Super-rich Romney admits paying only 15 per cent in taxes

Republican front-runner under pressure to make public his returns ahead of South Carolina primary

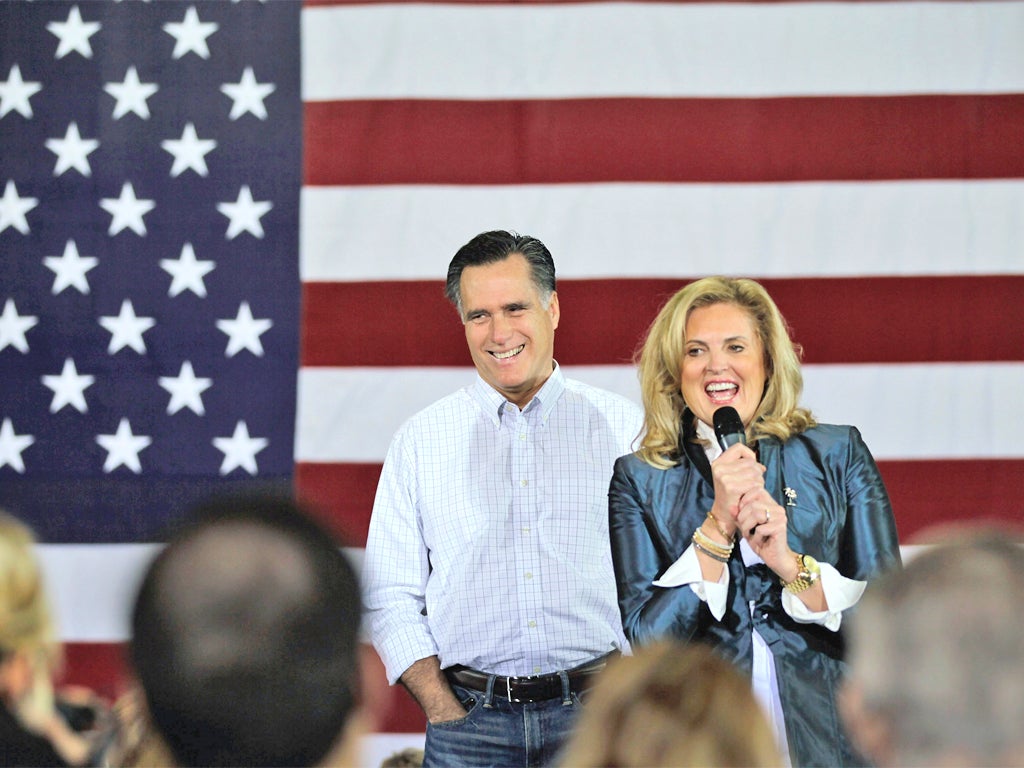

Just four days before voting in the crucial Republican primary in South Carolina, Mitt Romney conceded yesterday that he has only been paying about 15 per cent in taxes on most of his very considerable income, a rate far lower than most middle-class Americans are asked to contribute.

After taking a beating from his rivals for his years as CEO of Bain Capital, a private equity firm with a history of investing in companies that variously blossomed or went bust, the issue of his personal tax filings is now emerging as a potentially more dangerous threat to his candidacy. It took centre stage at a fractious candidates' debate in Myrtle Beach on Monday night when he was pressured to agree to make his tax returns public.

"Mitt, we need for you to release your income tax [returns], so the people of this country can see how you made your money," Texas Governor Rick Perry said to rowdy applause from 3,000 people packed into the Myrtle Beach convention centre. "As Republicans, we cannot fire our nominee in September. We need to know now."

If Mr Romney knew the question was coming, he failed before the television cameras to give any kind of comfortable response. Instead, wearing a now familiar clenched grin, he wavered, noting that in the past candidates have only made their filings available in April, tax filing time in America.

"If that has been the tradition, I am not opposed to that, time will tell," the former Massachusetts governor said, managing not to promise anything.

That Mr Romney is fearfully rich is not news. Details in the public domain suggest he has a fortune close to $250m (£163m) which on its own is probably generating another $1m for him each month after taxes. The risk is that he will be seen more than ever as symbolising the great American income divide that has spurred the Occupy Wall Street movement, particularly if he is benefiting from tax loopholes not available to most people.

It is a quirk sometimes known as the "Buffett Rule" after investment oracle Warren Buffett backed efforts by Barack Obama to correct it, saying that he was paying a lower tax rate than his secretary. Professional money and hedge fund managers generally get paid by sharing the profits of their companies rather than with regular salaries and are therefore able to get away with paying the lower 15 per cent tax rate applied to capital gains.

"What's the effective rate I've been paying? It's probably closer to the 15 per cent rate than anything," Mr Romney told reporters after a town hall event.

Monday night's debate offered other moments that did not flatter the candidates or the audience. Some in the hall booed, for instance, at the mention from moderators that Mr Romney's father was born in Mexico. Mr Perry, meanwhile, seemed to risk diplomatic pandemonium in Nato by saying that Turkey is governed by "what many would perceive to be Islamic terrorists". The Turkish foreign ministry made clear its displeasure in a statement yesterday.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies