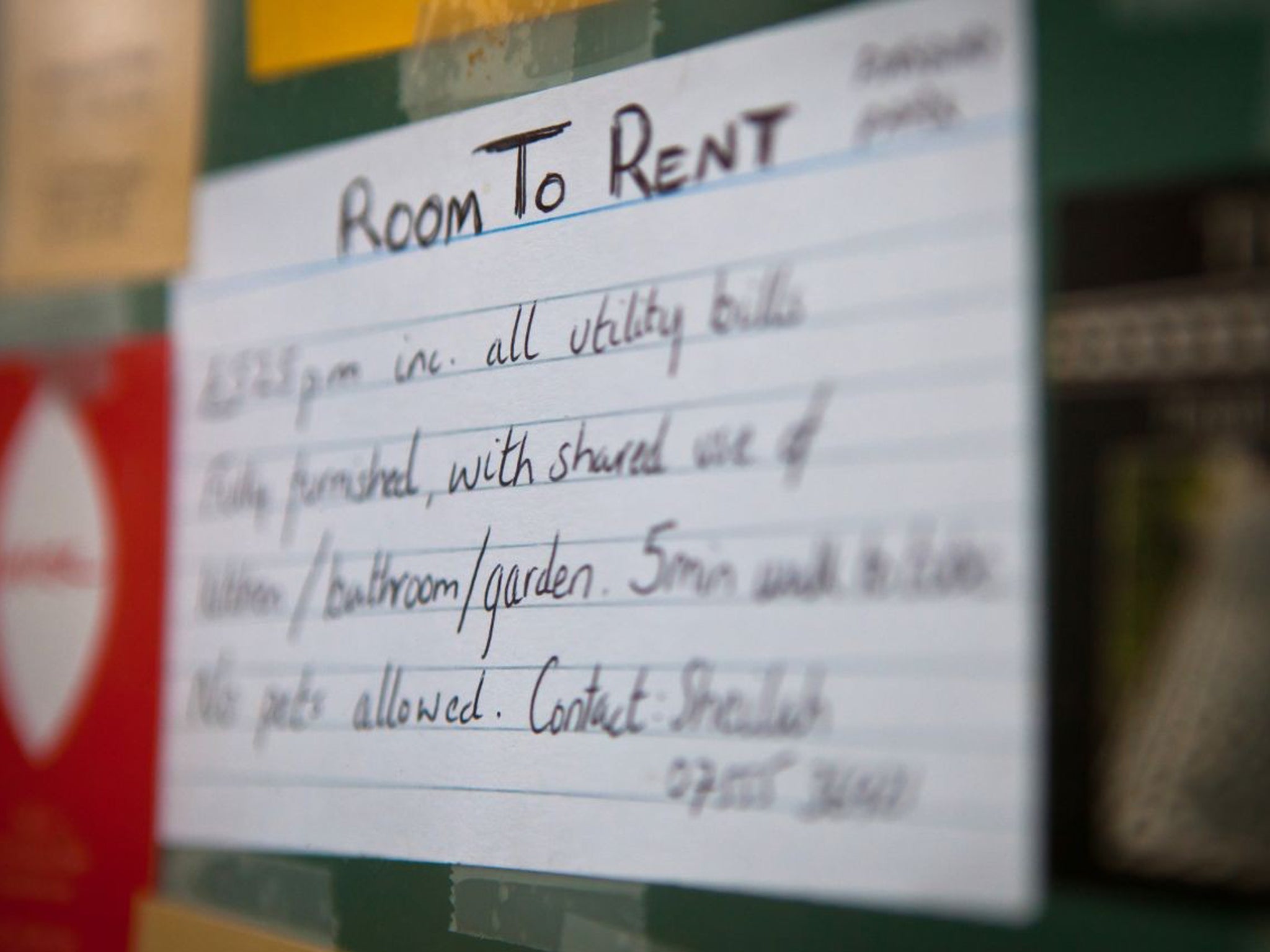

Renting out a room can open the door to extra cash

Making money from spare space could ease financial problems. But stick to the rules, reports Julian Knight

Money is tight for many of us, but there may well be a solution right under our noses – or should that be roof?

Renting out your spare room can bring in more cash than ever before as new research from easyroommate.co.uk shows that the rental on spare rooms is rising well above inflation. A combination of immigration, Britons moving around for work and a shortage of people willing to open their doors to lodgers has caused average rentals to rise by 4.3 per cent in the past year, the website says.

It's not just the young who are looking to lodge. Increasingly, a growing number of middle-aged and older people are looking for comfortable, clean short-term accommodation away from home. This is partly because they don't want to uproot their families away from friends and local schools but also because, outside London and some prime commuter towns, selling a home at a profit is not an option in a largely moribund property market.

Jenda Martin and husband David from Osterley, west London, are typical of homeowners who are looking to cash in on this trend.

"I lost my job in January 2012, and we knew we had to do something to help make ends meet, so my husband and I agreed to take in a lodger – we had briefly taken one in 2006, which had been a positive experience," Jenda said.

But the couple had a very particular type of lodger in mind – one who would fit in with their way of life: "We wanted a professional person, someone ideally who was a homeowner and would respect our home, but crucially an individual who wouldn't just lock themselves away but interact, take their meals with us and get on."

Jenda and David settled on Katherine, who lives in Bath and works in Heathrow and, importantly, was looking for a Monday-to-Friday let. "The whole thing has worked out perfectly, we have become firm friends with Katherine. She has brought real colour to our lives, earned some extra money and we have weekends to ourselves."

Jenda has now found employment again, and Katherine will soon move on, but the couple and their lodger will stay in touch. "Selecting the right lodger can make this a really positive experience. I used a website called mondaytofriday.com to meet Katherine. Now I have a job in Welwyn Garden City, which can be a three-hour commute, I am actually considering going down the same route myself, staying Monday to Friday near my work."

Renting out a room to a lodger brings with it an all-too-rare tax break. Homeowners letting a room in a property they occupy can earn up to £4,250 a year tax free.

Matt Hutchinson, a director of spareroom.co.uk, explained: "There is no need to fill in a tax return as the exemption is automatic. When we surveyed live-in landlords and asked them why they had taken in lodgers, 67 per cent said their motivation was financial.

"However, 29 per cent also cited social reasons as being important. Not everyone wants to live alone, even if they could afford to (which an increasing number of people can't)."

There have been rumblings that this tax break maybe under threat in the upcoming Budget as the Chancellor scrambles to fill a gaping hole in his finances. However, Judy Niner, the chief executive and founder of mondaytofriday.com, said this would be a foolhardy step.

"Generally, people feel they get so little in the form of tax breaks that take one away like this would be churlish, particularly as taking in a lodger is so often used as a means of helping to make ends meet," she said.

"In addition, it is absolutely crucial for labour-market mobility and preventing congestion on the roads and trains that there is property available for people to rent during the week. Kill the tax break and you will not only hurt individuals but the wider economy."

Homeowners considering taking in a lodger are urged to follow the rules to the letter before letting out a room. Most people have the right to take in a lodger, but inform your mortgage provider first. It is also important to contact your household contents and buildings insurance provider to see whether your policy covers you. Mr Hutchinson warned: "Most don't unless you specifically ask them to."

Research from spareroom.co.uk found that up to one in seven people looking to rent out a room is not properly insured to do so, potentially opening themselves up for catastrophic losses in the case of theft or fire.

Personal safety is obviously a concern for anyone opening up their home to a stranger. Most of the main websites designed to unite landlords and tenants, unlike a standard letting agent, place the responsibility firmly on the two parties to ensure their own safety.

This is reflected in the price of using these sites, which take a far smaller cut than a standard letting agent. Therefore, taking references is important and these should be followed up on with current employers and previous landlords.

Spareroom.co.uk says it has individuals checking adverts on the site to ensure there is nothing untoward going on, but ultimately it is a case of lodger and landlord beware.

Renting out a room is not just for homeowners. Some tenancy agreements allow renters to take in a lodger, although the landlord should be informed beforehand. With the coming of the controversial "bedroom tax" in April, Mr Hutchinson reckons more social tenants will be looking to rent a room: "We should see more social tenants becoming live-in landlords in 2013. The bedroom tax means there will be thousands of people who will lose out financially if they don't either move or take in a lodger. Many are unaware they even can rent out a room but, for most, it's a definite possibility and should be explored."

Such an outcome may increase supply of rooms and in turn place a cap on the rentals which, as the easyroommate.co.uk research shows, have been rising sharply.

Rent-a-room tips

To benefit from the rent-a-room scheme, you must comply with these conditions.

* The room or rooms must be furnished.

* They must be in your family home, where you live most of the time.

* The scheme doesn't apply if you're renting out a self-contained flat or letting office space.

* If you are a tenant in your home, check that your lease permits you to take in a lodger

* If you have been getting a single-person council tax exemption, you must let your council know you are no longer living alone. Unless your lodger is a student, you will lose the discount

* You will need an annual gas safety check. q Furniture and furnishings must meet safety standards.

* If you have more than two lodgers, your home will count as a House with Multiple Occupation (HMO) and you'll have to comply with extra health and safety requirements. You may also lose your tax break as you will be deemed as running a guest house.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies