Wanted: 125 real, live fire-breathers

We've all heard of the TV programme. But could the Dragons Den format help boost the economy? Rob Hastings reports

You can't blame aspiring entrepreneurs for thinking they need help from a seraph. Whether they have invented a laser scanner to detect skin cancer or simply created a new brand of fruit juice, securing the money to turn their proposals into real businesses is often harder than conceiving the ideas.Since the recession it's been tougher than ever.

Four of the biggest banks fell £1bn short of the Government's Project Merlin target for lending to smaller companies last month. The Office of National Statistics said in October that the number of firms able to get loans fell to 65 per cent last year, down from 90 per cent in 2007. And the situation for start-ups – trying to find backers before they have made any sales to prove their businesses can work – is trickiest of all.

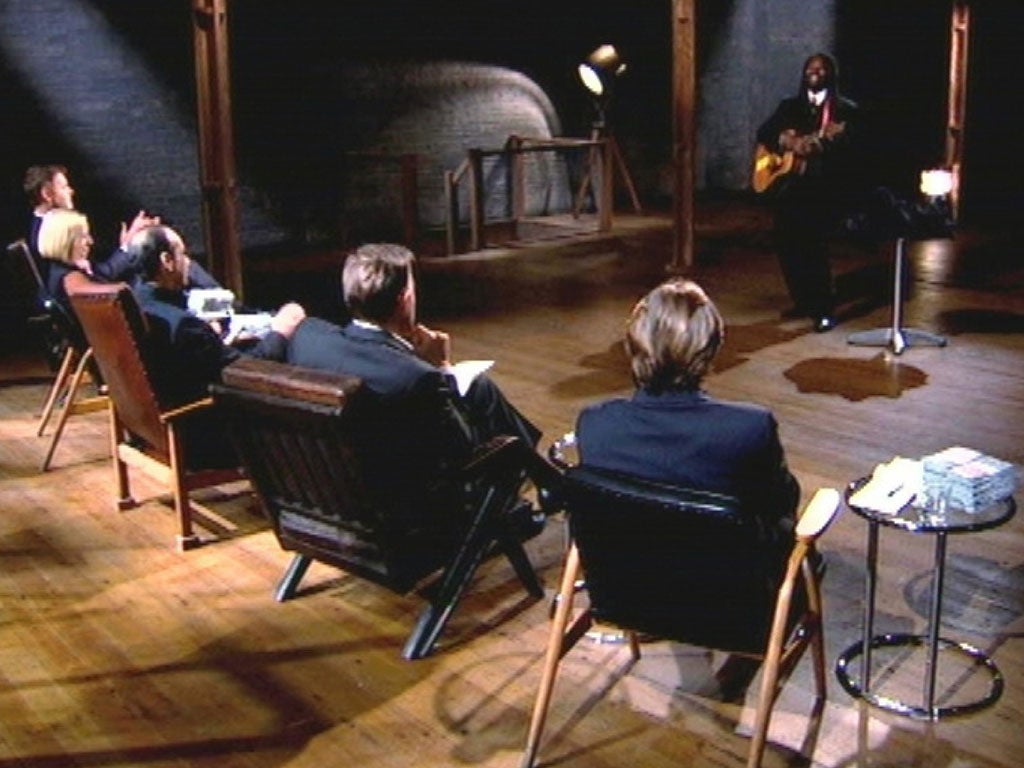

Now the search is on for a host of new "business angels" to provide salvation. Millionaires are being targeted for a real-life version of the television programme Dragon's Den, to invest their money and their expertise in new businesses, and help them get started in return for a share of profits and ownership.

Starting today, the City of London Corporation is aiming to recruit and train 125 wealthy individuals to become angel investors, in the hope they will contribute at least £10m to start-ups in the capital and create 200 new jobs in the process.

It may be a good start, but that alone is not going to jump-start the economy. However, the Government believes that coaxing more of the country's most wealthy and knowledgeable individuals to invest their money and time in fledgling businesses could be a key to recovery for the whole country.

So-called angel investing is already estimated to contribute as much as £1bn a year to Britain's freshest business hopes, and ministers want that to grow. Two weeks ago the Chancellor of the Exchequer, George Osborne, announced the seed enterprise investment scheme, a 50 per cent income tax break for people investing up to £100,000 in start-ups. With capital gains benefits thrown in too, it's a big incentive.

But investing in start-ups can be highly risky, and angels can end up with their wings being clipped – even Jenny Tooth of the British Business Angels Association admits that as many as half of these investments fail.

It's for that reason many club together in syndicates of five or six, allowing them to pool their money together and spread their bets across different kinds of investments. Each angel puts in £35,000 per deal on average – hoping for a return of ten times that. The model is not just about money, though. Often made up of investors from different professions – lawyers, accountants, marketing experts – syndicates also allow angels to contribute a wider variety of mutually beneficial business advice to their chosen entrepreneurs.

"I've got friends who do this and one of the things they really enjoy is that they can pop along and help out," said Stuart Fraser, chairman of the City of London Corporation's policy and resources committee. "One of the problems we suffer from is the over-reliance on bank lending. It's got restrictions and it has to be paid back in a certain time with interest paid on it. But equity investors are locked in so they can't take their money out, and they're much more flexible friends than banks."

A few websites allow designers and inventors to post their ideas online for potential investors to browse at their convenience, while some angel networks nominate a gatekeeper to look over proposals sent in by people scouting for funding before meeting the best ones to find out more.

But many deals are done through regional pitching conferences, where budding entrepreneurs set up presentations to lure in an angel. Next year, the City of London Corporation plans to begin hosting these events to matchmake businesses and investors.

"Angel investing is not a new concept, but we felt it needs promoting," said Mr Fraser. "If you are a successful businessperson you might be aware of it, but through our contracts we are trying to encourage individuals to become angels themselves."

THE ENTREPRENEUR

Laurence Kemball-Cook is a 26-year-old entrepreneur. Two years ago, working in his flat in Brixton, south London, he developed paving slabs and flooring tiles that can generate electricity when people walk on them. He secured commercial funding for his invention from a syndicate of six angel investors in September, with the deal going through in less than a month from first meeting them, and his company PaveGen has now won £2m of sales, including from the Westfield shopping centre in Stratford, east London.

"My angels varied from financial people, legal people, expert start-up people, and I used them as an extended advisory board," he says. "We recently got a contract from Siemens, and one of my angels is helping us set out the contracts for deals with these big companies. They're vital. They have a vested interest, and they all have a shared understanding of where we're trying to go.

"At the moment, banks aren't lending to small businesses – they say they are, but they're not. They need to see sales and customers, and with a start-up like mine there's no way they'll back you."

THE ANGEL

Rajat Malhotra is a 35-year-old solicitor who began investing in start-up companies with his business partner in January. They have put money into six companies so far, including a brand of fruit juice, a software firm and a medical diagnostic business.

"If you're a spotty kid who's 21, you might have a great idea but you won't have any assets like a house to offer as security to a bank. I don't think banks are terrible for not doing more of this sort of investing; the financial crisis has shown they shouldn't be doing crazy things like this anyway."

Angel investing isn't just about providing money, he says.

"The majority of the investments we've made are businesses that haven't sold anything yet, and that's where we can really help with our business experience and contacts. Entrepreneurs are very excitable and they can get very obsessed about their ideas, but it will often turn out they haven't thought about mundane things like insurance, and we can be there to steer them. If you're running a start-up, you're not only the CEO – you're the head of HR, the head of IT, the head of sales. There are very few people out there who are good at all those things, and that's where angels can help."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies