The Analyst: A reliable portfolio to ride out the storm

It has been a tough few years for UK equity income funds. The recession caused many dividends to be cut and led to many shares being de-rated.

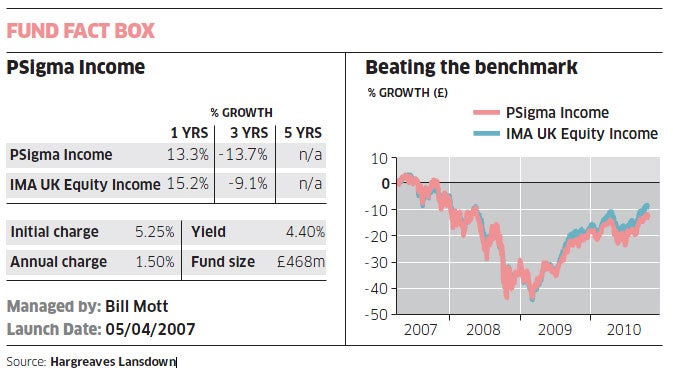

However, most of the bad news looks to have passed, and we can probably look forward to dividend increases over the coming years. So, given a background of the lowest interest rates for over 300 years, you might expect a revival in high-yielding stocks. Yet this has not really happened, and a number of funds in the sector, including one of my favourite fund managers, Bill Mott of PSigma Income, continue to struggle.

In a recent conference call with Mr Mott, I looked in detail at the stocks he owns and I find it hard to desert the fund. I certainly have had a fair share of criticism from investors for sticking with it, but it brings sharply into focus how patient you sometimes need to be. It is easy to forget that legendary fund managers such as Anthony Bolton had very long periods in the wilderness before going on to deliver exceptional results.

PSigma Income is really a fund for all seasons, which is perhaps its problem. It is not a momentum-driven fund, so it hasn't charged into commodities or mining stocks. Bill Mott has stuck to his guns, believing that defensive equities offer better longer-term prospects. I am inclined to agree. The markets and the world economy are extremely difficult to read, but there is one overriding theme that you need to look at: debt. Most Western governments have mortgaged their futures, and the problems have already surfaced in Ireland and Greece. I suspect they will emerge elsewhere too, and the UK is hardly immune.

We simply have too much debt, and when debt is paid back it means less money spent on discretionary items. It therefore seems completely logical to see Bill Mott heavily invested in less economically sensitive areas with strong and stable cash flow; sectors such as utilities, pharmaceuticals, tobacco and consumer staples. In addition, he has 11 per cent invested in large overseas companies, giving him greater diversification in some of these sectors. In both the UK and overseas holdings it is interesting to note that, in most cases, the equity is yielding considerably more than the equivalent bond in the same company. This strikes me as an odd state of affairs with dividends likely to rise over time.

Mr Mott sees three possible global scenarios: Firstly, a deflationary one akin to Japan's lost decade. Secondly, a scenario where quantitative easing eventually ignites inflation (which does not favour bonds); and thirdly, an anaemic recovery with gradual economic rebalancing. Of course the third scenario can encompass elements of the first two, and markets could be buffeted by expectations of both inflation and deflation at various times, but ultimately I feel Mr Mott (and other fund managers such as Neil Woodford) is correct in suggesting that we are in for a long hard slog.

Global economic rebalancing and debt repayment will take time, and although politicians like quick solutions, unfortunately there aren't any. So I suspect that the world economy will lumber on, lurching from one side to the other. In the end I expect a rebalancing will be achieved, but it could take a decade.

Given this scenario, I am happy with what I see in Bill Mott's portfolio. Stocks such as Centrica, GlaxoSmithKline, British American Tobacco and Reckitt Benckiser should remain resilient. Although the fund has had a difficult time over the last couple of years I believe investors should not shun solid, reliable businesses. Impatiently chasing returns in more speculative areas often ends in disaster, so every portfolio should have some exposure to more stable areas such as equity income, and this fund continues to fit the bill.

Mark Dampier is head of research at Hargreaves Lansdown, the asset manager, financial adviser and stockbroker. For more details about the funds included in this column, visit www.h-l.co.uk/independent

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks