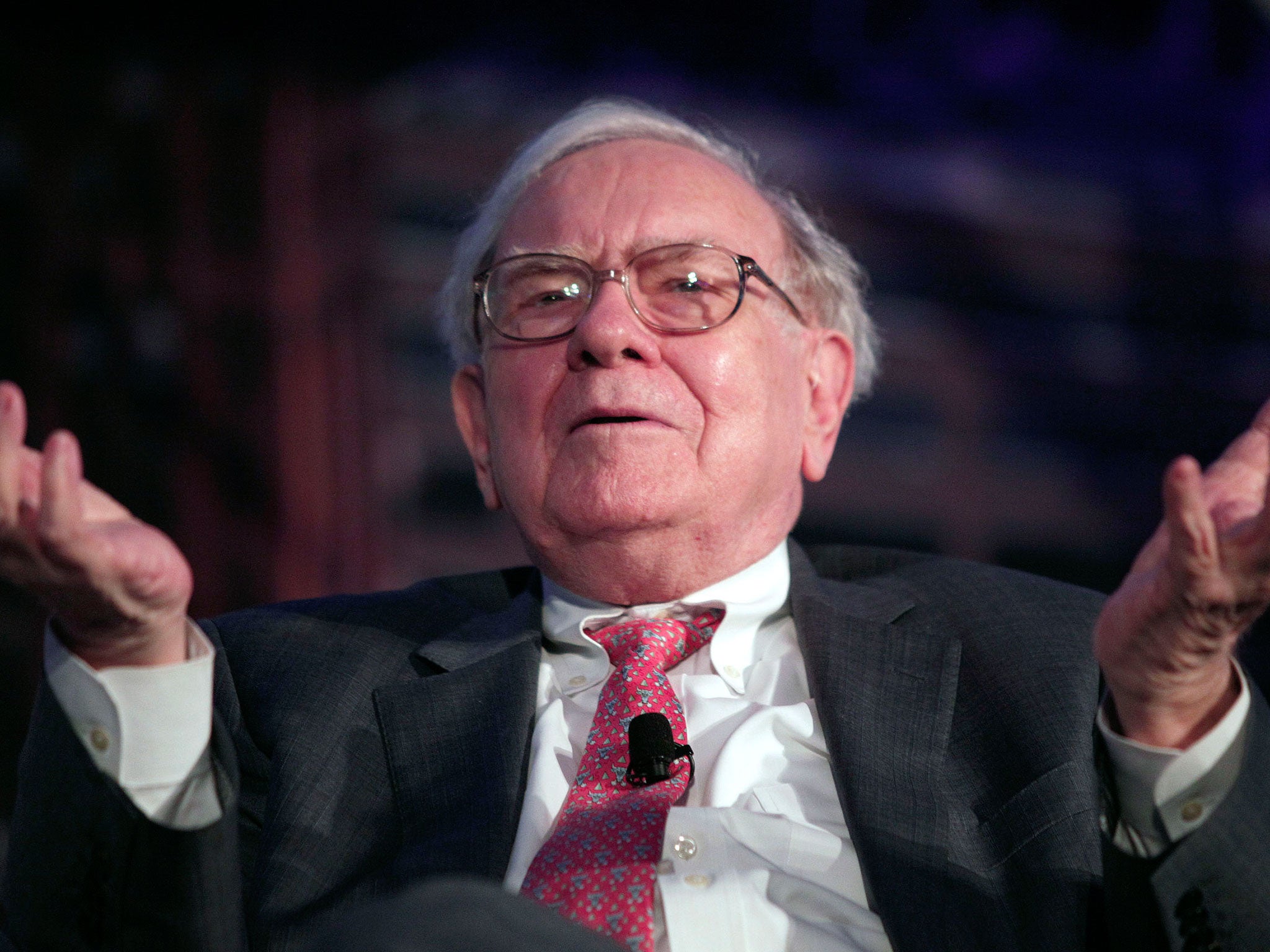

Warren Buffett says Tesco investment was a 'huge mistake'

The 'sage of Omaha' is the supermarket chain's third largest investor

Legendary investor Warren Buffett has admitted he made a “huge mistake” investing in Tesco, the troubled supermarket retailer with a £250 million black hole in its accounts.

The “sage of Omaha”, who is worth an estimated $67 billion (£41.5 billion), has built a 4.1 per cent stake in the company through his Berkshire Hathaway vehicle over the past seven years, making him Tesco’s third largest investor.

However, competition from discount rivals like Aldi and Lidl and a series of mistakes by management have left Tesco in turmoil.

Last week, it was forced to call in Deloitte to undertake a “comprehensive review” of its accounts after admitting that its first half profits will be £250 million lower than previously expected.

The profit overstatement came to light after an internal whistleblower alerted executives about irregularities in the way in which the company accounted for deals with suppliers. Tesco’s new chief executive Dave Lewis has suspended four executives in the wake of the admission, including its UK managing director, Chris Bush.

With Tesco shares having halved this year, 84-year-old Buffett told CNBC: “I made a mistake on Tesco. That was a huge mistake by me.”

Buffett’s comments come just days after Britain’s highest profile stock-picker Neil Woodford warned it could be years before he again dared to sink cash into Tesco giant or its major rivals. The £7 billion fund manager sold his stake in Tesco in the wake of the grocer’s first seismic profit warning in early 2012.

He said: “The industry, in my view, faces a long road to exit this period of depressed margins and crushed profitability — and maybe asset bases and balance sheets have to be rebalanced, before the industry can re-emerge as an investable proposition. The immediate future is going to be very tough for the sector but particularly for Tesco.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies