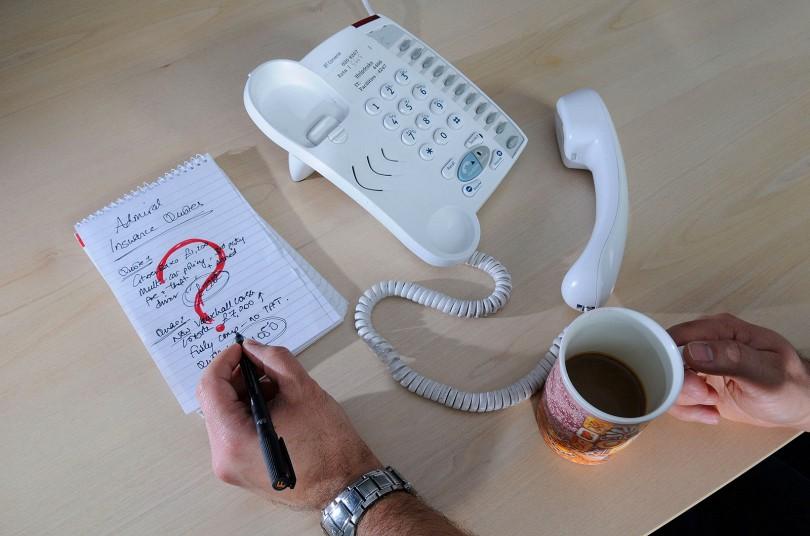

UK consumers face record high car insurance premiums as prices soar 11% in one year

The jump deals another sharp blow to UK households who have seen their incomes squeezed as a result of inflation outstripping pay rises

UK consumers are facing record high car insurance premiums, after the average cost of a policy soared 11 per cent to £484 in the last 12 months, according to new figures from the industry’s main trade body.

The average premium taken out in the first quarter of the year was £48 more expensive than in the same period last year with younger drivers and pensioners facing even steeper increases, the Association of British Insurers said on Tuesday.

The pace of price hikes is also quickening, with the average cost private comprehensive motor insurance jumping 4.8 per cent from the first quarter of the year, when average premiums were £462.

The jump deals another sharp blow to UK households who have seen their incomes squeezed as a result of inflation outstripping pay rises.

It means car insurance premiums are rising almost four times the rate of inflation and marks the biggest year-on-year rise since the ABI began tracking premiums for private cars in 2012.

The ABI says its figures are the only published measure of the actual premiums paid by customers, rather than quotes.

The ABI claims that the rapid rise is due to the recent Government decision to cut the personal injury discount rate – a calculation used to determine lump sum compensation to claimants who have suffered life-changing injuries – to minus 0.75 per cent, down from 2.5 per cent.

The move sent insurers’ share prices tumbling, and provoked widespread condemnation from the industry. Much of the cost is now being passed on to consumers.

Insurance Premium Tax also went up to 12 per cent on the first day of June, up from 10 per cent.

The ABI said it would now publish month-by-month premium data, in addition to its quarterly figures, to show the “unprecedented pressures” the changes are putting on premium prices. The latest figures show average premiums in the month of June alone were £498, the ABI said.

However, Tom Jones, head of policy at Thompsons Solicitors, said insurers have seen fraudulent car accident claims fall 5 per cent in the last year, making the significant jump in premiums hard to justify.

“Look behind the hyperbole and the ABI’s own figures show a downward trend in fraudulent - or allegedly fraudulent - claims. Presumably, the £1.3 billion in savings made by insurers as a result of detecting those reduced claims are finding their way into fat cat shareholders’ pockets, because they certainly aren't being used to reduce premium prices for consumers," Mr Jones said.

“The insurance industry brazenly sets itself against a growing body of evidence which contradicts its position on personal injury market reform by cherry picking the figures it needs to pressure two consecutive governments to change the law on small claims in order to increase their own profits."

Further price increases could be in store early next year, when most insurance companies are due to renew their own reinsurance policies. These are likely to be more expensive as they will now have to take into account the higher costs associated with the discount rate, the ABI said.

Business news: In pictures

Show all 13The news comes as the Government is set to face questions on Tuesday over its handling of the discount rate cut. Lord Hodgson has tabled a “motion of regret” to debate the issue.

Director general of the ABI, Huw Evans, said: “This dramatic increase drives home how important it is that the Government presses ahead with a new framework for the discount rate and call a stop to further hikes in Insurance Premium Tax.

“The UK is one of the most competitive motor insurance markets in the world, but the unprecedented increase in claims costs is driving up prices to record levels.

“Most younger and older drivers are likely to face increases even higher than this, hurting people who can least afford it.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies