Vince Cable rightly warns of an unbalanced economy dependent on debt and a housing boom ripe for a crash

Sir Vince is right; it is far too early to call victory in the economic war

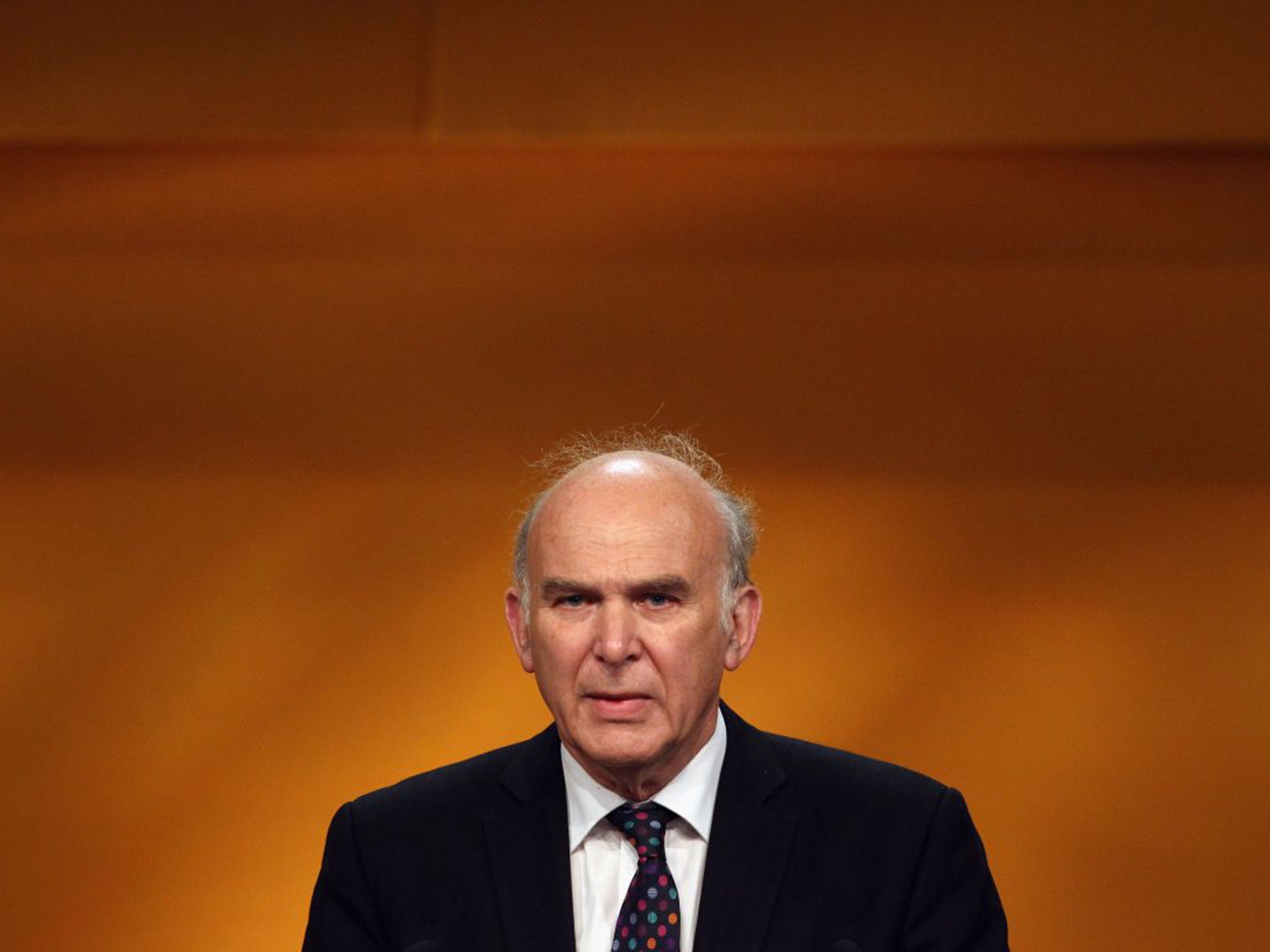

On his first day as the Coalition’s Business Secretary in 2010, the Liberal Democrat Vince Cable was welcomed to his new department by the Prime Minister as one of the brightest economic minds in the country. So he was, and is. Sir Vince had made a considerable reputation for himself as an economic authority, particularly during the banking crisis and the recession that followed. He consistently led in the opinion polls as the politician the public believed the most on financial matters.

As Business Secretary, however, he was in too junior a position to influence the general thrust of policy very much, and his frustrations at the Treasury’s programme of austerity – its speed and timing – were often visible. Although Sir Vince avoided much of the public blame for his party’s failure to meet its promises over university tuition fees, his own career suffered.

Having lost his seat in Parliament, Sir Vince is now back to what he enjoys most: telling it as it is on the economy. His latest essay, published in The Independent, follows his consistent themes for the past decade. He points out once again that the British economy remains precarious and unbalanced, that we are still living with the consequences of what he terms “the storm” of 2008. Despite his efforts, and those of his colleagues in coalition, the British economy remains hopelessly reliant on debt – now generated by the Bank of England through ultra-low interest rates and quantitative easing – as well as the housing market and finance. In London and the South-east there are more and more signals that the boom could be overheating. The possibility of a crash seems not to have been properly considered by the authorities, though the Bank of England has taken steps to slow the growth in mortgage lending, and wisely so. Yet, as Sir Vince notes, the Bank’s “extreme timidity” in taking them reveals “the high level of dependence on this precarious and dangerous form of growth”.

He is also right to point to other “black swan” possibilities. The recent turmoil in China and other emerging markets demonstrates how unbalanced growth still is – the counterpart to the imbalances in many economies in the West, with their savings funding our borrowing. The Government may have been extremely lucky in the timing of this year’s election, if the portents Sir Vince has spotted among the leading indicators are correct. Business confidence is apparently at its lowest ebb since the recession. Though new jobs have been generated, there has been less success in reversing the traditional British weakness – poor productivity.

This is where Sir Vince should turn his attention next. To be fair to the Chancellor, George Osborne appears to have woken up to this awkward fact; for, without higher output per worker there can be no long-term growth in living standards, and not much hope of an amelioration in public services either. Training was improved under the Coalition Government, but spending on infrastructure has been either late or unduly generous to foreign governments and companies, glaringly so in the nuclear energy field. Sir Vince is right; it is far too early to call victory in the economic war.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies