Like the NFL, the Monetary Policy Committee is recruiting players who could sink or swim

New recruits on the MPC have been put on the spot by the Governor’s warning on rates

The National Football League conducts an annual draft, otherwise known as the player selection meeting, where teams select the best college players. The position taken by the 32 teams in the drafting order is in reverse order relative to its record in the previous year, so the Super Bowl winning team goes last.

We have no idea how well these draftees will perform. Many first round picks are terrible failures. Some turn out to be stars like Eli Manning from the New York Giants. The Patriots’ great quarterback Tom Brady, who has three Super Bowl rings, was the 199th pick in the sixth round of the 2000 draft.

This year there was special excitement in my family when the Pittsburgh Steelers picked a Blanchflower, Rob that is, but no relation. My kids decided I needed the shirt and visited the Steelers’ website only to discover the cheapest available was $150.

Needless to say, I am still waiting.

The NFL draft hasn’t been the only one picking talent over the last month or so. Central banks have been at it too. Stan Fischer, Lael Brainard and Loretta Mester are new voting members on the US Federal Open Market Committee. Andy Haldane joined the Monetary Policy Committee this month. Kristin Forbes joins next month while Nemat Shafik joins in August.

The arrival of all this new talent makes it very hard to understand forward guidance. We just don’t know how these rookies will perform. Are they hawks or doves? We probably won’t find out for a while as they take time to become acclimatised and work out which way is up.

Given the change in the composition of the MPC it was rather surprising that Mark Carney in his Mansion House speech warned that interest rates could rise “sooner than markets currently expect”. Presumably that comes as news to the new members of the MPC who will actually get to vote on any interest rate rise but who wouldn’t have been consulted.

The reality, though, is that such a tightening is now less necessary given the pound has risen to above $1.70 alongside a rise in the yield curve, which has made borrowing more expensive.

The market is now expecting a rate rise in October 2014, which in my view looks totally bonkers given the continuing falls in real wages and the large amount of labour market slack that still exists in the UK economy. It’s unclear why Mr Carney said this given the changes in composition of the MPC. He must have known it would send markets into a tizzy. Or maybe he didn’t?

There was much comment in the media that there was a high probability that one or more members of the MPC would have voted for a rate rise at the June meeting.

Top of the list was the chief hawk Martin Weale, who in the end went along with everyone else arguing for no change. But he did produce an interesting speech in Belfast on the day the minutes were released when he calculated that, over three years, wage growth would pick up to 4 per cent from its current 0.7 per cent.

Mr Weale sensibly concludes: “There is the continuing unusual weakness in wages and a question of what signal should be drawn from that. It may well imply that there is rather more spare capacity in the economy than the committee has assumed. Should wage growth fail to revive, that will on its own tip the scales further in favour of maintaining a strong monetary stimulus.” Agreed.

I don’t share Mr Weale’s view that wages are set to grow at 4 per cent but I certainly agree that the data will speak and policy will have to follow. The differences between our views are large but I concur with his conclusion that these are tough judgement calls.

It’s hard to disagree with this statement from his speech: “I certainly do not want you to think that there is any definitive answer about what to draw from this; it is, as always, a matter of judgement.”

The fact that monetary policy is data dependent and not time dependent was made clear by the US Federal Reserve’s chair Janet Yellen at the press conference following the meeting last week which voted for asset purchases of $35bn a month.

The Fed is following the data and any interest rate rise will not come “for a considerable time”. The amount being purchased has been tapered by $10bn a month again but we should note that, in contrast to the MPC, they are still adding stimulus, despite a recent upward tick in inflation in May 2014.

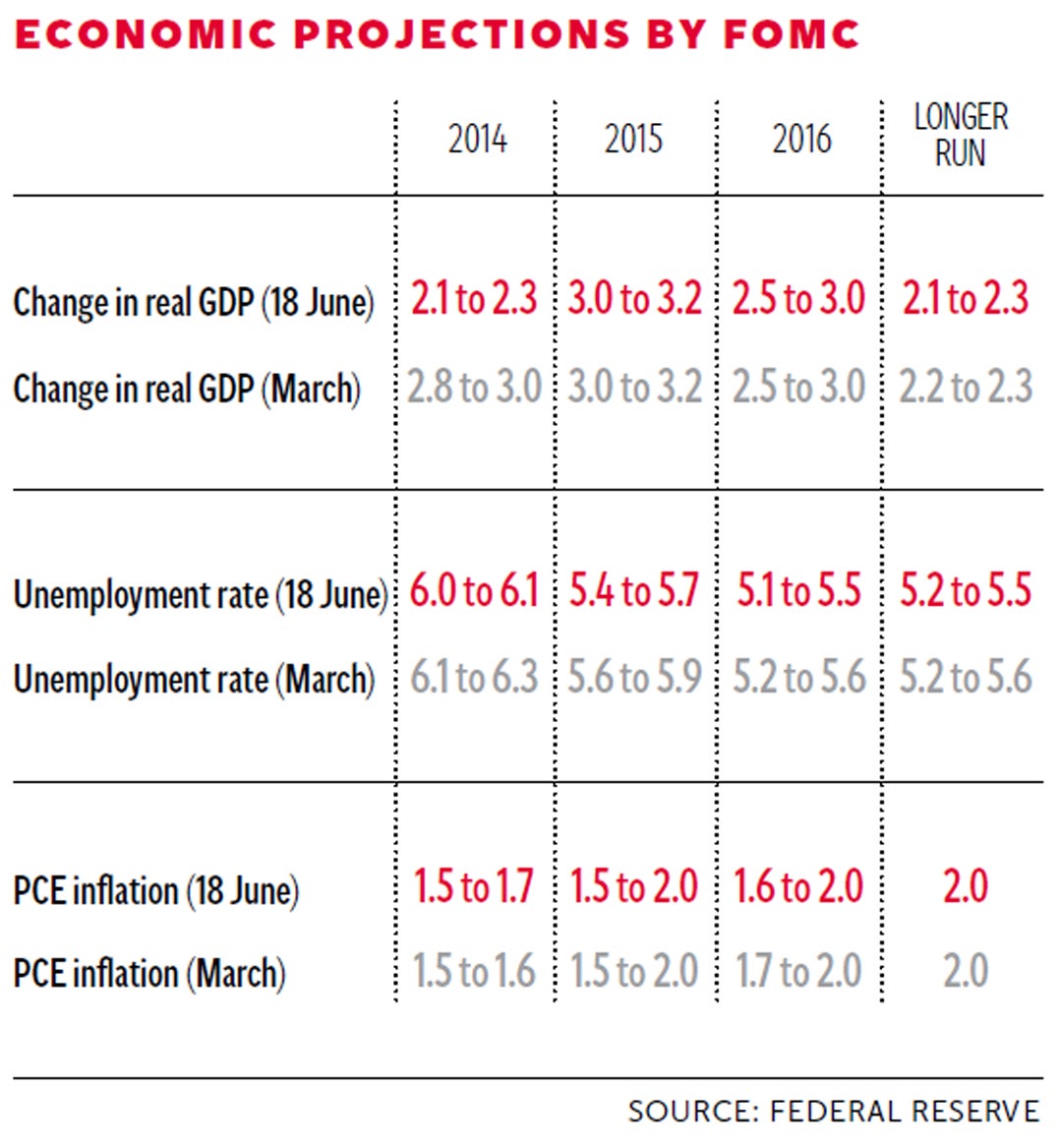

The above table shows the central tendency of the economic projections of the FOMC, which excludes the three highest and three lowest projections for each variable in each year. The FOMC has lowered its growth projection for 2014 compared with March. It expects inflation to remain below the target and sees low to moderate growth, with the economy remaining well above full-employment. In the minutes of the meeting it was also pointed out that: “Low nominal wage inflation was also viewed as consistent with slack in labor markets”. Nominal wage growth in the US is 2 per cent and real wages haven’t grown at all over the last year.

The Fed is continuing with tapering its asset purchase programme and only after that will it consider a rate rise. UK real wages are falling faster, unemployment is higher and inflation is lower than in the US. Although growth is stronger, they don’t have a house price bubble. I have no clue why the MPC would want to raise rates first in what is, essentially, quantitative easing wars. Blink and you lose.

If I’m right, the Bank of England should send me the Blanchflower shirt.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies