UK economy expands by only 0.3% in second quarter of 2017

Overall, the data marks a slight improvement from the 0.2 per cent expansion in the three months to March, which made the UK the worst performing economy in the EU at the start of the year

The UK economy expanded by 0.3 per cent in the second quarter of 2017, in line with consensus forecasts, as a slump in the pound and a spike in inflation continued to weigh on growth.

The Office for National Statistics (ONS) said that growth in the three months up to the end of June was driven by services, which expanded by 0.5 per cent – compared with 0.1 per cent growth in the first quarter of the year.

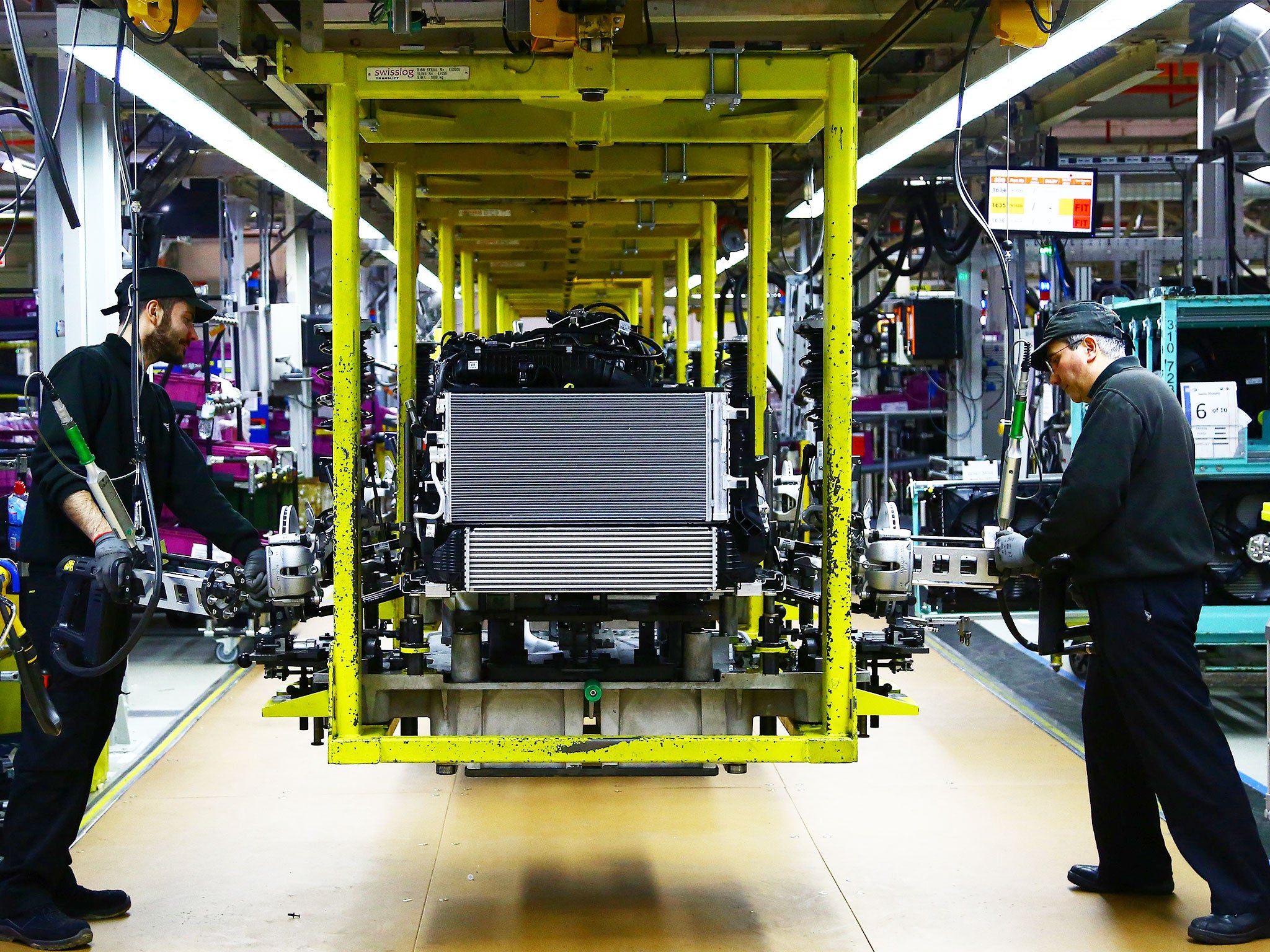

Construction and manufacturing were the largest downward pulls, following two consecutive quarters of growth, the ONS said.

Overall, the data – which was in line with consensus forecasts – marks a slight improvement from the 0.2 per cent expansion in the three months to March, which made the UK the worst performing economy in the EU at the start of the year.

That figure also represented a dramatic slowdown from the 0.7 per cent growth in the final quarter of 2016, and the 0.5 per cent growth in the quarter immediately following the referendum.

But most analysts still believe Brexit will set back the economy over the long run. The scale of damage, most say, will depend on the nature of future trade arrangements with the EU, which is the UK’s biggest trade partner.

The pound remains more than 10 per cent lower against the dollar since the June 2016 vote, and although the inflation rate unexpectedly slowed to 2.6 per cent in June – from a near four-year high of 2.9 per cent in May– much of that was down to lower petrol prices.

The pound was up marginally against the dollar after the announcement.

"We await the first revision to this preliminary estimate for a definitive view, but today’s release raises downside risks to our outlook for GDP growth for 2017, which currently stands at 1.7 per cent," said David Page, a senior economist at AXA Investment Managers.

Earlier this week the International Monetary Fund (IMF) slashed its growth forecast for the UK, saying that it now expects the country’s economy to grow by 1.7 per cent this year compared to a previous forecast of 2 per cent. It kept its estimate for 2018 unchanged at 1.5 per cent.

Professional services firm PwC last week trimmed its forecast for economic expansion, anticipating growth of just 1.5 per cent in 2017 and 1.4 per cent in 2018 from 1.8 per cent growth last year. And the Centre for Economics and Business Research (Cebr) anticipates that the UK economy will grow by just 1.3 per cent in 2017: a substantial downward revision from an earlier forecast of 1.7 per cent.

Average real wage growth in the UK between 2007 and 2015 was the lowest in the EU apart from Greece, and this year’s rise in inflation has heaped additional pressure on real wage growth and consumer spending.

“The UK’s economy is a long way from grinding to a halt, but growth is clearly becoming harder to come by,” said Nancy Curtin, chief investment officer at Close Brothers Asset Management.

“The competitive pound has boosted exports, as has increasing global demand. However, weakening consumer spending power is a real concern,” she said.

“The lack of real-terms wage inflation also continues to drag, as does low productivity. What’s more, companies still do not have clarity on the nature of Brexit, which is impeding long-term investment decisions.”

Schroders’ senior European economist, Azad Zangana, said that he forecasts some improvement during the second half of the year as inflation starts to abate, “but we doubt growth will return to above trend levels for at least a year”.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies