Wealth Check: Writer needs a word on finances

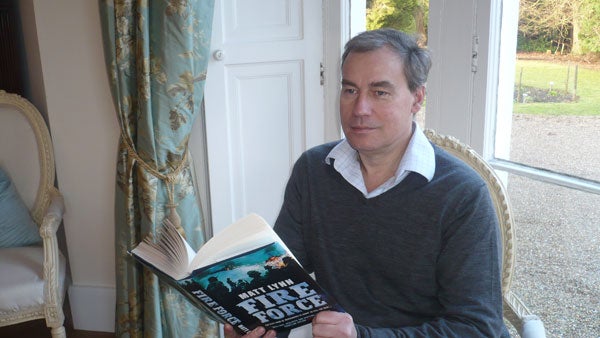

Matt Lynn, 47, is a self-employed thriller writer from Goudhurst, Kent. He lives with his wife, Angharad, a 39-year-old lawyer, and their three children, Isabella, 9, Leonora, 7, and Claudia, 2.

He says: "I need to support three children through school and university, and I'd like to be able to help them on to the property ladder as well. I'd also like to make sure I have a comfortable retirement. I can't really imagine I'll ever stop working, but I'd like to be able to stop depending on it financially."

Matt's business, a limited company, is the main source of income as his wife only recently came off maternity leave. His new book, Fire Force, was published in February.

Case notes

Annual income: £100,000 to £150,000 depending on the year

Annual expenditure: £109,000

Savings: £155,000 in an ISA account, £200,000 in the company account

Property: £1.25m house with an interest-only mortgage at 1.5 per cent

Investments: £500,000 buy-to-let flat with an interest-only mortgage of £275,000

Pension: Currently worth £30,000, with £1,500 annual contributions

Advising him are Christopher Wicks from Bridgewater Financial Services, Robin Keyte from Towers of Taunton and Aj Somal from Uniec Financial Solutions...

Planning

Matt hopes to continue writing into his old age, but he needs a retirement plan whereby work would be optional, not a necessity.

Wicks suggests setting a provisional retirement age for planning purposes – perhaps 66, when he would be eligible for a state pension.

He says: "It is about establishing your long-term goals and ensuring that there are the funds to deliver them. Even if you or your wife were to die or become incapacitated."

Matt hopes to build up a retirement income of £50,000 per year, so Wicks suggests creating a "cash flow model" to see whether his current arrangements would provide this.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Keyte predicts a fund of around £861,900 would be needed to provide an index-linked pension of £46,100, which could then be topped up with money from interest, rent from tenants and savings.

Pension

Matt is sceptical of pensions, but despite the negative press they remain one of the most tax-efficient ways to save for retirement.

According to Keyte, Matt's current pension would leave a shortfall of £713,800 on his desired retirement fund, so contributions should be increased considerably.

"The annual contributions that Matt needs to make from now onwards through to age 65 to meet this shortfall are £20,950 per annum," he says. "If Matt has more good years than bad years, this is an affordable option."

But before he does so, Matt should check he's getting the best deal on his current plan, and look into changing if not.

For an easy option, Keyte says a stakeholder pension plan can charge as low as 0.4 per cent. Matt should also consider a Self Invested Personal Pension (SIPP) plan, which allows holders greater freedom in choosing investments.

"I like the service offered by the Alliance Trust Select SIPP," says Keyte. "This allows investments in individual shares and fixed interest stock as well as funds."

Children

Matt already pays just under £20,000 per year in school fees for two of his daughters, and as they grow older costs will increase.

Taking into account an extra £9,000 per year for university costs and a £20,000 mortgage deposit for each daughter, Keyte predicts Matt will have to find extra revenue if he is to continue supporting them. He says: "The total funds required to meet all of these costs related to Matt's children over the years up until Claudia is 25 in 2033 are a massive £720,000. It may be that a second income will be available from Angharad which will make a significant improvement to the situation."

Somal recommends saving into a Child Trust Savings (CTF) account, where a maximum of £1,200 can be saved per year.

He says: "Money cannot be taken out of the CTF once it has been put in, but once the child is 18 they will be able to decide how to use the money."

Insurance

Matt's daughters depend on his income for their school fees, so he should consider insuring it against sickness or injury.

"It could pay a proportion of his income, say 60 per cent, until he recovers and is able to work again," says Somal. "This plan could be taken out on an individual basis or through his limited company."

Mortgage

Matt is paying interest-only on his mortgage, meaning he's making no dent in the debt.

"I recommend that Matt looks into moving this mortgage to a repayment basis as soon as reasonably possible," says Keyte. "It may mean this leads to a significant increase in outgoings: if so it would be worth doing some planning on ways to increase earnings, such as second earnings from Angharad's work as a solicitor."

For a free financial check-up, write to Wealth Check, The Independent, 2 Derry Street, London W8 5HF; or email wealthcheck @independent.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks