The Tories are shoring up their defences. Labour's are still dangerously exposed

Inside Westminster

“Labour finally admits failure as missed deficit target means further borrowing binge,” screamed The Daily Telegraph.

“Balls breaks promise to balance nation’s books,” said The Times. “Labour’s stealth tax: Balls to hike stamp duty after election,” predicted the Daily Mail.

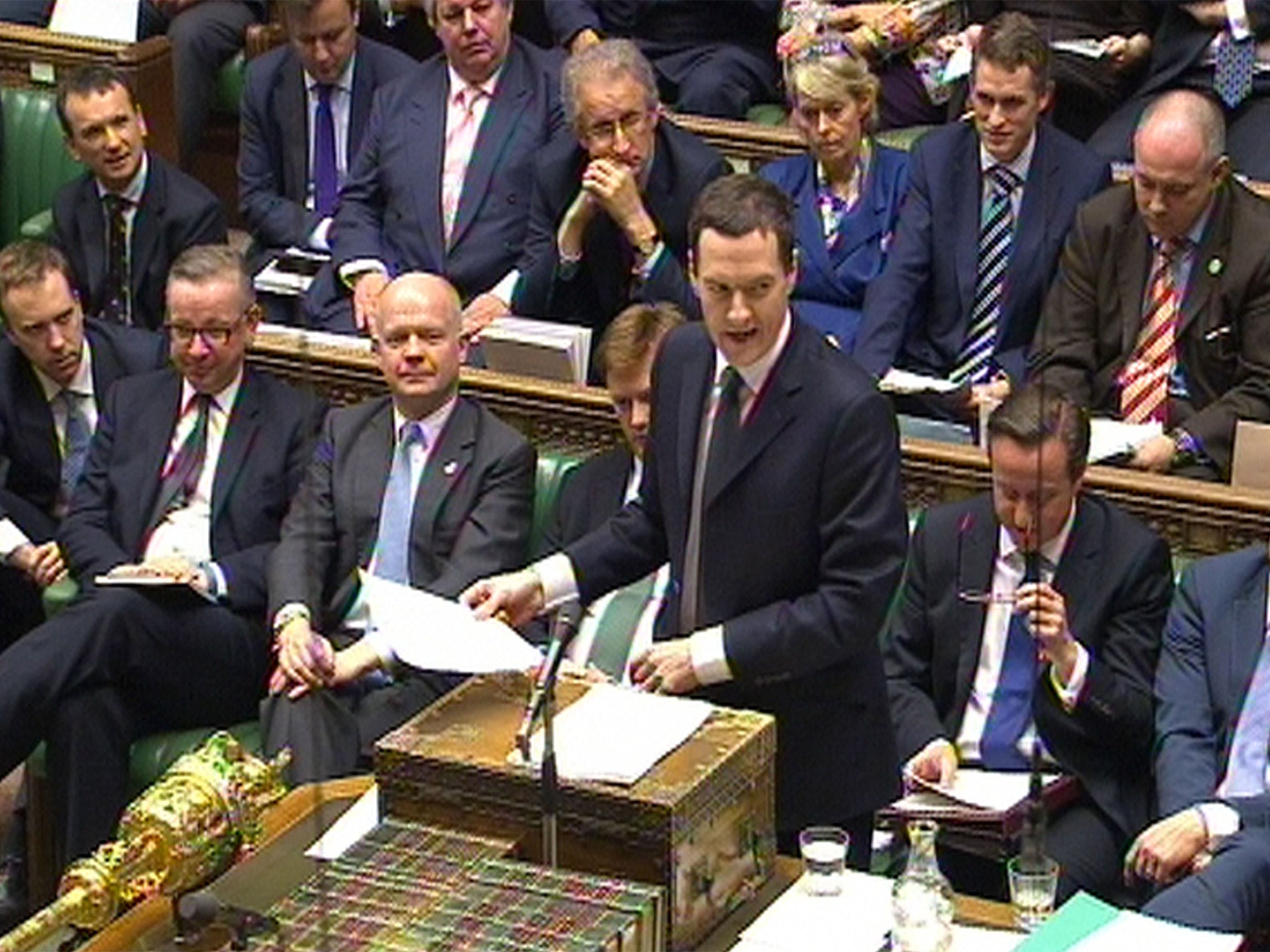

I couldn’t help wondering what the front pages might have looked like if Ed Balls, the shadow Chancellor, rather than George Osborne had presented this week’s Autumn Statement. Osborne won positive headlines in Conservative-supporting newspapers by announcing a surprise shake-up of stamp duty which means that 98 per cent of homebuyers now pay less. To conjure up a “tax cut for millions” with no money was a masterstroke.

Hitting rich homebuyers enabled Osborne to revive his dormant “we’re all in it together” slogan. His £1bn “Google tax” on multinationals was an attempt to show the Tories are not in the pockets of big business. His stamp duty reform also dented the appeal of the mansion tax proposed by Labour and the Liberal Democrats.

I suspect the third of my imaginary headlines – turning stamp duty into a stealth tax – will come true, whoever is in power after next May’s general election. The extra home sales it will generate are already expected to raise Treasury stamp duty revenues from £11.5bn to £19.5bn by 2020. Any future chancellor – Osborne included – will surely be tempted to fiddle with the property value bands to raise even more. It is much easier to tweak an existing tax than impose a new one.

The Chancellor tells us he will clear the deficit by 2017-18 and run a £23bn budget surplus by the 2020 election – all without imposing any tax rises. That is implausible enough but it gets worse: he also promises £7.2bn of income tax cuts. Senior Whitehall officials know it doesn’t add up, and that some tax rises will be needed to reduce the cuts below £55bn.

With an election coming, ministers would rather talk about money for the NHS, road schemes or flood defences. The Tories needed an “austerity plus” message different to the diet of cuts they offered in 2010, to show the pain since then has produced some gain.

Osborne and his Liberal Democrat deputy Danny Alexander splashed the infrastructure cash in key constituencies. “Our MPs in the marginals are happy bunnies; they are feeling the love,” said one senior Tory. The Chancellor got a hero’s welcome when he addressed Tory backbenchers after his Commons statement. Even those MPs who are not “Friends of George”, his growing band of potential backers in the future Tory leadership stakes, hailed what they saw as a brilliant, highly political package.

David Cameron and Osborne won’t lose sleep over the headlines about “colossal” spending cuts ahead. They judge that, if voters realise the scale of the remaining task on the deficit, they will stick with the Tories rather than take a punt on Labour.

Both parties acknowledge the need for cuts but when asked for specifics, their offerings are puny. Osborne cites a two-year freeze in most working-age benefits. But that would raise £3.2bn towards welfare savings estimated at more than £20bn.

His aides say his plans are credible, that people should “look at his record” on cuts since 2010. Labour cites its proposed 1 per cent cap on child benefit rises for two years to save £400m. But the Coalition is already doing year one. Much more honesty is required from all the parties on the big ticket items they would cut.

Labour feels aggrieved that Osborne got away with blue murder this week. He announced that the Coalition would halve rather than eliminate the deficit in the current five-year parliament as originally planned. Ironically, the very plan that Alistair Darling, the then Labour Chancellor, put forward before the last election, which was attacked as inadequate by the Tories.

But Labour doesn’t deserve any public sympathy. The party’s smoke signals suggest it would have room to spend £27bn a year more than the Tories, giving voters a real choice. The Labour leadership is torn between making a virtue of that and spelling out the deep cuts that would still be needed. So it sits uncomfortably on the fence, its fuzzy message reducing its chances of being trusted with the nation’s finances again.

The opinion polls suggest that voters would like Cameron to remain prime minister, but would prefer a Labour government. My top Tory sources tell me he is unlikely to defect to Labour, so the public will soon have a big choice to make.

The stamp duty hike for the rich was part of a wider canvas. “We are closing off our exposed flanks,” said one Tory strategist. Cameron aides say his speech on immigration a week ago was his “last word” on it before the election, although Ukip will have something to say about that. Osborne’s extra £2bn for the health budget was another attempt to neutralise a difficult issue. It was also yet another trap for Labour.

True to form, Labour declared that it would still spend an extra £2.5bn on NHS, no matter how much the Tories pledge for it. No one doubts the money is needed. But “I’ll raise you £2.5bn” was not a good message for a party which desperately needs to gain credibility on the deficit – and soon. The Tories are eliminating their negatives. Labour is not.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies