Here's how to turn the tables on tax avoiders

The problem is that HMRC simply can't compete with the big accountancy firms

We're here again. The International Consortium of Investigative Journalists has released “The Jersey Files”.

That might sound like a new Netflix drama, but in fact it's actually leaked files from wealth management company Kleinwort Benson that cast an unflattering light on the offshore dealings of a number of stars.

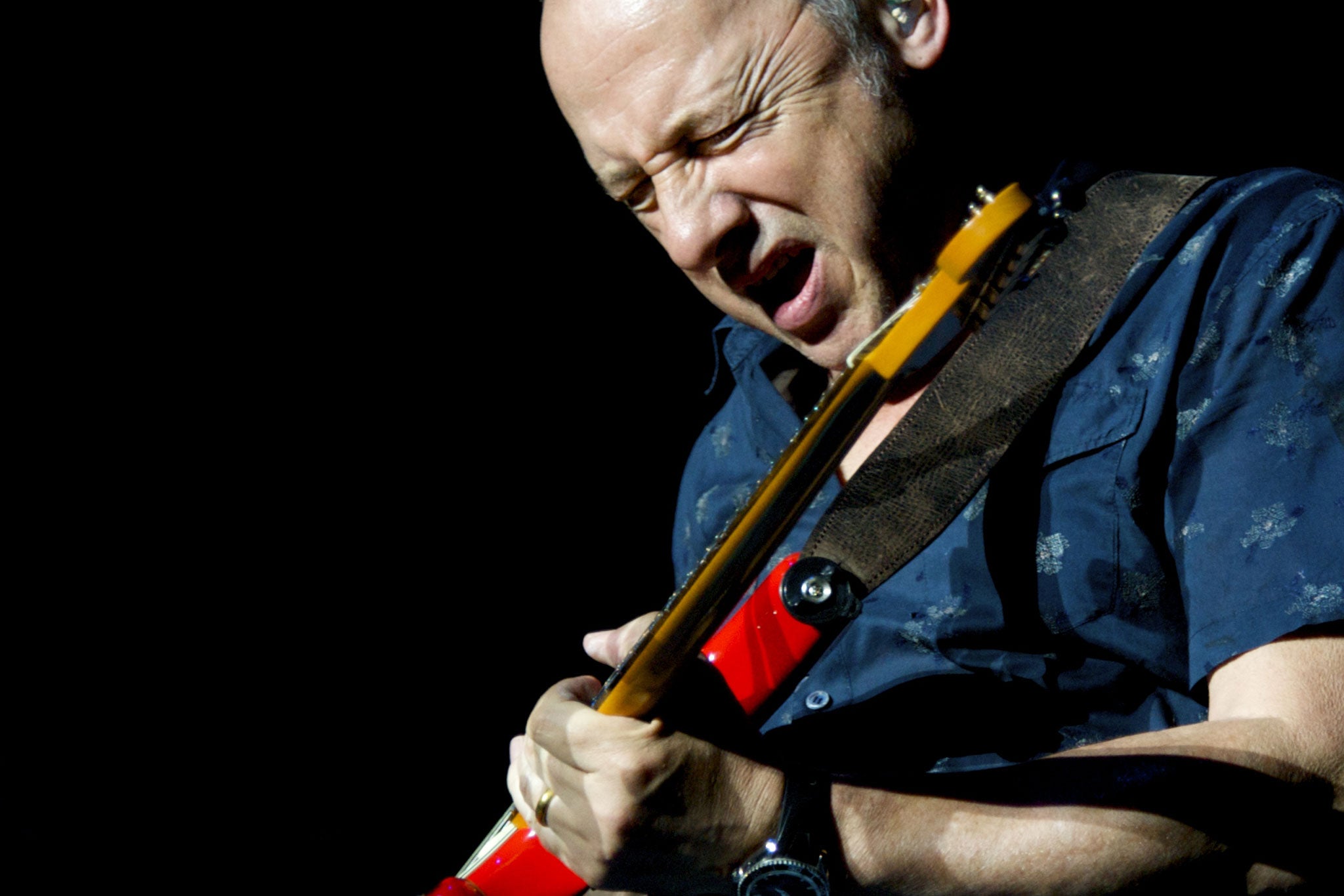

These things - the Jersey Files features the likes of Dire Straits guitarist Mark Knopfler, celebrity tailor Oswald Boateng, former Formula One team boss Eddie Jordan and former England footballer Bryan Robson - seem to emerge every few months.

If those involved offer up any explanation - and it's rare that they do - it's usually that they were advised to involve themselves in these sort of schemes by their accountants. So they were only following orders, and that makes it alright, doesn't it? Well, no.

Those involved may not have noticed but the rest of the country is still going through austerity. Public sector workers - the people who teach children, cure the sick, keep the country ticking over - have had their pay frozen, their pensions slashed, their workloads increased. Then there are who are looking for work but can't find it, and the young, and the disabled. I could go on.

Every pound stashed in some offshore bolt hole is a pound lost that could be helping them.

The best of it is, the tax burden on the wealthy is coming down. Despite the pain austerity is causing George Osborne lopped 5p off the 50p top rate of tax imposed on earnings above £150,000.

And it's not just individuals, as has been demonstrated by the tactics used by the likes of Apple, and Google, and Amazon, and Starbucks. This at a time when UK corporation tax is plumbing new depths - it's by far the lowest in the G7 - thanks to the Government aggressively cutting it in an attempt to attract companies to these shores. At a cost to the exchequer of £5bn a year according to the FT. All this, and they still won't pay.

Well, enough. It's time for a new approach. It's time for the authorities to counter aggressive tax avoidance schemes and practices with some aggression of their own.

I know there are measures coming in, such as allowing HM Revenue & Customs to grab the money from people using questionable avoidance schemes upfront, before it gets challenged in court, not least because the legal system's susceptibility to delay clearly favours the tax avoiders.

But measures like this don't go far enough.

So here are a couple of suggestions.

For a start we need more publicity. Publicity is a handy, and relatively cheap, tool. Especially bad publicity. Jimmy Carr showed the way here. The comedian stopped laughing and got serious after he was savaged for his involvement with the K2 tax scheme back in 2012. He admitted to a “terrible error of judgement” on Twitter.

But that's just the celebrities. Many other wealthy people are allergic to any publicity of any kind. The threat of being named for using avoidance schemes might cause them to think twice. So let's have HM Revenue & Customs using this by naming more of those involved in aggressive schemes that it's reviewing, rather than leaving it to leaks to us journalists.

What's that? You want privacy? Then pay up.

But let's go further. The problem right now is that the Revenue simply can't compete with the big accountancy firms when it comes to staff. That's why they're so keen to target little people like you and me with threatening letters for failing to pay £9.28 we had forgotten to include in our self-assessment. We're easy marks.

Easy marks who might revolt (with some justification) were the Revenue to try to compete with the salaries the likes of KPMG and its pals offer.

Perhaps, then, what's required is a new unit. A high value tax enforcement service. It'd work like this: You set the agency up with a budget, but then link future settlements, and the pay of its staff, to recoveries provided to the exchequer by giving them a cut of what they bring in.

That might mean that some people getting rich, but so be it. Ultimately, we'd all benefit, so I think I could live with it.

It's the sort of agency that ultimately could even by privatised, or contracted out, should Mr Osborne decide to go down that route (he probably would). Were a unit like this to start making real money there'd be no shortage of buyers.

Of course, its work would get harder after a few successes. The very existence of such a unit - with the aforementioned power to publicise - should serve to keep a lot of people honest.

But there will always be people who will go out of their way to avoid tax, and there will always be people to dream up ways of doing that for them. So it shouldn't be short of work.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies