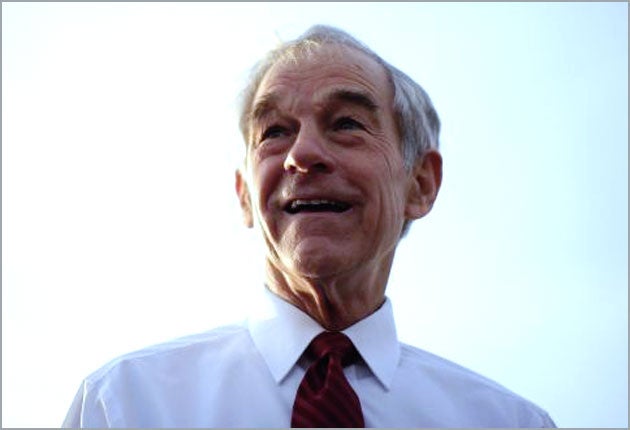

Ron Paul: Every man for himself!

It's taken a while, but America is warming to Ron Paul and his radical brand of extreme libertarianism

Pull US troops out of Afghanistan. Leave Iran alone. Legalise drugs. Get the government out of people's private lives. Say no to the bailout of Wall Street fat cats. As a menu of policy prescriptions, you might think that this all puts Ron Paul on the Soviet wing of the Democratic party. But you'd be wrong.

The 74-year-old Congressman from Texas, with his skinny frame and his hangdog face, is about as unlikely a poster child for the future of the Republican party as you are likely to find, but his ideas have struck chords with libertarian-minded college kids. Dismissed last year as the token nutjob in the line-up of Republican presidential candidates, his insurgent campaign proved surprisingly tenacious. Young people at music festivals wore "Dr Paul cured my apathy" badges, he spawned an internet fund-raising movement that had echoes of Barack Obama from the other side, and to this day he has a stronger YouTube presence than any other Republican politician.

To the extent that Paul is known outside the US, it is as the poor guy propositioned in a hotel room by a trouser-less Sacha Baron Cohen, in his movie Brüno. Paul flees, shouting: "he's queer, he's crazy, he hit on me".

But in the US, his books now become instant best-sellers and he tours university campuses pushing a libertarian agenda. Where once he believed he was seeding the ground for a movement that would triumph well after his own career is over, to his own astonishment, policies he has espoused to almost universal ridicule for decades might just be about to go into law.

And this is why the economic and political establishment fears Ron Paul as one of the most dangerous men in America. His innocuous-sounding plan to subject the US central bank to a regular audit of its activities is a Trojan horse for the wider aim to End the Fed – the title of his latest book. Behind the liberal-sounding policies lies an audacious agenda to erase 100 years of economic orthodoxy and take the US back to a Nineteenth-century version of every-man-for-himself capitalism. Inch by inch, he is making progress.

"The college kids I think are interested in the anti-war position, in personal civil liberties and allowing them to do with their own lives what they want – but I tell them, if you ruin your own life don't come begging the government to take care of you."

Paul greets The Independent at his rooms in Congress, decked out in the formal regalia of public office, with flags and seals, but with portraits in one corner that reveal his inspirations: members of the Austrian school of economists whose founder Friedrich von Hayek predicted government attempts to intervene in the economy would set their people on "the road to serfdom".

"Ideas are the only things that count, and politicians are, for the most part, pretty much irrelevant," he says. "What was boiling out there I just brought to life. This material has been available in a quiet way on the internet and from a few libertarian think-tanks, but I was pretty shocked when college kids started calling out 'End the Fed, End the Fed.'"

Growing up in Pittsburgh, Paul was fascinated by the jar of coins that his parents kept on the kitchen shelf. He became a stamp and coin collector – still is – and he is fascinated by what gives money value. He's got a proportion of his savings in gold. Currencies come and currencies go, he says, but when people wanted to escape Vietnam during the war, they paid with gold coins at the border. "Most people think gold is beautiful, that's why it's money. It's because it's beautiful and rare and divisible and it lasts a long time. We don't use lead."

He decided to go into politics on the day, in 1971, when Richard Nixon said the dollar could no longer be exchanged for gold. Since then, the global financial architecture has been built entirely on the world's faith in the good credit of the US government. Paul is crouched under it, convinced the architecture will collapse.

"Remember that the pound got into trouble after World War I and lost supremacy around the world. The Bank of England blew that currency, and we're blowing ours; the British ended their empire because of too much spending and mismanagement and now we're ending ours. Our central bank is supposed to give us sound economic growth, low unemployment, steady interest rates and price stability. They've failed totally and utterly."

The Federal Reserve was created in 1913 to set interest rates, so as to smooth the economic cycle, dampen recessions and prevent panics. Paul's beef is that, in an economy where the currency is not tied to the value of gold, the central bank can simply print more and more money to fund the expansion of the economy and of central government. Over time, that will erode the purchasing power of the currency, but as long as that happens slowly through moderate inflation, no one seems to mind. One day, though, America's creditors will baulk at seeing the value of their dollar holdings whittled away.

Paul's apocalyptic vision of a post-empire America, bankrupt and swept clean of federal government welfare and war spending, seems less fanciful with every day the dollar declines on the global currency markets. Foreign governments are mulling creating new currency units for trading oil and other commodities and for storing as reserves. The Texan Congressman is only saying the same things he has always said, but now fewer people think he sounds mad.

And on America's wars he is certain of one thing: they will end.

"There's never been a war fought without inflation. In Roman times, they would clip coins, or dilute the metal, or print paper money like we did in revolutionary times. Today, we still call it printing money, but they just click a computer. If we had to pay for every cent we spent over in Afghanistan and Iraq we wouldn't be there."

Far from a "surge" in Afghanistan, the US should be pulling out, he said. "It has nothing to do with self-defence. The greatest threat to our national security is our occupation of those countries and the results of our occupation. We stimulated the birth of radical Islam and paid for some of these madrassa schools because we wanted radical Islam to be motivated to kill Communists, now they've turned on us. This is a war of aggression, a war of occupation. It's illegal under our constitution, it's immoral, it makes no sense whatsoever and it's going to break the bank."

Every year for decades, Paul has introduced a bill calling for an audit of the Fed, but it was only this year, amid public anger over the Fed-financed bailouts of Wall Street, that Paul has found a rag-bag of politicians rallying to his cause. The Fed has come under constant and sometimes contradictory fire for failing to spot the credit bubble before it burst in 2007, funnelling money to what Paul calls its "special friends" on Wall Street, and for pumping trillions of dollars of newly created money into credit markets without any Congressional oversight. When Ben Bernanke, its chairman, goes to Capitol Hill tomorrow for hearings to confirm him in a second term, he is expected to face a harsher grilling than any predecessor in generations.

Meanwhile, Paul's plan for an audit looks set fair to be appended to wider financial reform legislation. Economists are aghast, since it repeals a 1978 provision that was intended to protect interest rate policy from short-term political influence. Scores of eminent economists signed a petition against the measure, warning that credit markets will punish the US for anything that smacks of weakening the independence of the Fed, and Mr Bernanke himself, in his mild-mannered way, wrote at the weekend that "these measures are very much out of step with the global consensus on the appropriate role of central banks".

Congressman Paul, though, is determined to press on with his movement to abolish central banking. "Transparency is a good issue," he says. "Start with transparency and finding out how the Fed abused the monetary system, and then you move to the next stage."

Ron Paul: The maverick outsider

Born 20 August 1935 in Pittsburgh

Early Life Attended Dormont High School in Pittsburgh. Studied biology at Gettysburg College before obtaining a medical degree from Duke University School of Medicine.

Family Married Carol Wells, with whom he has five children, 18 grandchildren and two great-grandchildren. His son Rand is also a political activist and announced his US senate bid in August this year.

Career Paul entered politics in 1974, running as a Republican for the House of Representatives. Although he lost, he was elected to office in a 1978 and served until 1985. Feeling that Ronald Reagan's presidency had been a failure, he left the Republicans for the Libertarians, first running for president in 1988. Enjoyed an unexpected renaissance with his maverick candidacy for the presidency last year.

He Says "The obligations of our representatives in Washington are to protect our liberty, not coddle the world, precipitating no-win wars, while bringing bankruptcy and economic turmoil to our people."

They Say "Ron Paul is the one exception to the Gang of 535." William Simon, Secretary of Treasury

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks