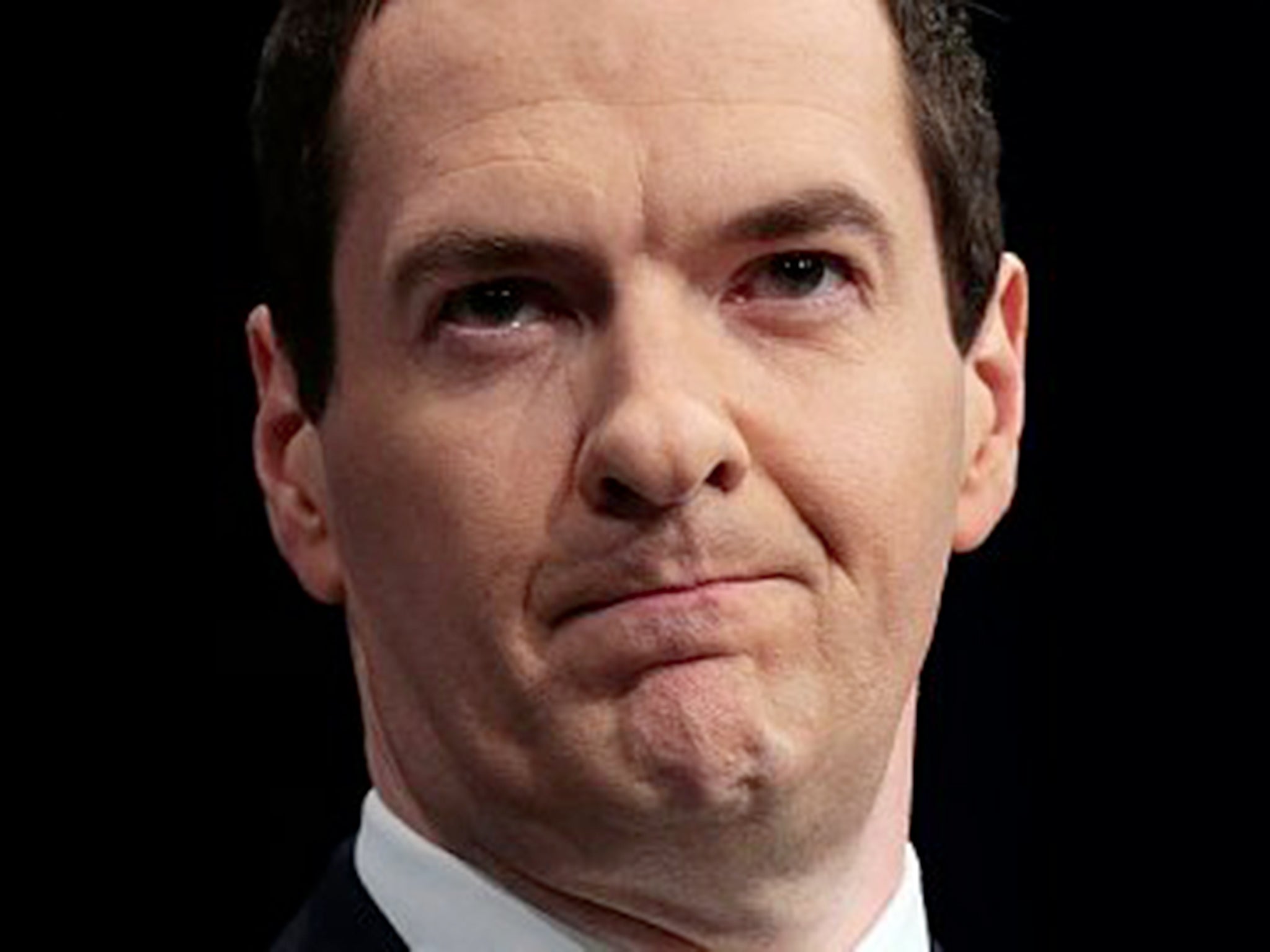

Tax credits Lords defeat Q&A: How did George Osborne get in this mess?

The measures were contained in a statutory instrument, a piece of secondary legislation, which had already been passed by MP

Q: What did peers vote on?

A: George Osborne’s plans announced in the Budget to reduce the amount which low-paid workers receive in tax credits to top up their pay.

The Commons Library estimated the move would cost 3.3 million working families around £1,300, but the Government insisted most would be compensated by increases to the national minimum wage and tax thresholds.

Q: What form did the vote take?

A: These measures were contained in a statutory instrument, a piece of secondary legislation, which had already been passed by MPs. The tactic provoked criticism that the Government was trying to ram the measure through.

Q: What was the effect of the vote?

A: Peers did not reject the substance of the Chancellor’s proposals, but threw the plans into chaos by demanding a three year delay in implementation for the worst-off.

Q: What happens next?

A: Mr Osborne immediately signalled that transition arrangements for the tax credit cuts would be contained in his Autumn Statement on November 25, while insisting “we can achieve the same goal of reforming tax credits, saving the money we need to save to secure our economy”.

Effects of the cuts to Tax Credits

Show all 6Q: How does he do that?

A: The crucial question. Suggestions include mitigating the cuts by speeding up his planned rise in the tax-free allowance or increasing the level at which employees pay national insurance. He could also adjust the detail of the tax credit cuts to shift the losses to slightly better-off workers, although this would simply shift the pain between two groups of “strivers”.

Q: So he’s got a bit of breathing space?

A: Not really. Mr Osborne appears before MPs on Tuesday, when he will face challenges on how he gets out of this mess. And on Thursday the Commons will hold a backbench debate on tax credits where a new approach will be backed by growing numbers of Tories. Losing support on his own side could be as damaging to Mr Osborne as the plans’ rejection in the Lords.

Q: Where does this leave the Lords?

A: On a collision course with the Chancellor and Prime Minister, who both pledged after the votes to act on the “constitutional issue”.

It has been suggested the Prime Minister could pack the Lords with ranks of newly-appointed Tory peers, to secure a majority, although that would make a mockery of his promise to cut the cost of politics.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies