David Blanchflower: Wages fall as the mystery of the British and American job markets gets deeper still

Nobody, and I mean nobody, would have expected wages in the UK to be more flexible than in the US

Labour economics used to be easy. All you had to do was watch the unemployment rate and that told you most of everything. As it went up things were bad and pay weakened. When the unemployment rate fell that meant the economy was getting better and that meant pay rises. Low unemployment meant big pay rises. High unemployment meant smaller rises. Simple. At some point the unemployment rate hit a brick wall as the economy reached full employment, and that point was well above zero because in a capitalist economy firms die and firms are being born all the time. Once full employment is reached firms struggle to find workers and have to bid them away from other firms, so wages start to rise. Easy peasy. Sadly not any more.

A slight complication was that in bad times the unemployment rate tended to understate how bad things were. As the unemployment rate rose, workers lost their jobs but instead of moving to unemployment they withdrew from the labour force to inactivity. Labour economists call these folks out-of-the-labour-force (OLF). Youngsters who couldn’t find jobs became students in bad times and this also causes inactivity to rise. In the upswing employment often rose as these OLF moved back to jobs. And it rose before unemployment fell.

But the world has become much more complicated than that. For example, there are marked differences in recent years between what has happened to the UK and US labour markets. As the economics Nobel prize winner Bob Solow famously noted, the labour market isn’t the same as the market for fish. Unemployment has fallen rapidly in both countries but wages haven’t responded. Since May 2010 the unemployment rate in the UK has fallen from 7.9 per cent to 6.2 per cent in the latest Office for National Statistics release, while the US has seen an even faster fall, from 9.6 per cent to 6.1 per cent.

In the US since May 2010 real wages are flat, whereas in the UK they are down between 8 per cent and 10 per cent, depending on whether you use the Consumer Price Index or the Retail Price Index as a deflator. Prior to the Great Recession, nobody, and I really do mean nobody, would have expected that wages would have been more flexible downwards in the UK than the US. There was nothing in any of the data we had to suggest that wages, rather than unemployment, in the UK was going to take the strain.

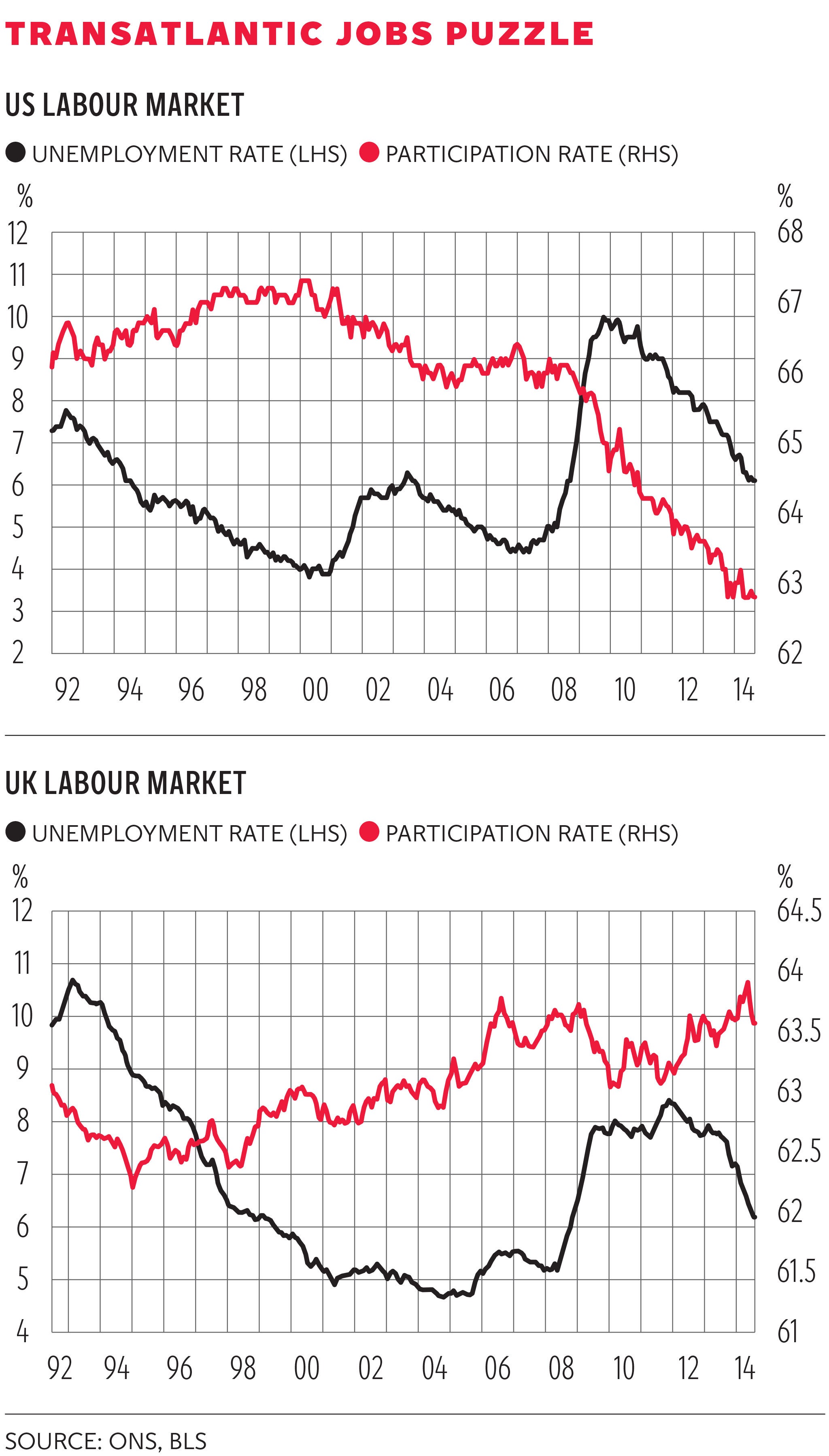

So what has been going on? The charts illustrate for the US and the UK the relationship between the participation rate, which is the proportion of those aged 16+ that are in the labour force, that is employed or unemployed, and the unemployment rate. In the latest data we have the unemployment rate at 6.1 per cent in the US and 6.2 per cent in the UK, with the participation rates 62.8 per cent and 63.5 per cent respectively.

The paths of the participation rate are very different despite broad similarities in the path of the unemployment rate. The unemployment rate is the number of unemployed divided by the labour force.

Starting with the US chart we can see that the participation rate has fallen steadily since around 2000. It has continued to do so as the unemployment rate fell from 2010, in fact the unemployment rate fell in large part because of a decline in the size of the labour force. That decline continued through April 2014 at 62.8 per cent and has remained steady ever since, even though the unemployment rate continued to decline – from 6.3 per cent to 6.1 per cent. The question is whether these OLFs will return to the labour force when times improve and whether they should be counted as part of labour market slack.

In the case of the UK the participation rate rises on a steady trend from 1994, through the beginning of 2009 as the Great Recession took hold. It then starts to rise again from the middle of 2012. Of particular note though is the sharp decline in the participation rate in the most recent data over the last two months – from 63.9 per cent in May 2014 to 63.5 per cent in July. Despite the fact that unemployment fell over this period by 103,000, and the unemployment rate dropped from 6.5 per cent to 6.3 per cent, this was mostly because of a decline in the size of the labour force as inactivity rose by 150,000.

The recent drop in unemployment looks to be due to the unemployed leaving the labour force rather than getting jobs. Plus employment fell by 34,000, including a drop of 64,000 in the number of full-time workers. So the decline in the unemployment rate may be giving a false read – the labour market may well be loosening once again. It appears that these non-participants are ready to spring back into the labour force when there are jobs available so they are an additional source of downward wages pressure.

But there is something else going on as well. In both countries we have evidence that there has been a sharp rise in underemployment. In both countries we do know what has happened to part-time workers who would prefer full-time jobs. As a proportion of employment this rose in the US from 1.9 per cent of employment in the middle of 2007 to 5.3 per cent in November 2010 and now stands at 4.3 per cent. In the UK the number of part-time workers who say they want a full-time job as a proportion of total employment went from 2.3 per cent in mid-2007 to 4.9 per cent in the autumn of 2013 and currently stands at 4.4 per cent and unchanged over the last three months, April-June 2014. These underemployed are also pushing down on wage growth.

All of this makes it very complicated for central banks to work out what is going on in the labour market. That is why they have focused on wages, as there are so many variables moving at any one time and this is the simplest indicator. Both in the US and the UK there appears to be much more slack than is indicated by the unemployment rate.

The big question is how many inactives will join the labour force as the economy approaches full-employment and how many extra hours workers will work before wages are pushed up. My best guess is that wages are not going to start rising much in either country before the unemployment rate gets below 4 per cent. We are a long way from full employment.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments