Panama Papers: First George, then Boris, then Jeremy - it's tax transparency day in the Commons

The move by the London Mayor will irritate Number 10 and put further pressure on the Chancellor and potential leadership rival George Osborne

Boris Johnson has kiboshed attempts by Downing Street to draw a line in the sand over the public disclosure of politicians’ tax affairs after he unilaterally released details of his own half-a-million a year income.

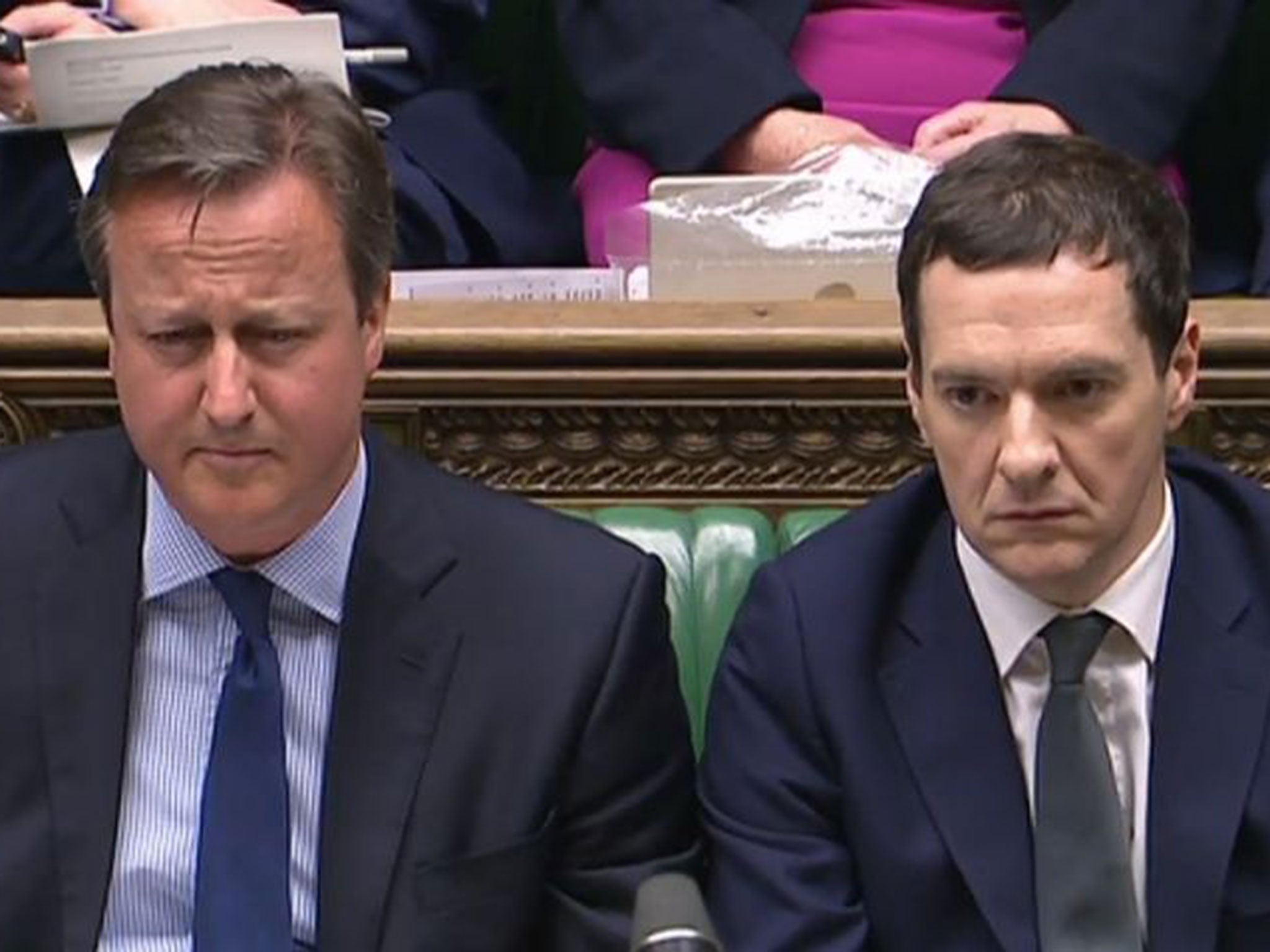

The move by the London Mayor will irritate Number 10 after David Cameron went to the Commons on Monday and ruled out the need for wider disclosure of MPs’ tax affairs. It will also put further pressure on the Chancellor and potential leadership rival George Osborne, who has declined to publish anything but his most recent tax returns.

The former shadow Home Secretary Yvette Cooper suggested that Mr Osborne's reticence may have been because his earlier tax returns would show that he benefited directly from his decision to scrap the 50p rate of tax in 2012.

So far, Mr Cameron, Mr Osborne, Mr Johnson, Labour leader Jeremy Corbyn and shadow Chancellor John McDonnell have each published some or all of their tax returns over the past five years.

They reveal that:

- George Osborne made nearly £45,000 in share dividends alone in 2014-15. He also received an income of £33,000 from the house he rents out while living in Downing Street

- Boris Johnson’s £143,000 a year income as Mayor of London is dwarfed by the £266,000 he earns as a weekly columnist for The Daily Telegraph

- Jeremy Corbyn had the simplest tax affairs of all – with an outside income of just £1,850 beyond his Parliamentary salary. However, he was still unable to submit his tax return form in time and was forced to pay a £100 fine

Mr Cameron told the Commons that he did not favour widening the need for greater disclosure of the tax returns of public figures – including those in local government such as the Mayor of London. “I think there is a strong case for the Prime Minister and the Leader of the Opposition, and for the Chancellor and shadow Chancellor, because they are people who are or who wish to be responsible for the nation's finances,” he said. “As for MPs, we already have robust rules on members' interests and their declaration, and I believe that is the model we should continue to follow.”

But with Mr Cameron standing down before the end of the Parliament and his successor as Tory leader certain to become Prime Minister, those who wish to join the contest will be almost certain to follow suit. Some Labour MPs, including Caroline Flint and Chuka Umunna, have also published their tax details. That could result in many other MPs feeling they have to follow suit for fear of being caught out at the next election.

In his first full public explanation of his own involvement in the Panama Papers scandal, Mr Cameron insisted he had at all times acted properly and said he had handed all the details of his financial affairs to the Parliamentary Commissioner for Standards. He said he had sold all his shares in 2010 because he did not want any conflict of interest.“I didn't want anyone to be able to suggest that as Prime Minister I had any other agendas or vested interests," he said.

Mr Cameron told MPs he accepted that he had handled the affair badly, but was “angry about the way my father's memory was being traduced”. “I know he was hard-working man and a wonderful dad, and I'm proud of everything he did to build a business and provide for his family," the Prime Minister said.

Mr Cameron, who received £300,000 from his late father Ian and £200,000 from his mother Mary, said it was “natural human instinct” for parents to want to pass things on to their children. “As for parents passing money to their children while they are still alive, it is something the tax rules fully recognise,” he said.

The Prime Minister said it was right to “tighten the law and change the culture” to crackdown on evasion and aggressive avoidance, but the Government should “defend the right of every British citizen to make money lawfully”.

He said all Crown dependencies apart from Guernsey and Anguilla have agreed to provide UK law and tax agencies with full access to information on the beneficial ownership of companies. He said he expected to conclude similar arrangements with Guernsey and Anguilla in the near future.

New laws would also be introduced in the UK, Mr Cameron told MPs. "Under current legislation it is difficult to prosecute a company that assists with tax evasion, but we are going to change that, so will legislate this year for a new criminal offence to apply to corporations who fail to prevent their representatives from criminally facilitating tax evasion," he said. "We are providing initial funding of up to £10m for a cross-agency task force to swiftly analyse all information that has been made available from Panama and take rapid action."

Jeremy Corbyn said Mr Cameron’s statement was a “masterclass in the art of distraction", while the veteran Labour MP Dennis Skinner was ejected from the chamber for calling Mr Cameron “dodgy Dave” and refusing to withdraw the remark.

Mr Corbyn accused the Prime Minister of failing to appreciate the public anger over the “scandal of destructive global tax avoidance” revealed by the Panama Papers. “What they have driven home is what many people have increasingly felt: there is now one rule for the super-rich and another for the rest,” he said. “I'm honestly not sure that the Prime Minister fully appreciates the anger that is out there over this injustice.”

But former Conservative minister Sir Alan Duncan said the Commons risked being “stuffed full of low-achievers” if MPs were compelled to reveal their tax affairs.

What they declared - and what they didn't

George Osborne

The Chancellor earned £200,000 last year, including income from shares in his family’s wallpaper company, a summary of his 2014-15 tax return reveals. The summary, published by the Treasury, shows he earned £44,647 from dividends in his family’s wallpaper company, on top of his £120,526 salary as an MP and Chancellor of the Exchquer. He also made £33,562 from his half of the rental income he and his wife make from their London home. Mr Osborne has declined to publicise his previous tax returns.

Boris Johnson

The Mayor of London paid nearly £1m in tax in four years, a summary of his tax returns shows. Mr Johnson's total taxable income between 2011-12 and 2014-15 was £1,985,901. The tax bill over the period, which follows on from the last time Mr Johnson published his tax returns in 2012, totals £916,481. Mr Johnson's mayoral salary totalled £575,644 over the four years, but the amount was dwarfed by income from his outside activities, the statement by chartered accountants Begbies showed.

The prolific writer was paid £987,097 for his Daily Telegraph column, while book royalties brought in a further £469,385. New York-born Mr Johnson had an overseas income tax bill of £728, but did not have any US tax liabilities during the period, according to the summary.

Jeremy Corbyn

Beyond the £70,795 he earned as a backbench MP, the Labour leader had a taxable income of only £1,850 – but he had to pay a fine for filing his tax return late.

Labour released his handwritten tax return from February this year – despite the deadline for paper submissions being 31 October last year. Returns filed up to three months late attract a fine of £100, with higher penalties if longer. Asked why Mr Corbyn – who was elected leader in September – had filed his returns late, a senior Labour spokesman said: "He did have a pretty busy few months last year. He does his own tax return. He doesn't have an accountant."

Of the extra earnings, £1,350 was listed as coming from "lecture income" and another £500 from "survey income". Mr Corbyn also registered £500 of tax-deductible expenses, described as "share of cost of study".

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments