Urenco move: Shadow over next big state sell-off

A deal for the UK's share in the uranium powerhouse may reap £3bn. But some fear our secrets may fall into the wrong hands

Abdul Qadeer Khan does not enjoy the extra security that has been imposed on him by Pakistan's defence ministry, which is worried about another Osama bin Laden-style raid on its territory. "It is like death that comes uninvited," Dr Khan has said of the battery of 120 AK rifle-bearing security personnel who stand at his side.

But that's the price of smuggling the nuclear secrets that gave Pakistan the bomb. Time magazine described him as "the merchant of menace," though Dr Khan now disowns an admission in 2004 that his network sent nuclear weapons technology to Libya, Iran and North Korea.

If the unions have their way, Dr Khan's face could soon replace Margaret Thatcher as the dark image of their great ideological enemy, privatisation. In the 1970s, Dr Khan worked for Urenco, the British, Dutch and German uranium enrichment group, until he fled to Pakistan with top-secret blueprints.

Today, the government is keen to cash in on its one-third stake of Urenco in a sale that is set to raise £10bn. The other shareholders are German energy companies RWE and Eon, while the Dutch state holds the balance.

The Treasury could end up with more than £3bn, around the same amount that the Royal Mail flotation will raise when it debuts on the stock exchange on Friday.

That deal has caused an almighty ruckus with staff and union leaders, who are voting on strike action, while the shadow Business Secretary Chuka Umunna has accused the government of undervaluing a prized asset.

The Urenco sale is further off but even more incendiary, raising fears that without public-sector safeguards more nuclear secrets could end up with rogue states.

The news that the company has hired advisers from Rothschild to advise on its options is probably the push that was needed to finally get this long-mooted auction under way.

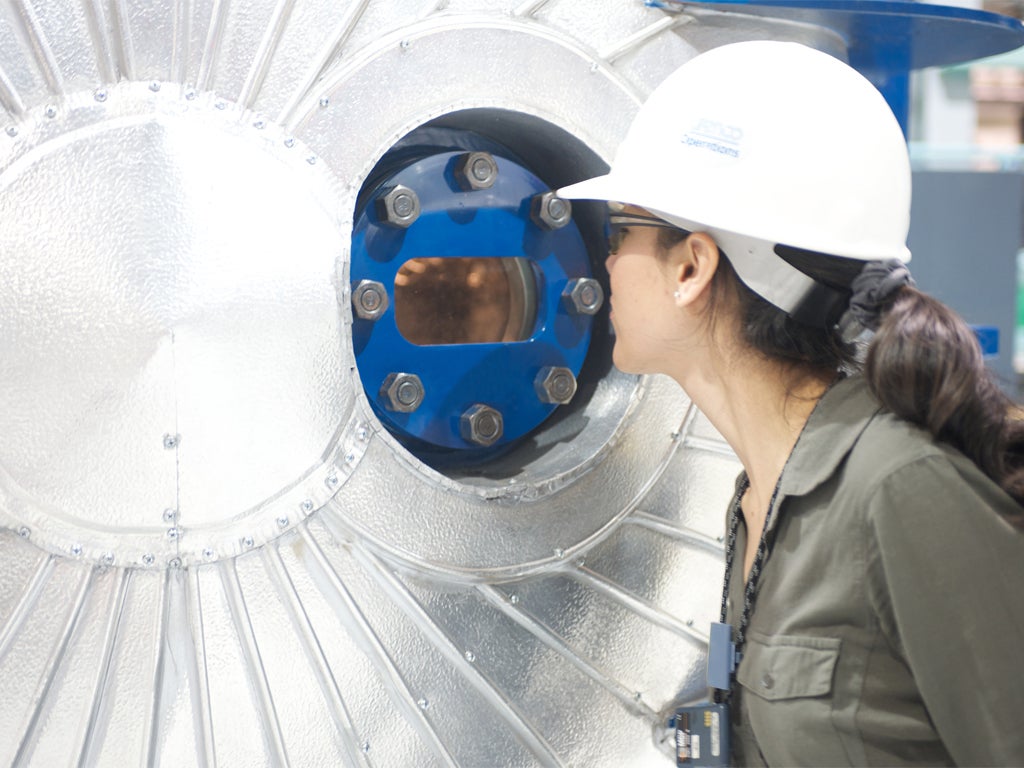

Headquartered in the semi-rural Buckinghamshire village of Stoke Poges, where, appropriately enough given its atomic plot, Goldfinger was partly shot, Urenco has a 31 per cent share of the world's uranium enrichment market.

This provides the fuel for nuclear power utilities and Urenco has enrichment plants in the US and the three investor countries, including one in Capenhurst, Cheshire.

"It's a ridiculous idea," according to the GMB national secretary for energy Gary Smith, who earlier this week complained to The Independent of the prospect of the Chinese investing in the nuclear new-build programme. "We're flogging off precious nuclear assets instead of developing a strategy around nuclear. It's absolute madness."

The MP who represents Sellafield, Jamie Reed, questions the notion of a sale given the problems that he has witnessed at the Cumbria site. Nuclear Management Partners, which includes the FTSE 100 engineer Amec, was handed a five-year extension to clean up Sellafield last week, despite a catalogue of problems that saw the group fall behind schedule on 12 out of 14 major projects last year. He says: "These are questions of genuine national interest and that should be the guiding principle here … privatisation right now will surely be affected by the consequences of the Fukushima disaster on the market place."

The last Labour government looked at a Urenco sale, but it is understood that then-environment secretary Ed Miliband doubted the rationale.

A Whitehall source who would never be confused with "Red Ed" argues a sale is "absolutely barking mad". This is not because of national security, given that intellectual property is likely to be ring-fenced "by a 50ft barricade" within what is known as the Enrichment Technology Company.

A buyer, be it a state-backed fund like Singapore's GIC or a conglomerate such as Mitsubishi, would not, in theory, have access to the technology it owned. Instead, the owner would be guaranteed a source of revenue in what is likely to be a growing market as countries from the UK to China look to nuclear to plug their energy gaps.

"This is classic Treasury paranoia about getting cash today to bring forward spending," adds the source, arguing that future revenue would easily top the £3bn a sale would garner. "Why would you sell this now? I've got a horrible feeling they're going to leave quite a lot of value on the table – and it barely costs the taxpayer a penny [to keep]."

The transaction will also get messy with each shareholder having its own advisers – Rothschild is looking after the company's board. The Dutch government confirmed its intention to sell in May.

An industry source argues, then, that Urenco's 1,600 staff shouldn't have any immediate concerns over what a sale would mean for jobs. He says a sale is unlikely until next year, while the Government is alert enough to realise that it "still has to work out what sort of governance needs to be put in place given the sensitivities".

The last thing the Coalition needs in the build-up to the General Election are its plans being depicted as creating a wave of wrathful new Khans.

Privatisations in the pipeline

Royal Mail

Shares in Royal Mail are set to start official trading on Tuesday in a sell-off that's expected to net £3.3bn for the Treasury's coffers.

Lloyds and RBS

The state has already sold 6 per cent of its stake in Lloyds for £3.2bn. It still owns 33 per cent and 81 per cent of RBS, a legacy of the state bailouts in the financial crisis.

Semi-privatisations

An auction is under way for a £400m contract to manage the Defence Infrastructure Organisation, which looks after the MoD's estate. It is also trying to sell a contract to run the Defence Equipment and Support, which buys the forces' tanks and missiles, while the US firm Bristow is set to take over helicopter search and rescue from the RAF and Navy from 2015.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks