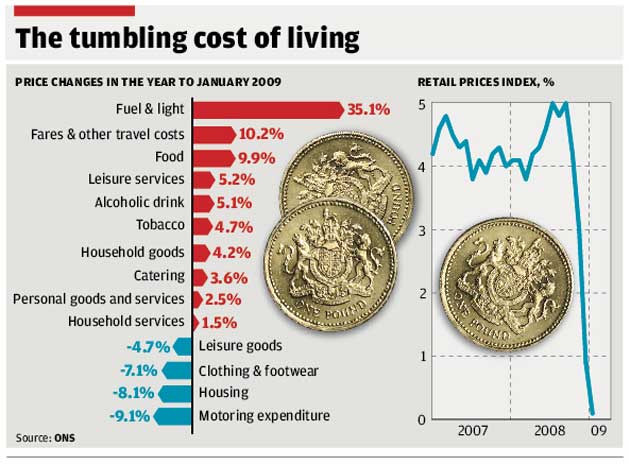

Retail Price Index inflation just stayed positive at 0.1 per cent, defying expectations that plunging mortgage payments and house prices – which are not included in CPI – would send it into negative territory. But RPI was at its lowest level for 49 years and is expected to turn negative soon, as house prices continue to tumble.

Economists warned that the surprisingly strong figures should not be taken as indicating a trend and could have been distorted by the time it takes for the Government’s 2.5-point cut in VAT to feed through to prices.

The Bank had been worried about inflation and the prospect of spiralling wage demands but now falling prices are seen as the main threat.

George Buckley, an economist at Deutsche Bank, said big falls in energy prices would see CPI below 1 per cent by the middle of the year.

The Bank of England warned in its quarterly forecast last week that the UK would only narrowly avoid deflation. It expects the effects of the recession to keep CPI below target for the next two years. Separate government figures yesterday reported a 10.2 per cent year-on-year fall in house prices in December.

David Page, an economist with Investec, said wage growth would slow “quite markedly” this year, affected also by high unemployment. But he said wages were not expected to fall.

Downward spiral: Why it is feared

If there is one thing that central bankers fear more than high inflation it is deflation. A fall in prices sounds like a good thing for a slowing economy because it makes consumers better off. Consumers have certainly benefited from price drops on certain goods, such as electronics and clothes, in recent years.

But sustained, general price falls would wreak massive damage by creating a vicious downward spiral. In this scenario, consumers defer spending, expecting goods to be cheaper in the future. And when consumers stop spending the economy gets worse. Businesses respond by cutting prices and costs, leading to|increased unemployment and even less spending. Once deflation takes hold, it is hard to shake off, as Japan found in its “lost decade” of zero growth from the early 1990s.

In the United States, prices fell by 10 per cent a year from 1930-33, turning a recession into the Great Depression. Until the 1930s, economists had assumed that deflation would correct itself because lower prices would increase demand.

The spectre of the Great Depression is why central banks are pumping massive amounts of money into their economies to support demand.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies