The housing market is returning to life on the back of an increase in bank loans to first-time buyers and the Chancellor’s mortgage subsidies, according to a host of new statistics.

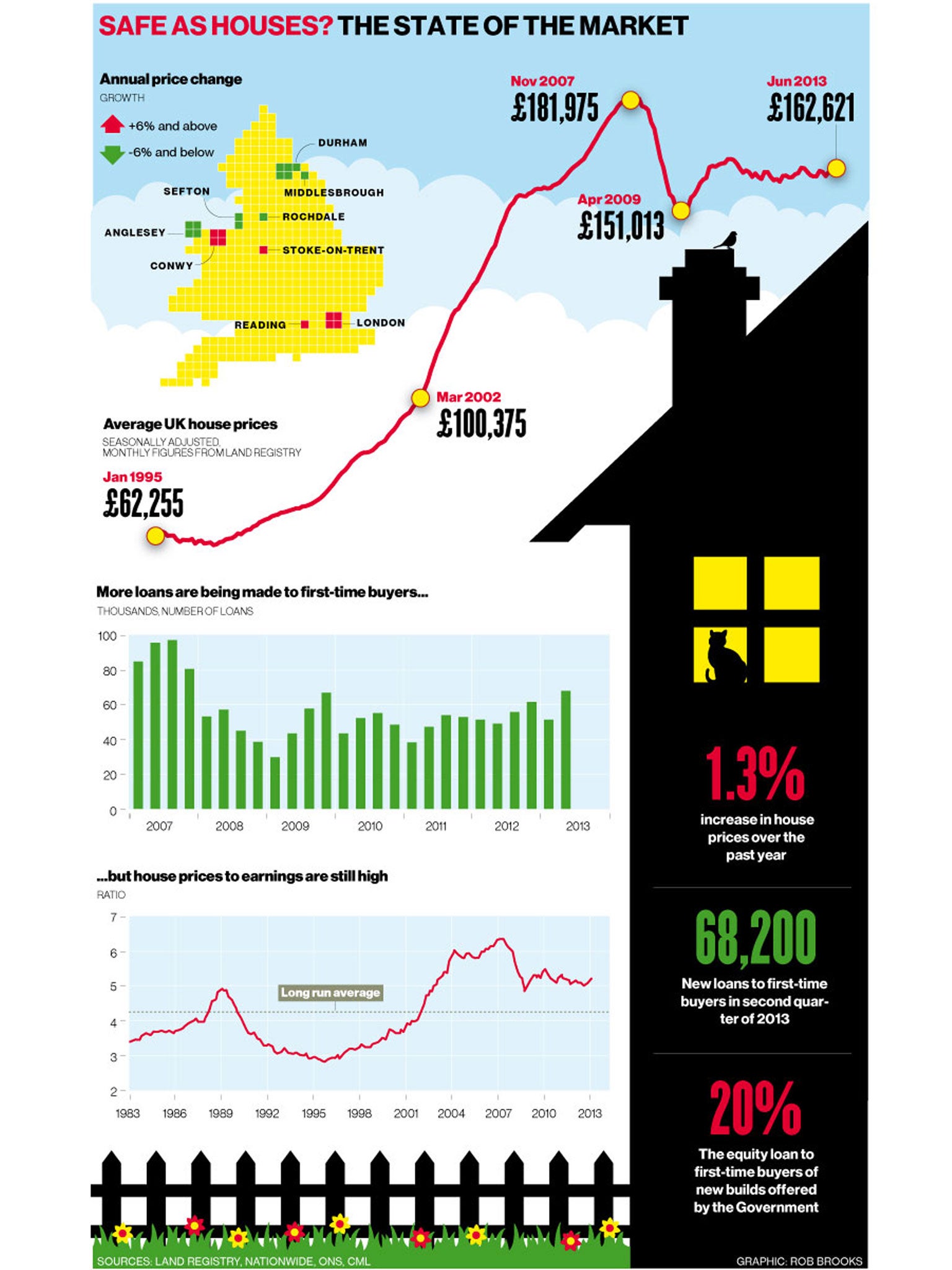

Figures from the Land Registry suggest average house prices in England and Wales reached £242,415 in the second quarter of this year, a 1.3 per cent increase on the same period last year. Over the three months, the average price of a flat breached £250,000, making purchasers liable for the 3 per cent Stamp Duty levy.

The housing market, which has been in the doldrums since 2010, seems to have been reinvigorated by an infusion of new blood in the form of first-time buyers. The Council of Mortgage Lenders reported yesterday that the number of loans made to this group, who have largely been frozen out of the market in recent years by a refusal of banks to lend to them, hit 68,200 in the second quarter. That is the highest level of new loans to new home buyers since before the global financial crisis in 2007, according to the CML.

Regular surveys are pointing to an increase in both prices and activity. The Halifax index recently showed house prices in the three months to July were 4.6 per cent higher than a year earlier. The rival Nationwide index showed prices last month to be 3.8 per cent higher on the year. And today the RICS Residential Market Survey reports that in July the number of potential buyers looking to enter the market grew at the fastest rate since July 2009.

Housing market activity has been stronger in the wealthier parts of the country, notably London and the South-east. But, according to RICS, the bounce back is now starting to manifest in the rest of the UK, too.

“Growth in buyer numbers and prices have been happening in some parts of the country since the beginning of the year, but this is the first time that everywhere has experienced some improvement,” said Peter Bolton King, RICS global residential director.

Market specialists say the uptick in activity has been driven by various support offered to home-buyers by the Government and the Bank of England.

Last August the Bank established a Funding for Lending Scheme (FLS) which offered banks and other lenders cheap loans in the hope they would pass the funds on to small businesses and prospective home borrowers. Small business lending has continued to shrink since the middle of last year, but the FLS seems to have an impact on home loans.

The number of new mortgage approvals for house purchases was 57,667 in June, according to the Bank. That was some 10,000 higher than a year earlier (although it remains well below the monthly average of 90,000 seen in the first half of the last decade when the boom was in full swing).

The impact of this inducement to lending was augmented by George Osborne’s Budget in March, which unveiled a “Help to Buy” scheme. This is split into two parts. The first is a government equity loan for first-time-buyers who purchase a newly-built home.

This means prospective buyers need only put down 5 per cent of the asking price up front, while the state provides a further 20 per cent. The state loan is free for five years and this offer has been available since April.

The second part of Help to Buy is a mortgage guarantee scheme. The state will underwrite a portion of new mortgages worth up to £600,000 in an attempt to get the market motoring. The scheme, which could underpin up to £130bn of new loans, will go active in January 2014.

The new Governor of the Bank of England, Mark Carney, administered a further injection of steroids to the housing market last week when he announced that the central bank intends to hold the Bank rate down at the record low of 0.5 per cent until unemployment falls below 7 per cent. On the Bank’s present forecasts, that will not occur until the second half of 2016, implying a further three years of rock bottom interest rates for mortgage borrowers.

But some economists are warning that all this official support for the housing sector could create a damaging new house price bubble and impede the desired rebalancing of the UK economy from consumption to saving. Others have argued that it is dangerous for the Government to encourage first-time buyers to overstretch themselves to get on the housing ladder when average house prices remain well above their historical ratio to average incomes, implying the risk of another correction.

Average house prices are around five times average household earnings. That is down on the six times ratio seen at the peak in 2007, but above the 4 times long-run average.

The Treasury Select Committee has argued the effect of the plethora of official subsidies could merely be to push up house prices, rather than increase the supply of new homes. “It is by no means clear that a scheme, whose primary outcome may be to support house prices, will ultimately be in the interests of first-time buyers,” the committee argued in April.

Another fear is that the various official mortgage subsidies, which are supposed to be a temporary response to a dysfunctional banking system, will become a permanent feature of the financial landscape in the same manner as Fannie Mae and Freddie Mac in the United States. Both semi-official institutions had to be rescued by Washington in the global credit crisis of 2008-2009 having underwritten hundreds of billions of dollars of bad American home loans.

The Chancellor has said that the new super-regulator at the Bank of England, the Financial Policy Committee, will decide on whether the life of Help to Buy should be extended in three years’ time.

Mr Carney said last week that the Bank would be monitoring the housing market closely, but he dismissed concerns of an incipient bubble, saying that the number of potentially risky high loan-to-value mortgages presently being created by the banks is well down on the levels of the last decade.

According to statistics from the Land Registry, UK house prices peaked in late 2007 and dropped by around 20 per cent over the next 17 months as the UK slipped into its most severe recession since the Second World War. House prices gained 10 per cent between early 2009 and August 2010, as the economy bounced back, but then they shed 4 per cent over the next six months as activity stagnated. House prices were then relatively flat until this start of this year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies