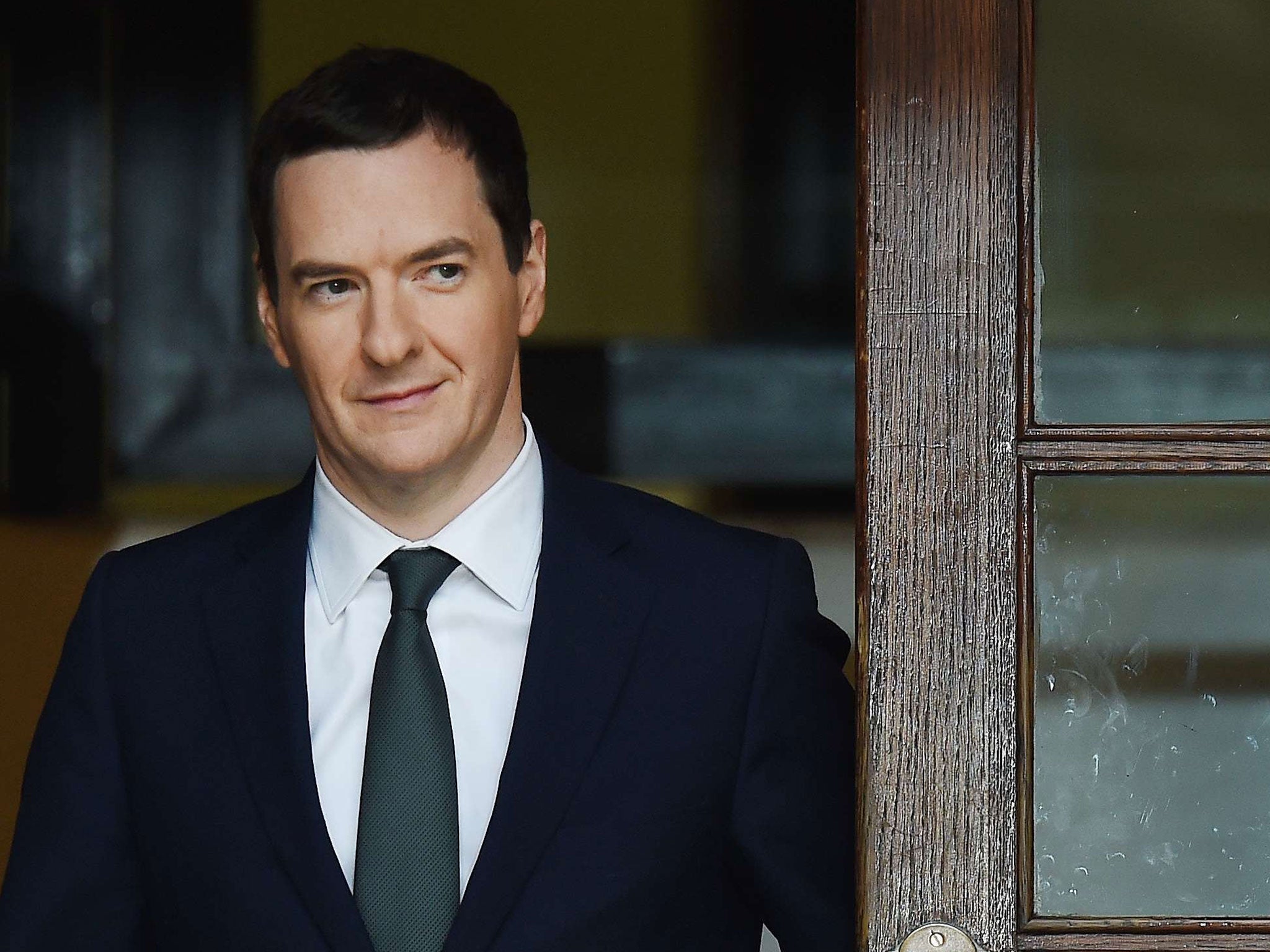

Autumn Statement: The chart that shows how much extra taxpayers will pay because of George Osborne's changes

The Chancellor made major changes to stamp duty and brought in new "Apprenticeship Levy" to raise £3bn a year

Taxpayers could be handing the Government an extra £5 billion over the coming five years thanks to changes announced in the Chancellor’s Autumn Statement.

Analysis for The Independent by Statista showed that the new apprenticeship levy, changes to stamp duty and the “making tax digital” initiative were among policies driving millions of pounds into HM Revenue & Customs’ coffers.

Delivering his statement to the House of Commons on Wednesday, George Osborne said he was achieving his target to move public finances into surplus by 2020.

He hailed higher tax receipts and lower interest payments for helping reduce the country's debts and borrowing.

The Office for Budget Responsibility's forecast shows the UK is expected to narrowly beat its borrowing goal this year and move “out of the red and into the black” in 2019/20 with a slightly higher-than-expected £10.1 billion surplus.

“We have the economic security of knowing our country is paying its way in the world,” Mr Osborne said.

But the Tory Chancellor has been criticised over changes to the new Universal Credit (UC) system cutting the entitlement for working families.

An estimated 2.6 million employed households can be expected to be an average £1,600 a year worse off under UC than they would have been under the existing system, said the Institute for Fiscal Studies.

Transitional protections mean that no existing claimants will lose out in cash terms when the new system comes in, but new claimants and those whose circumstances change will lose out in the long run, the IFS said.

Despite Mr Osborne's decision to scrap cuts to tax credits proposed for next April, the IFS said that his plans still envisage reducing non-pension benefits to their lowest level as a share of national income for 30 years.

Additional reporting by PA

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies