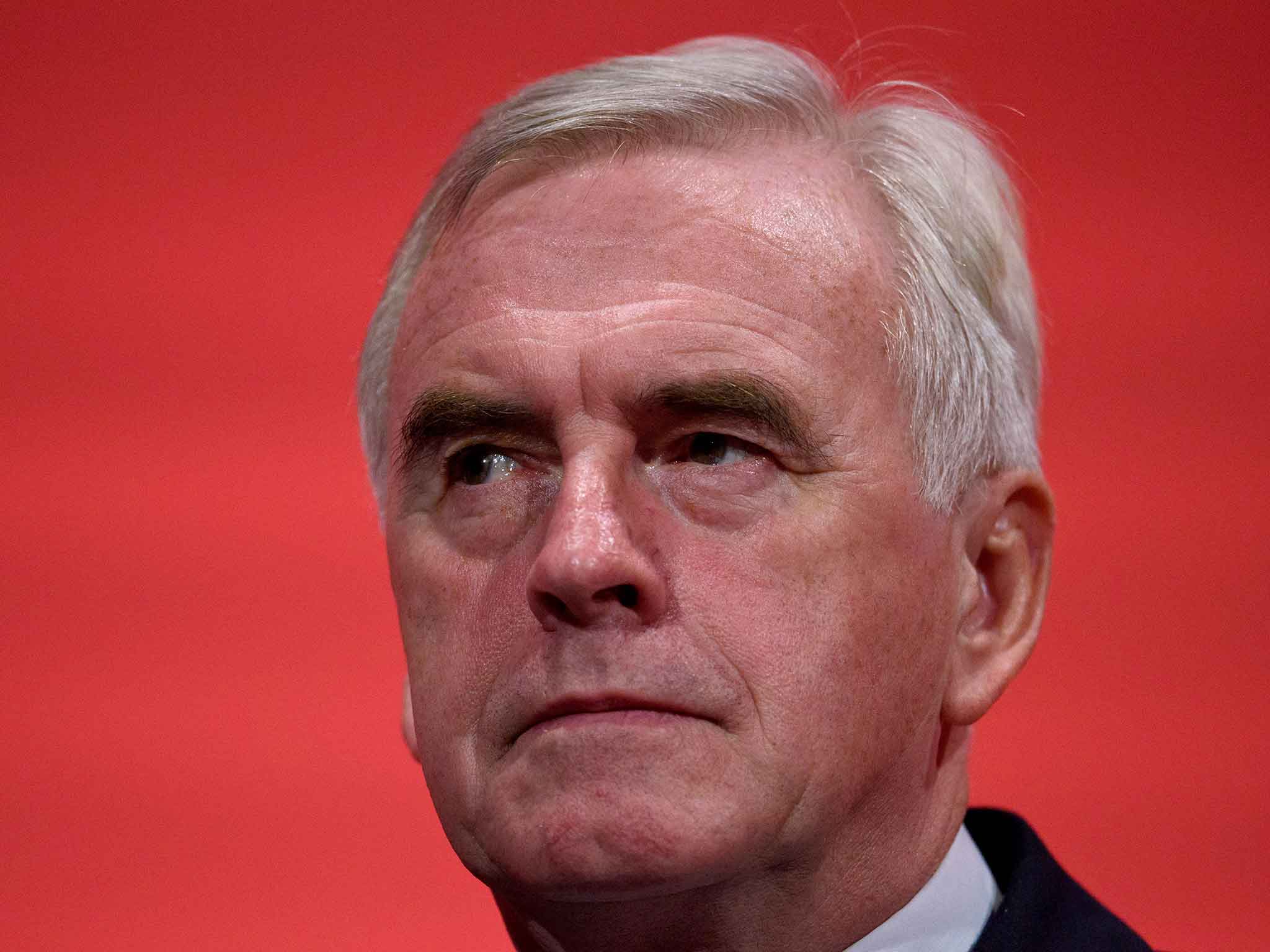

Labour shadow chancellor John McDonnell pledges wholescale review of tax system

- Mr McDonnell warns factors that caused the 2008 financial crash have re-emerged

- Shadow chancellor raises prospect of 'Robin Hood' tax on financial transactions

Many of the factors that caused the 2008 financial crash have re-emerged, Labour’s shadow chancellor John McDonnell has warned as he pledged a wholesale review of Britain’s tax policies, a rethink of the Bank of England’s mandate and raised the prospect of a Robin Hood tax on financial transactions.

Ahead of his keynote speech to the Labour party conference he expressed his desire to widen the Bank of England’s remit so it was not just focussed on setting interest rates to meet its narrow task of its 2 per cent inflation target.

The review will consider extending the Bank of England’s mandate to include other measures of prosperity such as economic growth and investment.

Mr McDonnell warned that the gap between imports and exports was at its biggest in history, asset prices were rising and consumer debt was spiralling – just as it did before the economic crash.

Many of the factors that we had before the last economic crisis are there now

The party’s review of tax policies, which will be aimed at redistributing incomes from rich to poor, will include the possibility of introducing a financial transaction tax – dubbed the Robin Hood tax.

He alarmed some in the party last night by telling a fringe that “either we introduce a financial transaction tax unilaterally in this country, or Europe or globally”, but he clarified his position this morning, insisting he would not want to introduce a UK-only financial transactions tax.

He said his proposal for a review of HMRC’s tax collection will examine how it can retrieve £25bn in tax avoidance, claiming this was a fraction of the total £120bn “tax gap” between taxes due and sums collected.

The new shadow chancellor faces the challenge of winning back the public’s trust on the economy and in a bid to reassure those who fear a radical overhaul of economic policy, he insisted every one of Labour’s economic policies will be tested by a new economics advisory committee of six renowned economists, including Joseph Stiglitz and Thomas Piketty.

He will ask Mr Osborne for access to public institutions to test the Opposition’s proposals, such as the Office for Budget Responsibility and the Bank of England. A similar move by the former shadow chancellor Ed Balls was rejected by the Chancellor.

The new policies will also be tested with the public to ensure they are trusted ahead of the 2020 election, in a new era of openness that will stop politicians “dictating” to the public. It heralds “a breath of fresh air in British politics,” he said. In a bid to demonstrate he was proposing a serious platform of economic policies and distance himself from those who have dismissed him as a “left-wing firebrand”, he said his speech would be “pretty boring” and compared his speech to “talking to your local bank manager”.

He told the Today programme: “Many of the factors that we had before the last economic crisis are there now. We have a huge balance of payments deficit – it’s -the biggest we’ve had in our history – asset prices are rising again, consumer credit is rising again. These are all the factors, many of the factors, that caused the last crisis.

“It’s about having a fair and just economy and in many ways, what that means as well, is giving people a say over how that economy develops. And what we’re launching today is a huge public engagement exercise where British people come together, to say what is the state of the economy, how is it affecting them, give an example.

He added: "One of the things I am going to say in my speech today is that we are going to do a review of HMRC, the people who collect the taxes, we are going to review all the range of taxation policies and the whole objective is that the burden is lifted off the middle and low earners and particularly the poorest."

He said today was the start of “opening up one of the biggest debates on our economy this country has ever seen”.

"Everyone will have their say, so the future policies of the Labour Party will be determined by the British people themselves, having faith in the people - trust the people,” he said.

"We will be able to come up with the ideas, then we will rigorously test them and test them again until we know they will work in the interests of everybody and not just the rich elite in this country."

Mr McDonnell insisted the Bank of England would retain its independence under his watch but criticised its Governor, Mark Carney, for failing to deliver on his remit. But he said it had been 18 years since the Government had reviewed its central bank and said it was time to launch another rethink of its responsibilities. “They are and they will retain their independence in the same way that they had under Gordon Brown, in the same way they have under George Osborne,” he said.

“I’ll announce it today as a pre-announcement, we are going to have a review of the Bank of England’s mandate, retain the Bank of England’s independence but review its mandate. At the moment its mandate focuses on inflation. I have to say, and I don’t want to be critical of Mr Carney, but they are not meeting that mandate at the moment on inflation. However, we want to review it – it’s been 18 years since we did. There will be a parliamentary debate and we want to continue within that other aspects for consideration. So, for example, prosperity within the economy, long-term investment in the infrastructure – those rounded issues that the Bank of England should be taking into account but doesn’t do publicly.

“No [Mark Carney is not fulfilling his mandate], because he is missing it at the moment because of inflation. I know there is a debate going on within the Bank of England going on at the moment about their economic modelling. I am saying that if we go into Government we will invest in the Bank of England to make sure that economic modelling is brought up to date. I would say to George Osborne give us access to that modelling so that we can test our policies.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies