The Big Question: Is the housing crash finally over, and is the market now recovering?

Why are we asking this now?

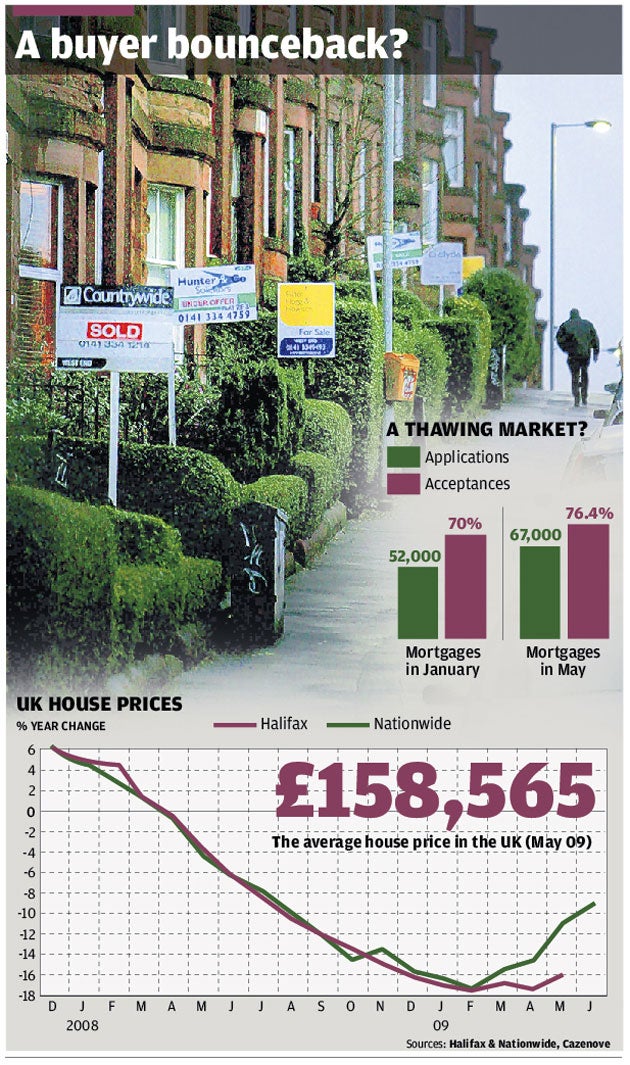

Yesterday David Miles – author of a Government-commissioned report on the mortgage market in 2004 and a new member of the Bank of England's Monetary Policy Committee – said that "expectations are crucial in the housing market and they look a bit better now than a few months ago ... My hunch – and I put it no stronger than that – is that we have seen most of the overall aggregate house price falls." The Bank, meanwhile, said that the availability of mortgage credit was expected to rise over the next few months. Earlier this week the Nationwide Building Society's house price index registered a 0.9 per cent rise in prices during May – three out of the last four months' figures have shown an increase; the Halifax and other indices agree. The House of Commons Public Accounts Committee also recommended yesterday that the planning process be speeded up to allow enough homes to be built to meet demand.

Are house prices now stabilising?

Yes – though that doesn't mean they will stay that way for ever. The most compelling data is probably that published by the Land Registry, which is comprehensive. According to that source, house prices fell by 0.2 per cent in May, the same decline as the month before, and that was the smallest drop since February last year. Property values are now 15.9 per cent lower than in May 2008, a gentler fall than the 16.5 per cent annual fall seen in February, and 17.4 per cent below the peak prices of January 2008.

So what?

So what indeed. In the housing slump of the early 1990s there were 17 months when house prices rose, even though the overall trend was firmly downward – a downwards staircase pattern rather than a ski slope. Most graphs in economics exhibit a certain amount of volatility or "noise". So economists, as you might expect, disagree on whether what we are seeing now is really the start of a trend. It could be that prices will stabilise and not rise for a very long time, or they could drift down for another couple of years.

In the case of the last crash, real terms values did not revert to their 1989 peak until 2001. Even the most upbeat of those watching the market expect prices to finish this year lower than they started. Overall, the rough consensus view among economists is for another 10 per cent fall from current levels.

So, is the house price recovery likely to continue?

Some say the current revival in house prices is simply a function of special factors, such as the release of pent-up demand from cash buyers or those with very large deposits. They have been waiting for signals that the market may have bottomed out and are now taking advantage. However, by their nature, these sorts of buyers are neither very large in number nor a sustainable source of strength for the market. The other factor appears to be shortage of stock in what has become a very thin market, which also tends to make "price discovery" more tricky. In the boom, most people knew what the house down the road or the flat below theirs went for; now buyers and sellers are less certain as to what to compare their homes with. Some householders are also reluctant to put their place on the market if they think they will make a loss on it.

Where do we go from here?

The fundamentals in the housing market remain weak for several reasons. One is the number of mortgage approvals for first-time buyers. This is the main source of new money coming into the market and drives prices. Since the onset of the credit crunch and the disappearance of many foreign lenders and mortgage brokers, the availability of finance at high loan to value ratios has disappeared. Analysts at Cazenove say that the main factor that traditionally drives the British property market is the availability of 90 or 95 per cent plus mortgages – of the kind no longer offered. That, apparently, is more important even than very low interest rates or rising incomes in driving demand. Until the banks and building societies return to those sorts of deals – unlikely when they would virtually guarantee negative equity for the borrower in a few months' time – the market will not stage a strong recovery.

This accounts for the collapse in mortgage approvals. At the rate they were falling last summer and autumn, the British first-time buyer would have become an extinct species by Christmas. Since then the number of mortgages granted has picked up, but is still abnormally low – 55 per cent below its long-run average and 33 per cent below the trough reached in the 1990s downturn. The Bank of England's own figures suggest that they are stuck at about 43,000 per month – not nearly enough to push prices up over the long term.

What about where I live?

Northern Ireland is experiencing the worst declines – prices have fallen by 26 per cent compared with this time last year. Wales, on the other hand, is showing the most marked rises – up 7.7 per cent on the beginning of the year. Following five consecutive quarter-on-quarter declines, house prices in Greater London rose by 4.8 per cent in the second quarter of 2009, and by more in prime locations. East Anglia is up by 5.2 per cent over the same period.

Most regions in northern England saw prices fall slightly compared to the previous quarter, although Yorkshire and Humberside and the East Midlands both recorded increases. Scotland is reportedly fairly flat, having held up better than the rest of the nation in the early part of the slump.

Why are falling house prices so bad?

They aren't, for first-time buyers; and they are enjoying the "gloomy" headlines – though they know better than most that houses remain unaffordable when compared to incomes. For homeowners, falling prices have pushed many – about 1 in 10 – into negative equity, destroying their wealth. As long as they have a job and can afford to service the home loan that's only a paper loss; but the rising trend of unemployment and repossessions will turn that into the loss of a home.

What is likely to happen next?

As usual there will be many countervailing forces at work. On the optimistic side (for homeowners) is the huge amount of cash being pumped into the economy by the Bank of England (about £100bn so far) and extremely low interest rates. There are encouraging signs that the economy is probably over its worst decline, although it may still relapse – the so-called double dip recession. Estate agents are seeing more enquiries.

And in the long term?

Long term, housing remains an attractive, tax-efficient investment for most people, and demographics and a shortage of land ought to keep real increases on an upward trend. On the other hand, unemployment is rising, interest rates will probably go up next year, most people are desperately trying to pay off debt rather than take more on. The banks are far from fixed, and the Government will have to repair our catastrophic public finances, which will squeeze the rest of us when taxes have to go up, starting with VAT in the new year.

Is Britain's housing market settling down?

Yes...

* Following the cutting of credit access, mortgage approvals are now expected to rise

* An Englishman's home is his castle – and home ownership remains extremely popular in the UK

* Though some are not convinced, house prices are showing signs of stability

No...

* There remain few high loan-to-value mortgages which are vital for first-time buyers

* House prices are still far beyond what many first-time buyers can afford and so a vital part of the market's mechanism remains damaged

* Higher rates of unemployment and bankruptcies will choke off a revival

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments