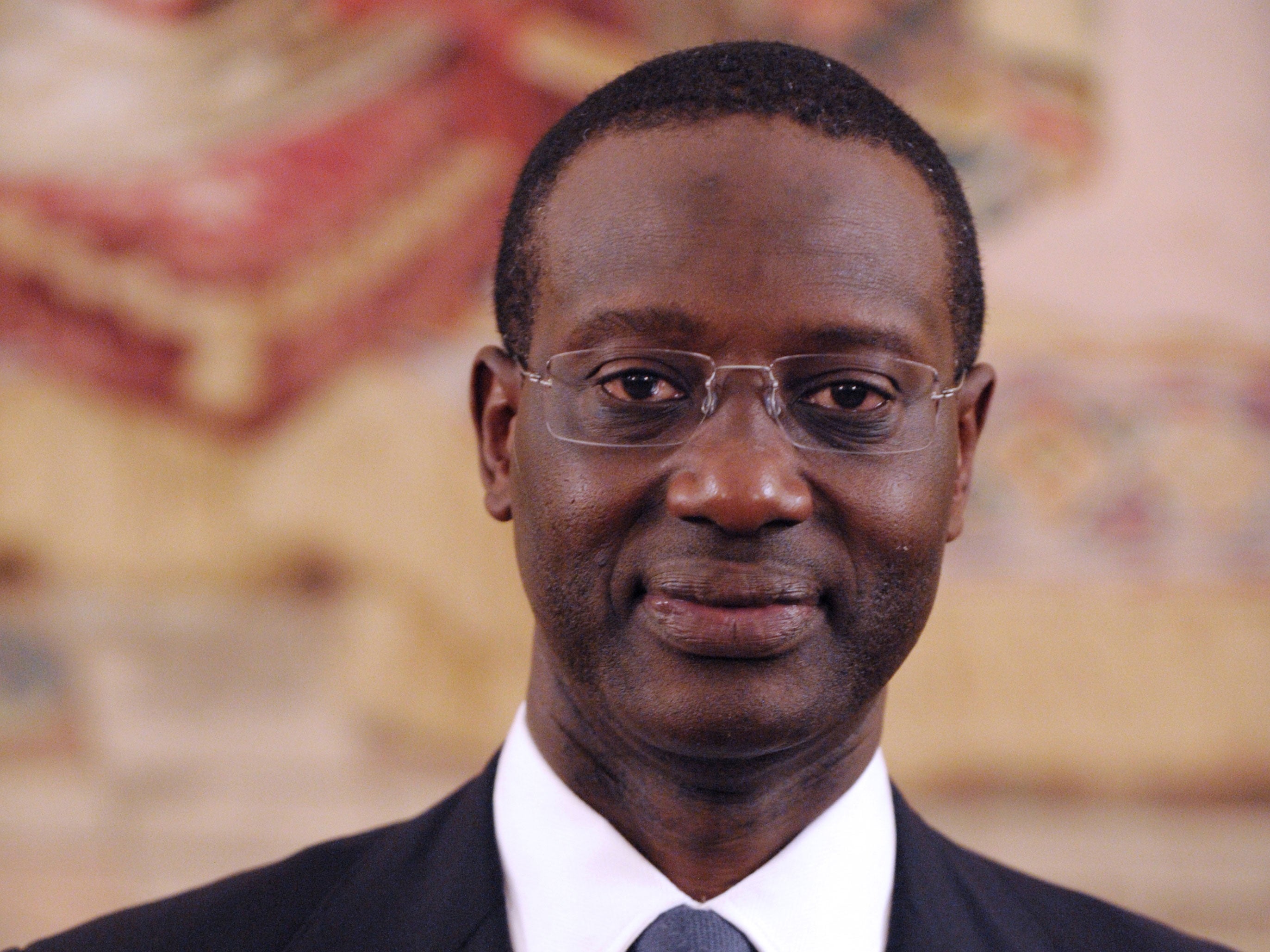

Prudential US chief to lead as Tidjane Thiam quits for Credit Suisse

Mike Wells beats rivals to the top job as shares slip 3 per cent

The head of Prudential’s US business has been lined up to replace Tidjane Thiam as the FTSE 100 insurer’s new chief executive.

Mike Wells, 54, the American who runs Jackson National Life Insurance, is understood to have seen off external and internal rivals to replace Mr Thiam, 52, who is set to succeed Brady Dougan at Credit Suisse later this year. Mr Wells has held senior roles at the firm for 15 years and joined its board in 2011. The £11.7m pay package he received last year eclipsed the £8.7m picked up by his current boss.

Prudential confirmed yesterday Mr Thiam was departing for Credit Suisse after its annual meeting in May but refused to confirm who his successor will be. Other internal candidates included Nic Nicandrou, the finance director, and Jackie Hunt, who runs the insurer’s UK business.

The group’s chairman, Paul Manduca, said: “As would be expected of a FTSE 100 company, the board is always focused on succession planning and a process has already examined a range of external and internal candidates. We are fortunate to have a very strong management team across the group and we have identified a successor and expect to be able to announce a new chief once the regulatory approval process has been completed.”

News of the boardroom changes saw shares in Britain’s largest insurance company fall 3 per cent, or 51.5p to 1,612p, and Credit Suisse’s rise nearly 8 per cent to Sfr25 (£15.94). An Ivorian-born French national, Mr Thiam quit Aviva to join Prudential in 2007 and succeeded Mark Tucker as the group’s chief executive two years later. His departure was announced alongside Prudential’s annual results, where a strong performance in its Asian business boosted group profits.

Although his reign has coincided with a 175 per cent rise in the company’s share price, it has not been without controversy and almost came to an abrupt end after Prudential’s bungled bid for AIA in 2010, which later led to a £30m fine by the City regulator. An investor rebellion forced the firm to pull the plug on the $35.5bn (£23.5bn) AIA deal.

Mr Dougan, 55, hit the news when he picked up a $100m pay and bonus package from Credit Suisse in 2010. An ex-chairman called it “a mistake”. He joined in 1990 and became chief executive in 2007.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies