The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Apple tax: Tim Cook open letter to Europe condemns £11bn EU ruling

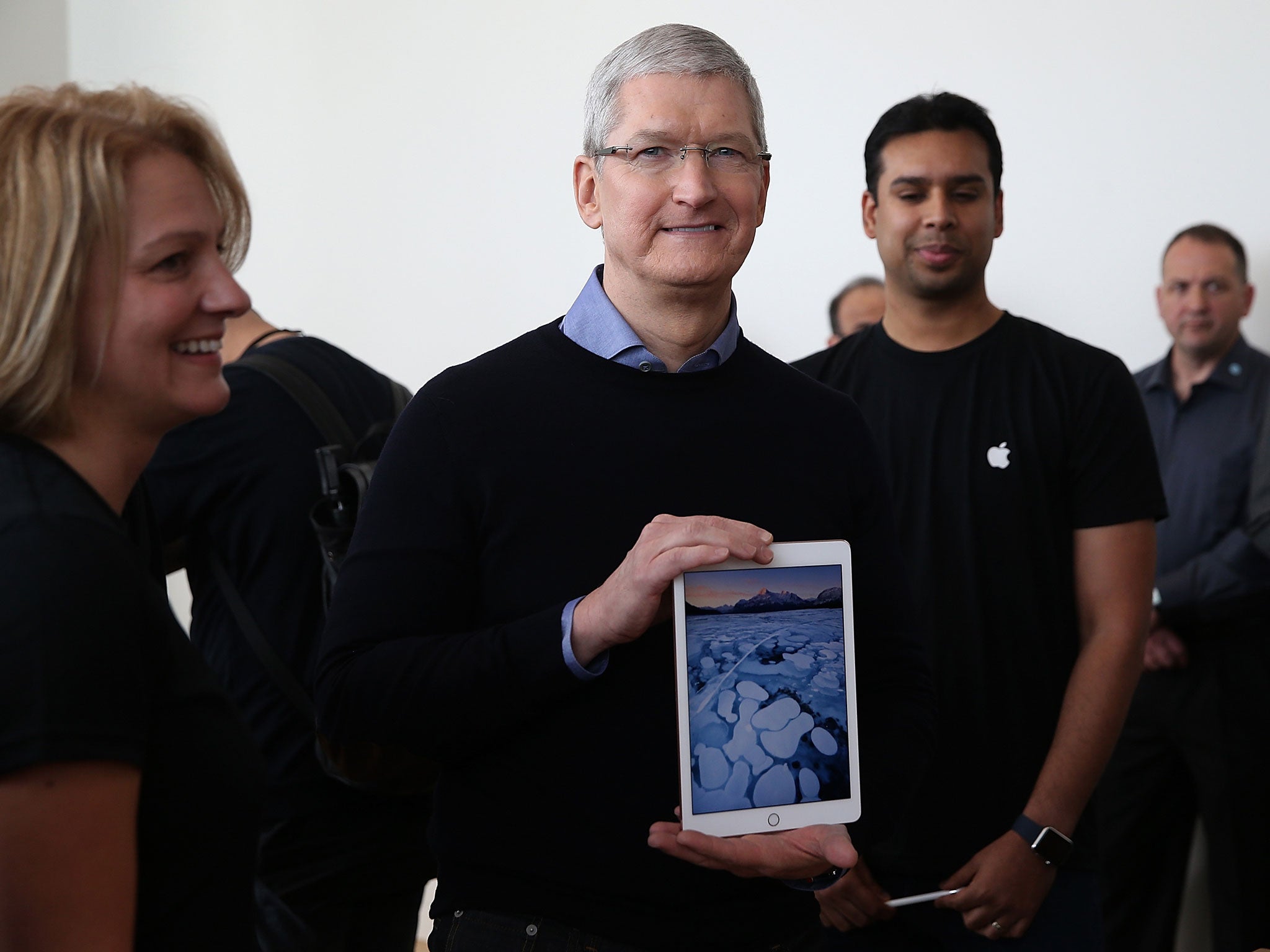

The CEO wrote the open letter after the EU made its ruling

Apple CEO Tim Cook has denounced a decision by the European Commission that said his company owed up to $14.5bn in unpaid taxes, saying the ruling was unjust, unfair and incorrect.

In an open letter posted on the Apple website, Mr Cook said Apple had started operating in Ireland at a time when the city of Cork was suffering from high unemployment and extremely low economic investment. It had since become the largest taxpayer in Ireland, the US and the world.

“Over the years, we received guidance from Irish tax authorities on how to comply correctly with Irish tax law - the same kind of guidance available to any company doing business there. In Ireland and in every country where we operate, Apple follows the law and we pay all the taxes we owe,” he wrote.

“The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process.”

He added: “The opinion issued on August 30th alleges that Ireland gave Apple a special deal on our taxes. This claim has no basis in fact or in law."

The letter was posted after the EC ruled that Ireland should to recoup 13 billion Euros ($14.5bn) from Apple over a “sweetheart” tax deal offered to the tech company.

Following a three-year long investigation, the commission concluded the tax arrangements between Ireland and the multinational tech firm were illegal.

Ireland’s corporation tax rate is already relatively low at 12.5 per cent, but the commission said Apple’s tax deal meant the firm was paying an effective corporate tax rate of less than 1 per cent.

Mr Cook said most of Apple’s research and development efforts took place in California so most company profits were taxed in the United States. He said the Commission wanted to retroactively change the rules to collect more money in its own region.

“Taxes for multinational companies are complex, yet a fundamental principle is recognised around the world,” he wrote. “A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.”

The US has been quick to criticise a decision by the European Commission that Apple should pay back taxes in Ireland - saying the move will “undermine foreign investment”.

“The Commission’s actions could threaten to undermine foreign investment, the business climate in Europe, and the important spirit of economic partnership between the US and the EU,” a US Treasury spokesperson said on Tuesday.

The Associated Press said that the White House had also voiced concerns that American taxpayers will ultimately bear the brunt of the European Union’s decision.

White House spokesman Josh Earnest said Apple could deduct the payment from those back taxes to the amount owed the United States government and that was not fair.

“We are concerned about a unilateral approach…that threaten to undermine progress that we have made collaboratively with the Europeans to make the international taxation system fair,” said Mr Earnest.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks