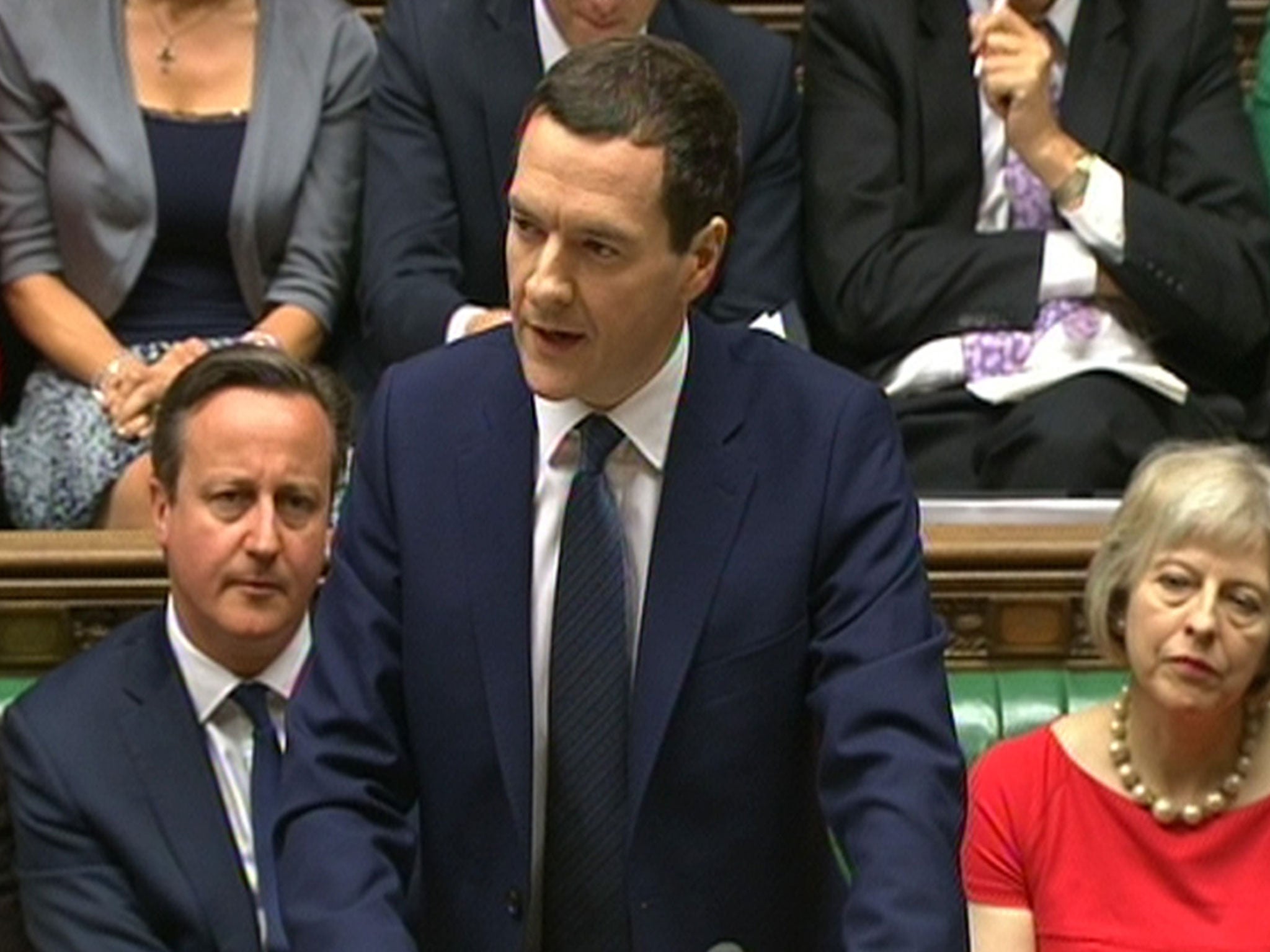

The most radical Budget in years: George Osborne unveils living wage plans, tax giveaways for middle classes but severe welfare cuts

Chancellor delivers first all-Conservative Budget for 19 years

George Osborne has delivered the most radical Budgets in years, announcing a landmark national living wage, a host of tax giveaways for the middle classes alongside severe cuts to the welfare budget in the first all-Conservative Budget in nearly two decades.

Some of the most eye-catching of measures announced by the Chancellor were flagship policies in the Labour party's election manifesto, leading to concerns among the Opposition that the Tories are taking advantage of Labour's lack of leadership by moving on to Labour turf in their pursuit of "One Nation" Conservativism.

Surprise announcements to introduce a compulsory national living wage of £9 by 2020 and the scrapping of the permanent non-dom tax status were similar to the headline pledges made by Ed Miliband before the election.

But these announcements came alongside details of how Mr Osborne will make a staggering £9bn of further savings from the welfare budget, hitting low income families hard by freezing the top-up payments of tax credits for the lowest paid workers for four years.

In addition, the earnings level at which tax credits will begin to be withdrawn will be reduced from £6,420 to 3,850.

He also announced that families with more than two children will no longer be able to claim child tax credit on the third and successive children.

But these swingeing cuts to benefits were accompanied by a surprise announcement to raise the compulsory national living wage for those aged over 25 to £7.20 in April next year, rising to £9 by the end of the decade.

Corporation tax will fall to 18 per cent from its current level of 20 per cent in a move designed to encourage firms to boost pay as the government eyes a major overhaul of the way child poverty is measured in the UK.

The Chancellor also announced plans to speed up plans towards raising the personal allowance to £12,500 by 2020, committing the government to increasing the current rate of £10,600 to £11,000 in April next year - £200 more than was previously planned.

The middle classes will enjoy a double benefit - not only seeing their tax-free amount rising but the higher rate 40p tax threshold will go up from £42,385 to £43,000 next April.

In a blow to students from low income families, Mr Osborne announced that maintenance grants will be scrapped because they are unaffordable. They will be replaced with loans, with the maximum amount available for those from households with an income under £25,000 to rise to £8,200.

Meanwhile public sector workers will suffer further pain after Mr Osborne announced a four-year freeze in their pay.

Key points

Welfare and pensions

Working-age benefits to be frozen for four years - including tax credits and local housing allowance but not maternity pay.

Rents paid through housing benefit will be reduced by 1 per cent a year for the next four years.

Tax credits and Universal Credit to be restricted to two children, affecting those born after April 2017.

Higher-income households in social housing required to pay rents at the market rate

Most 18-21-year-olds will not be entitled to claim housing benefit with a new so called “earn or learn” obligation

The earnings level at which tax credits will begin to be withdrawn will be reduced from £6,420 to 3,850.

Annual tax relief on pension contributions to be limited to £10,000 a year

Taxation and pay

Introduction of a new so called ‘national living wage’ for all workers aged over 25, starting at £7.20 from April 2016 to reach £9 an hour by 2020

Inheritance tax threshold will be increased to £1m from 2017

Personal tax allowance to rise to £11,000 next year

The level at which people start paying income tax at 40p to rise from £42,385 to £43,000 next year.

Corporation tax to fall to 18 per cent from current level of 20 per cent.

Tax relief on buy to let mortgages to be reduced from 2017 over four years.

Public borrowing and spending

Public sector pay rises to be restricted to 1 per cent for next four years

£37bn of further spending cuts by 2020, including £12bn of welfare cuts and £5bn from tax avoidance.

Defence spending to be ring fenced meeting Nato commitment to spend two per cent of GDP until the end of the decade.

Deficit to be cut at same pace as during last Parliament - securing a budget surplus a year later than planned in 2019-20

Borrowing set to fall from £69.5bn this year to £43.1bn, £24.3bn and £6bn before hitting a £10bn surplus in 2019-20

Transport

No rise in fuel duty with rates continuing to be frozen

Major reform to vehicle excise duties to pay for a new road-building and maintenance fund in England

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies