George Osborne has sought to calm volatile financial markets in the wake of the Brexit vote in the referendum, but has left his own future as Chancellor in doubt.

“Britain is ready to confront what the future holds for us from a position of strength” he said in a statement at 7.15am at the Treasury.

"Growth has been robust and employment is at a record high. Our economy is now about as strong as it could be to confront the challenge the country now faces."

This was the Chancellor's first public appearance since the bombshell referendum results were announced on Friday morning, which sent markets into turmoil.

“That is not the outcome that I wanted or that I threw everything into campaigning for but..now the people have spoken and we, in this democracy, must all accept that result and deliver on their instructions.” he told journalists.

But he stressed the economic pain that is likely to follow last week's seismic vote and noted that businesses had paused investment plans due to the uncertainty of the UK's future relationship with the EU, its biggest trade partner.

"It is inevitable that Britain’s economy is going to have to adjust to the new situation we find ourselves in...It will not be plain sailing in the days ahead." he said.

However, financial markets continued to exhibit signs of major stress despite the Chancellor's reassurances.

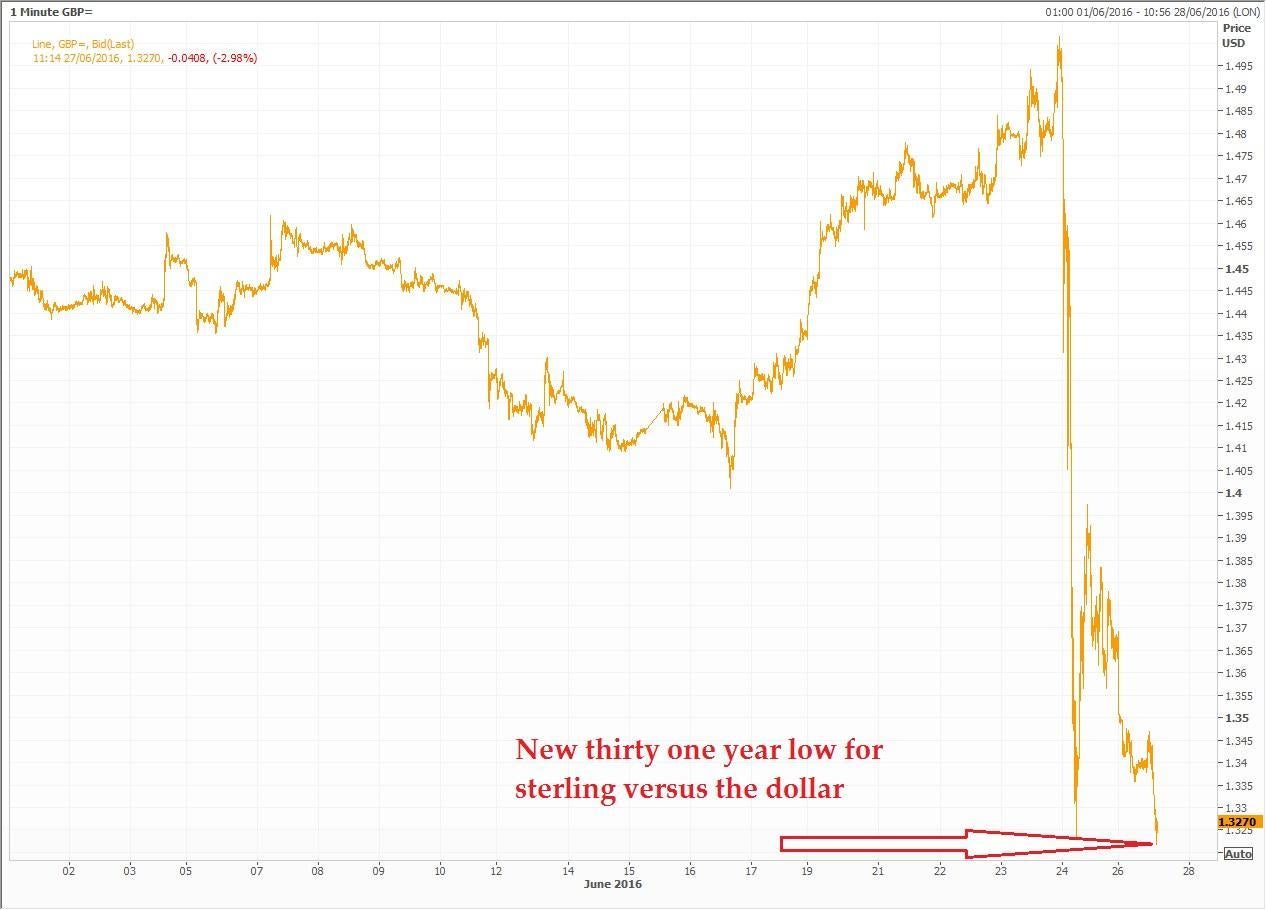

The pound, after initially strengthening against the dollar, tanked again in morning trade to $1.3274 before falling to a new 31-year low against the US dollar soon after.

Pound still falling...

And 10 year UK government bond (Gilt) yields - a reflection of the long-term cost of borrowing - sank below 1 per cent for the time in history as investors piled into a perceived safe haven asset.

Gilt yields dip below 1 per cent for first time in history...

The FTSE was trading down around 1.29 per cent, but shares in banks were pummeled, with the Royal Bank of Scotland down 15 per cent and Barclays off 12 per cent on the day. Shares in both had to be temporarily suspended after automatic circuit breakers were triggered.

Mr Osborne had been accused of “scaremongering” by the Leave campaign about the likely economic impact of a Brexit vote.

But the Chancellor said he did not "resile" from anything he said during the campaign, which included that Brexit would push the UK economy into recession and that there would need to be a "punishment" Budget immediately after a Leave vote to cut spending and raise taxes in order to keep the deficit under control.

He suggested that such an emergency fiscal package could still take place in the autumn.

But he ducked questions about whether he would carry on as Chancellor beyond October, when David Cameron is due to step down as Prime Minister.

"There will be questions about the future of the Conservative Party, and I will address my role within that in the coming days" he said.

Many prominent Conservatives have said that it is inevitable that he will be forced to step down.

But Mr Osborne stressed that he would continue doing the job in hand, saying that he has been in contact over the weekend with the Governor of the Bank of England, Mark Carney, other European finance ministers and the heads of UK banks.

“It's my country right or wrong and I intend to fulfil my responsibilities to the country” he said.

Sterling slipped another 2.6 per cent against the dollar in trading overnight to $1.3385, having experienced its biggest one day fall on record on Friday when the currency tanked by 8 per cent.

The FTSE 100 closed more than 3.15 per cent lower after the result, having opened down 8 per cent. Futures markets indicated that the blue chip index will open around 3 per cent lower this morning.

In a potentially significant intervention, Mr Osborne suggested that any move to trigger the automatic divorce process from the EU, known as Article 50, should not be done too early.

"Only the UK can trigger Article 50, and in my judgement we should only do that when there is a clear view about what new arrangement we are seeking with our European neighbours" he said.

David Cameron has already said that the decision on Article 50 will be taken by whoever succeeds him in October, although there has been pressure from some in Europe for the process to be started earlier.

Here’s the full text of the speech just delivered by chancellor George Osborne in an effort to calm markets after the UK’s vote to leave the EU:

"Today I want to reassure the British people, and the global community, that Britain is ready to confront what the future holds for us from a position of strength.

That is because in the last six years the Government and the British people have worked hard to rebuild the British economy.

We have worked systematically through a plan that today means Britain has the strongest major advanced economy in the world.

Growth has been robust.

The employment rate is at a record high.

The capital requirements for banks are ten times what they were.

And the budget deficit has been brought down from 11% of national income, and was forecast to be below 3% this year.

I said we had to fix the roof so that we were prepared for whatever the future held.

Thank goodness we did.

As a result, our economy is about as strong as it could be to confront the challenge our country now faces.

That challenge is clear.

On Thursday, the people of the United Kingdom voted to leave the European Union.

That is not the outcome that I wanted or that I threw everything into campaigning for.

But Parliament agreed that there are issues of such constitutional significance that they cannot solely be left to politicians, and must be determined by the people in a referendum.

Now the people have spoken and we, in this democracy, must all accept that result and deliver on their instructions.

I don’t resile from any of the concerns I expressed during the campaign, but I fully accept the result of the referendum and will do everything I can to make it work for Britain.

It is inevitable, after Thursday’s vote, that Britain’s economy is going to have to adjust to the new situation we find ourselves in.

In the analysis that the Treasury and other independent organisations produced, three particular challenges were identified – and I want to say how we meet all three.

First, there is the volatility we have seen and are likely to continue to see in financial markets.

Those markets may not have been expecting the referendum result – but the Treasury, the Bank of England, and the Financial Conduct Authority have spent the last few months putting in place robust contingency plans for the immediate financial aftermath in the event of this result.

We and the PRA have worked systematically with each major financial institution in recent weeks to make sure they were ready to deal with the consequences of a vote to leave.

Swap lines were arranged in advance so the Bank of England is now able to lend in foreign currency if needed.

As part of those plans, the Bank and we agreed that there would be an immediate statement on Friday morning from the Governor, Mark Carney.

As Mark made clear, the Bank of England stands ready to provide £250 billion of funds, through its normal facilities, to continue to support banks and the smooth functioning of markets.

And we discussed our co-ordinated response with other major economies in calls on Friday with the Finance Ministers and Central Bank Governors of the G7.

The Governor and I have been in regular touch with each other over the weekend – and I can say this this morning: we have further well-thought-through contingency plans if they are needed.

In the last 72 hours I have been in contact with fellow European finance ministers, central bank governors, the managing director of the IMF, the US Treasury Secretary and the Speaker of Congress, and the CEOs of some of our major financial institutions so that collectively we keep a close eye on developments.

It will not be plain sailing in the days ahead.

But let me be clear. You should not underestimate our resolve.

We were prepared for the unexpected.

We are equipped for whatever happens.

And we are determined that unlike eight years ago, Britain’s financial system will help our country deal with any shocks and dampen them – not contribute to those shocks or make them worse.

The second challenge our analysis identified in advance was the uncertainty that a vote to leave would bring in the coming months and beyond as Britain worked with its European allies to create a new relationship.

The Prime Minister has given us time as a country to decide what that relationship should be by delaying the decision to trigger the Article 50 procedure until there is a new Prime Minister in place for the autumn.

Only the UK can trigger Article 50, and in my judgement we should only do that when there is a clear view about what new arrangement we are seeking with our European neighbours.

In the meantime, and during the negotiations that will follow, there will be no change to people’s rights to travel and work, and to the way our goods and services are traded, or to the way our economy and financial system is regulated.

However, it is already evident that as a result of Thursday’s decision, some firms are continuing to pause their decisions to invest, or to hire people.

As I said before the referendum, this will have an impact on the economy and the public finances – and there will need to be action to address that.

Given the delay in triggering Article 50 and the Prime Minister’s decision to hand over to a successor, it is sensible that decisions on what that action should consist of should wait for the OBR to assess the economy in the autumn, and for the new Prime Minister to be in place.

But no one should doubt our resolve to maintain the fiscal stability we have delivered for this country.

To all companies large and small I would say this: the British economy is fundamentally strong, we are highly competitive and we are open for business.

The third and final challenge I spoke of was that of ensuring that Britain was able to agree a long-term economic relationship with the rest of Europe that provided for the best possible terms of trade in goods and services.

Together, my colleagues in the Government, the Conservative Party and in Parliament will have to determine what those terms should be – and we’ll have to negotiate with our European friends to agree them.

I intend to play an active part in that debate – for I want this great trading nation of ours to put in place the strongest possible economic links with our European neighbours, with our close friends in North America and the Commonwealth, and our important partners like China and India.

I do not want Britain to turn its back on Europe or the rest of the world.

We must bring unity of spirit and purpose and condemn hatred and division wherever we see it.

Britain is an open and tolerant country and I will fight with everything I have to keep it so.

Today I am completely focussed on the task in hand as Chancellor of the Exchequer to bring stability and reassurance.

There will be questions about the future of the Conservative Party, and I will address my role within that in the coming days.

In conclusion, the British people have given us their instructions.

There is much to do to make it work.

We start from a position of hard-won strength.

And whatever the undoubted challenges, my colleagues and I are determined to do the best for Britain."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments