Senate considers options on fiscal cliff

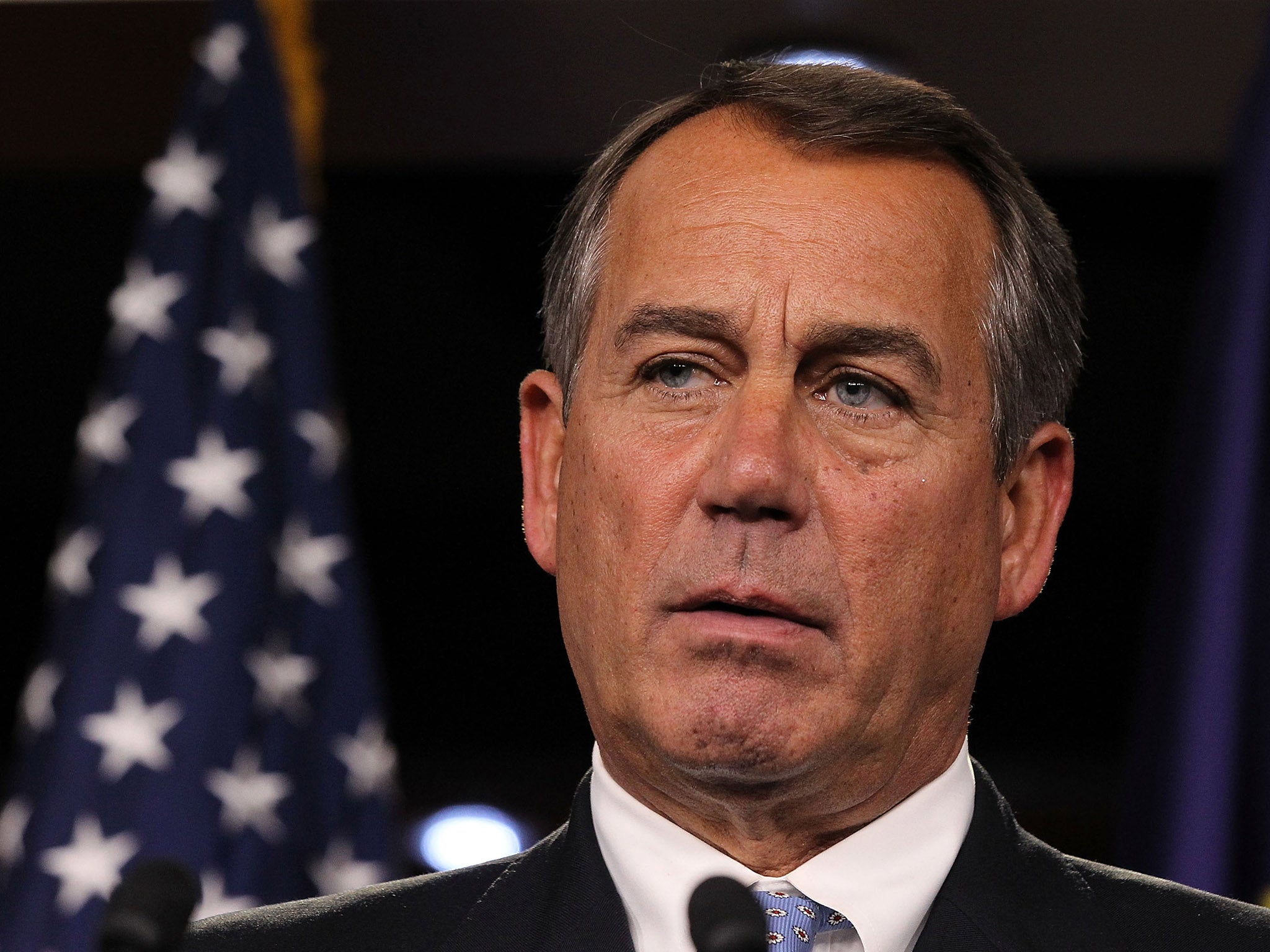

As congressional leaders prepare to meet Friday morning at the White House to discuss the looming fiscal cliff, much of Washington is focused on the potential for compromise between President Obama and House Speaker John Boehner.

But what if, after two years of trying, that pair still can't get a deal to solve the nation's budget problems? Then there's hope in the Senate, where people in both parties are hard at work on Plan B.

The bipartisan Gang of Six is still at it, drafting legislation based on the recommendations of Obama's fiscal commission, known as Bowles-Simpson. The Senate Finance Committee met Thursday to discuss how to proceed.

And on Wednesday, at the request of Senate Minority Leader Mitch McConnell, R-Ky., several senators offered ideas for various elements of a bargain at the GOP policy lunch, including Patrick Toomey, R-Pa., and Bob Corker, R-Tenn.

Few of the senators would offer details of their plans, saying they don't want to interfere with any agreement that might emerge between the Big Two. But Sen. Lindsey Graham, R-S.C., a longtime champion of a far-reaching debt deal, said the ground for compromise is fertile.

"If Boehner and Obama can come together with a deal that sails through the House, then start in the House," Graham said. But "if you can't get a deal from Boehner-Obama, start in the Senate."

There are pragmatic reasons to pursue a Senate-first approach, chief among them the broad recognition among Republicans in the Senate that any deal must include actual tax increases. Not tax increases through economic growth, as Boehner and his troops keeps saying, but, as Graham said, "real revenue."

Corker, for instance, said he has put together a far-reaching deficit-reduction proposal that tackles all the big budget problems, including the rampant growth in spending on federal health programs and the need for new tax revenues.

"I'm trying to show people how you can get to a really big number really easily," Corker said. "If the meeting Friday is a photo op, it's really depressing. And the most constructive thing those of us who want to solve the problem can do is just to continue working to try to get consensus."

Corker declined to provide details of his plan, but two people familiar with it said it would would raise around $800 billion over the next decade by imposing a $50,000 cap on deductions.

Meanwhile, Toomey, an ardent fiscal conservative, said he had drafted a proposal to simplify the tax code that would not raise additional tax revenue. But he added that he remains open to fresh revenues as part of a broader debt-reduction deal.

"Depending on whatever the president might eventually agree he's willing to do to get spending and entitlements under control," Toomey said, "of course, revenues will become part of the discussion."

Sen. John Barasso, R-Wyo., said senators in both parties are "eager to get things done and appalled that we aren't doing anything yet." With hundreds of billions in tax increases and automatic spending cuts set to pound the economic recovery in January, the most effective path forward, Barasso said, would be for Obama to present "a specific plan to deal with the nation's problems."

Democrats argue that Obama has presented such a plan: a version of his most recent budget request that seeks $1.6 trillion in new revenue. On Thursday, White House economic adviser Gene Sperling said a significant deficit reduction package should include "well over" $1 trillion in new revenues, noting that the president's budget calls for $1.65 trillion in new taxes.

Meanwhile, groups from across the political spectrum are descending on Washington to press for solutions. On Thursday, mayors worried about the economic impact of federal budget cuts held meetings on Capitol Hill and at the White House, as did a group calling themselves the "Patriotic Millionaires" who are arguing in favor of raising taxes on the wealthy.

"My belief is that people who have a lot and whose taxes have been reduced is to pay a little more," said Garrett Gruener, a venture capitalist and founder of Ask.Com. "My experience is marginal tax rates do not matter at whole do any of these decisions or any of the decisions I've seen in my firm."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies