Theresa May Brexit Speech: The charts that show how much it will hurt economically

Specific forecasts are hard, but we can provide some useful context for thinking about the potential cost and by looking at the results of economic modelling

How much will it hurt?

That’s the question that many are asking in the wake of Theresa May’s speech at Lancaster House, in which she revealed that the UK will pull out of the single market and seek to sign a "comprehensive" free trade deal with the European Union.

There can be no specific answer because we don’t know what type of free trade deal (if any) will be agreed by the UK and the EU.

But we can provide some useful context for thinking about the potential cost and also by looking at the results of previous economic modelling.

The main benefit of the single market – relative to a free trade agreement – is that the single market primarily benefits our services firms.

This is because the single market removes non-tariff barriers such as diverging licensing regimes which are a particular impediment to services exporters.

This particularly matters for Britain since services are 80 per cent of our GDP and 44 per cent of our exports - both high shares by international comparisons.

And we're increasingly reliant on services exports, relative to goods.

That services export share is up from around 30 per cent at the turn of the Millennium and still rising fast.

Our services exports are increasingly important to the UK...

And Europe is a major destination for those exports.

The EU accounted for £89bn in UK services exports 2015, around 40 per cent of our total services exports.

The vaunted emerging economies of Brazil, Russia, India, and China account for less than 5 per cent combined.

This is important because any free trade deal we do with those countries is a) unlikely to cover services b) even if it did would probably not compensate for any serious loss of services exports to the EU.

...and we export far more services to Europe than to the BRICS

We could lose other benefits from leaving the single market.

The EU single market's free trade deals cover 8.6 per cent of global GDP. And the European Free Trade Area free trade deals cover 13.1 per cent of global GDP

We could have joined the latter if we'd sought to join the European Economic Area in 2019, like Norway.

But Ms May ruled that out yesterday.

So we will be saying goodbye to these existing trade deals.

No doubt we will try to replicate many of them in the next two years - but trade expert warn that this timetable is far too ambitious for such complex negotiations.

So what's the bill?

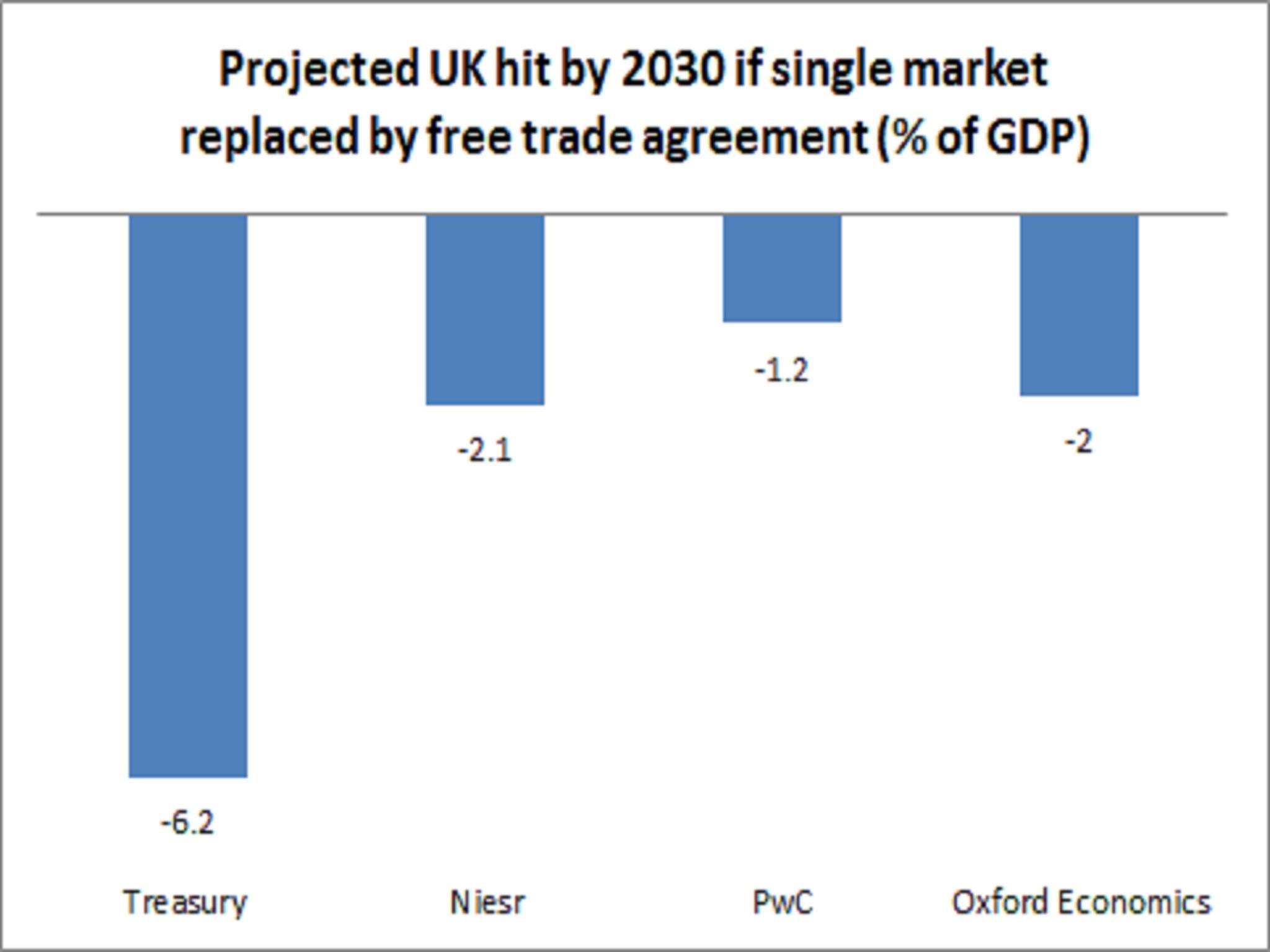

There is huge uncertainty about all this but various credible forecasting teams modelled the impact of a UK free trade agreement relative to staying in the single market before the referendum based on historic trade patterns and well-established economic theory.

The Treasury's estimate of the cost was something of an outlier at 6.2 per cent of GDP by 2030 - but the rest were all negative and pointed to at least 1 per cent of output lost.

GDP growth is likely to be be lower...

One per cent of GDP is around £20bn in today's money. So the lower end of the forecasts implies a loss to each of the UK's 26 million families of around £800.

Incidentally, a recent You Gov poll found 54 per cent of Leave voters would not be willing to lose any money for regaining control of UK immigration (the main objective of leaving the single market).

If the Treasury's forecast is more accurate the loss to each household is more like £4,500.

A hit to GDP growth will also hurt the public finances.

Before the referendum the IFS estimated the cost to the public finances of a free trade deal, based on the assumption that the Niesr (National Institute for Economic and Social Research) economic forecasts were borne out.

They put the cost at £27bn to £24bn, implying at least one more year of extra austerity.

...meaning more public sector austerity...

These calculations are out of date now given the Chancellor ditched the goal of a 2019-20 budget surplus in the November Autumn Statement.

But they give a rough idea of the size of the austerity pain - in the form of lower public spending or higher taxes on UK households - likely to follow the UK leaving the single market if the Government is to balance the state's books.

The OBR's December forecasts give another ball-park perspective - although they were compiled before the OBR knew what sort of Brexit deal the Government would seek.

They showed a £59bn deterioration in the public finances due to the Brexit vote by 2020-21.

If the OBR has been too optimistic this hole will be greater.

....thanks to a big hole in the public finances

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies